(NLDO) - Most of the excess corporate taxes paid range from tens of millions to hundreds of millions of VND, with some units having an excess of more than 2 billion VND.

Business representative transacting at Tax Department Region II

The Binh Thanh District Tax Team, under the Tax Department of Region II (formerly the Ho Chi Minh City Tax Department) has just announced a list of 1,645 enterprises and cooperatives that have overpaid their tax obligations beyond 10 years from the date of payment to the state budget, but have not offset their tax obligations or requested a tax refund.

Accordingly, the excess payments include corporate income tax, value added tax, special consumption tax, personal income tax, fines, late payment fees and other fees and charges.

Most businesses pay excess taxes ranging from tens of millions to hundreds of millions of dong, with some businesses paying excess taxes of more than 2 billion dong.

Typically, Saigon Technical Infrastructure Joint Stock Company overpaid 102 million VND in personal income tax, Ba Nhat Bamboo and Rattan Cooperative overpaid 87 million VND in corporate income tax, Quyet Tien Freight Transport and Tourism Cooperative overpaid 832 million VND in corporate income tax...

In particular, PAK Company Limited overpaid personal income tax of more than 2 billion VND.

Binh Thanh District Tax Team (Region II Tax Department) also announced the non-refundable handling of overpaid amounts including tax, late payment fees and fines for cases where taxpayers do not operate at the registered address and the overpaid amount is over 10 years old.

According to regulations, in the case of taxpayers not operating at the registered address, the Binh Thanh District Tax Team said that after 180 days from the date the tax authority issues a notice of inactivity at the registered address, the directly managing tax authority will publicly announce the list of overpaid amounts on the website and mass media.

After 1 year from the date of publication of the list without receiving a refund request, the tax authority will issue a decision not to refund the overpaid tax, finalize the accounting books and publicize this decision within 3 working days.

In case taxpayers have overpaid taxes for more than 10 years but do not complete refund procedures, periodically after March 31 of each year, relevant tax departments will review and make a list of overpaid taxes for more than 10 years.

The tax authority sends a notice to the taxpayer. In case the taxpayer has terminated the tax code or is not operating at the registered address, this information will be made public on the electronic information page. After 15 working days from the date of sending the notice without receiving a response, the tax authority will issue a decision not to refund the overpaid tax and finalize the settlement on the management system.

According to the Binh Thanh District Tax Team, the handling of overdue tax payments is carried out in accordance with the provisions of the Tax Administration Law No. 38/2019/QH14 and Circular 80/2021/TT-BTC of the Ministry of Finance, ensuring transparency and avoiding the situation of overpayments that have been left unprocessed for many years.

Tax authorities publicly disclose the list of overpaid taxes to ensure transparency in tax management, while creating conditions for businesses and cooperatives to review, confirm and carry out necessary procedures, proactively contact to clarify information and handle overpaid amounts if still valid.

Source: https://nld.com.vn/cong-khai-1645-doanh-nghiep-va-hop-tac-xa-nop-thua-thue-196250318184251169.htm

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

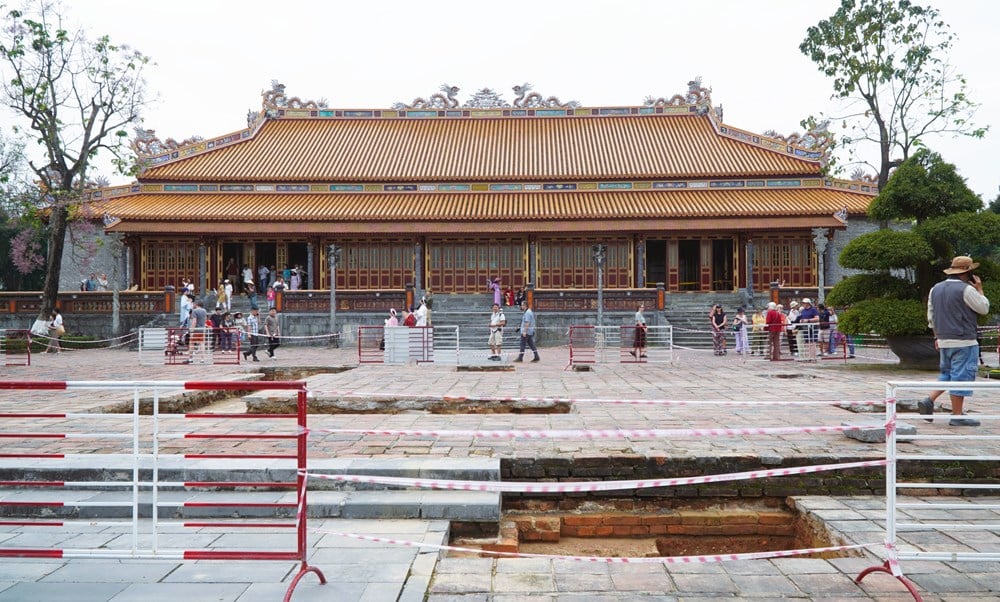

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)