(Dan Tri) - Information technology products, coal, gasoline, oil, washing machines, microwave ovens, etc. are proposed by the Ministry of Finance to be added to the list of objects eligible for value added tax (VAT) reduction until the end of 2026.

The Ministry of Finance has just announced to collect opinions on the draft Resolution of the National Assembly on reducing value added tax (VAT). The Ministry proposed to implement the policy of reducing VAT by 2% in the direction of expanding the subjects eligible for the 2% VAT reduction compared to Resolution No. 43/2022, which will end in June this year.

According to the draft, goods and services subject to a tax rate of 10% can be subject to an 8% rate until the end of 2026. Sectors that will continue to not receive this tax reduction include real estate, securities, banking services, telecommunications, mining products (except coal), metals, and groups of goods subject to special consumption tax.

However, the drafter plans to expand the list of items eligible for a 2% VAT reduction.

Proposal to reduce 2% VAT on gasoline (Photo: Tien Tuan).

Specifically, information technology products and services (such as washing machines, microwave ovens, data processing services, rentals and related activities, information portals, etc.), prefabricated metal products (such as barrels, tanks and metal containers, boilers, etc.). The Ministry of Finance believes that these are goods and services serving the direct consumption purposes of the people.

The drafting unit also proposed tax reductions on coke, refined petroleum (such as coke, fuel oil and gasoline, lubricating grease, etc.), chemical products (such as fertilizers and nitrogen compounds, plastics and synthetic rubber in primary form, etc.), coal at the import stage and coal sold at the commercial stage (domestic coal has been reduced according to Resolution 43). The Ministry of Finance believes that these are goods used in the production of input materials to serve the purpose of producing consumer goods directly for the people.

The Ministry also proposed adding gasoline to the list of products eligible for tax reduction. This unit said that gasoline and oil were previously not subject to the 2% VAT reduction, because gasoline is in the group of products subject to special consumption tax, while oil is a mining product. However, these are important products that directly impact domestic production, consumption and macroeconomic stability, so this agency plans to add gasoline and oil to the list of products eligible for tax reduction.

Instead of proposing a 6-month tax reduction as in previous resolutions, the Ministry of Finance has drafted a regulation to extend the tax reduction to 1.5 years, from July 1 this year to December 31, 2026.

According to calculations, extending this tax reduction period until the end of 2026 is expected to reduce budget revenue by about VND 121,740 billion. Of which, the last 6 months of this year will reduce by about VND 39,540 billion, and in 2026 it will be VND 82,200 billion.

According to the Ministry's data, in the first two months of the year, the VAT reduction was estimated at VND8,300 billion. Previously, in 2022, the implementation of the VAT reduction policy supported businesses and people with a total of about VND51,400 billion, in 2023 about VND23,400 billion, and in 2024 about VND49,000 billion.

Source: https://dantri.com.vn/kinh-doanh/de-xuat-giam-2-thue-vat-den-het-2026-giam-cho-may-giat-lo-vi-song-xang-20250324163350178.htm

![[Photo] General Secretary To Lam receives First Deputy Secretary General of the African National Congress (ANC) of South Africa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/bb2999907e1245d5b4c7310a890d8201)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

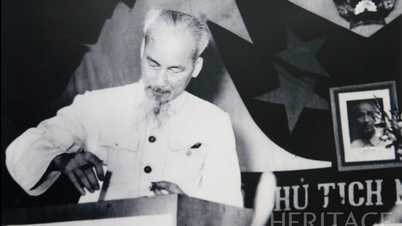

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)