|

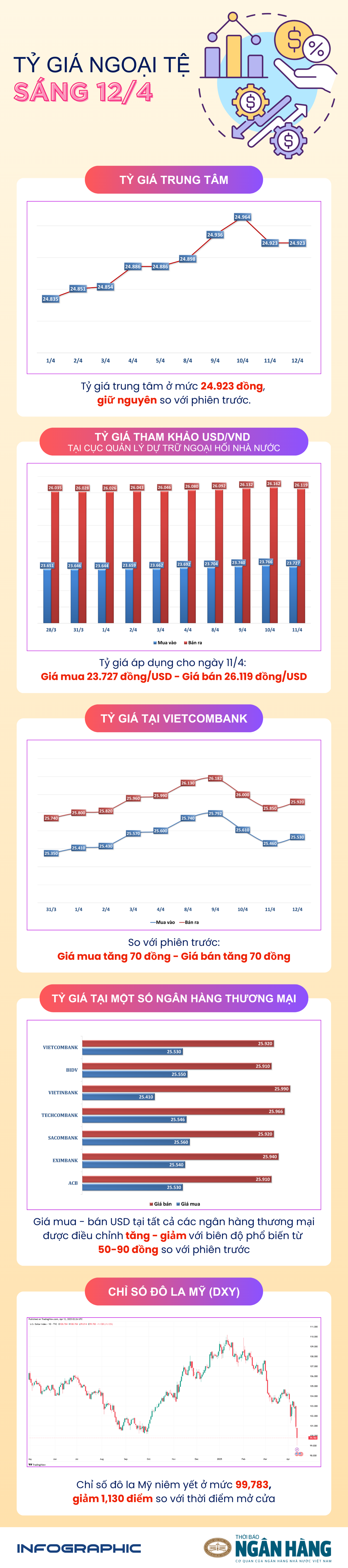

The greenback continued to fall, with the US dollar index (DXY) falling below 100 - a three-year low, reflecting a serious loss of confidence in the US economy following the fluctuations in US President Donald Trump's tariff policy.

President Donald Trump on the afternoon of April 2 (local time) announced a basic tariff of 10% on imports from all trading partners and higher tariffs (reciprocal tariffs), ranging from 10-49%, on dozens of partners that have trade surpluses with the US. Mr. Trump then increased tariffs on China to 125%, before postponing tariffs on many countries for 90 days. This erratic move caused a sell-off in US stocks and bonds, shaking the USD's position as the leading reserve currency.

“The collapse of the US dollar is not just a technical issue, but also signals deep market concerns about the health of the US economy,” said expert Adam Turnquist from LPL Financial.

The sharp decline suggests foreign investors are dumping dollar assets as the US market loses its appeal amid tariff policy uncertainty.

“The sudden drop in demand for USD suggests that countries are reconsidering their dependence on the greenback. This reduces the sustainability of the US fiscal deficit, limiting the ability to spend to boost growth, similar to the UK and France before,” warned expert George Saravelos from Deutsche Bank.

Source: https://thoibaonganhang.vn/sang-124-bac-xanh-tiep-tuc-lao-doc-162676.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the ceremony to celebrate the 1015th anniversary of King Ly Thai To's coronation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/6d642c7b8ab34ccc8c769a9ebc02346b)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Policy Forum on Science, Technology, Innovation and Digital Transformation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/c0aec4d2b3ee45adb4c2a769796be1fd)

Comment (0)