Five investment and savings tips from VCBF financial experts

Investing and building wealth may seem complicated, but it actually comes down to basic principles that anyone can apply.

|

Investing is a long term process

Investors often tend to think that choosing the right time to invest is the key to investing. Reality has proven that waiting to buy at the bottom and sell at the top is impossible. Long-term investment and persistence over time are the main factors that create profits.

Long-term investing is the practice of buying and holding an investment for a long period of time (e.g. 5 years or more). Thanks to the power of compound interest and time, your assets will grow significantly without worrying about short-term fluctuations.

Increase revenue and diversify investment tools

Increase your income by creating multiple streams of income, starting normally by saving a portion of your regular salary and considering what to do with it when you receive a bonus. Then investments can generate other streams of income, from interest on deposits or bonds, dividends on stocks, rental income from property, profits from running or participating in a business, or even from patents or royalties.

As for investment channels, identify investment channels and funds that are suitable for your financial goals and risk tolerance. Diversifying investment channels helps minimize risks such as market risk, policy risk and liquidity risk.

|

|

Don't focus on short term profits

When starting out, many people look for the highest return on investment at the moment. However, start with investments that have a history of steady long-term growth. An investment that has a consistent return is better than one that has a spike in growth one year, then declines or increases very little. If you follow short-term trends, investors tend to buy at high prices.

For example, when buying a car, you may be attracted by new features and modern technology. But the most important thing is the stability and durability of the car over time. A car that works well for 1-2 years, but breaks down quickly will make the owner worry and think, hesitate during the operation. This turns the car into a burden, rather than a useful asset.

Instead of being absorbed in seeking short-term profits, build a long-term investment plan with appropriate investment channels and holding periods. Set specific financial goals such as: buying a house, buying a car, saving for children, investing financially or preparing for retirement... Persistence and clear direction will help you achieve sustainable success.

Discipline is indispensable in investing.

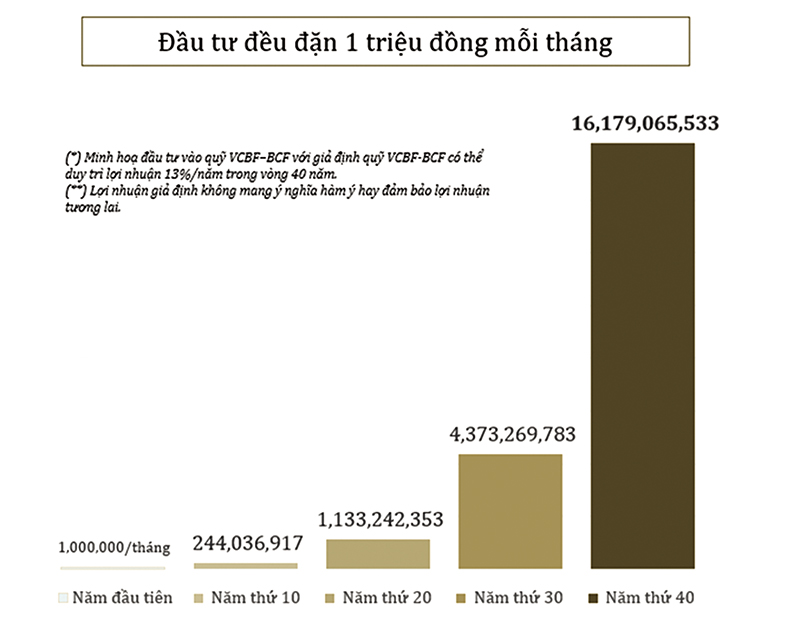

Be persistent in investing every month with a fixed deduction from your salary and maintain it regularly for many years. You will not be able to imagine that, with only 1 million VND/month, after 40 years, assuming a compound interest rate of 13%/year, you can have more than 16 billion VND.

As your income increases, increase your monthly investment amount and you will get a larger amount. Investing monthly also reduces your risk by averaging out the highs and lows.

Look for investment funds managed by a trusted fund management company.

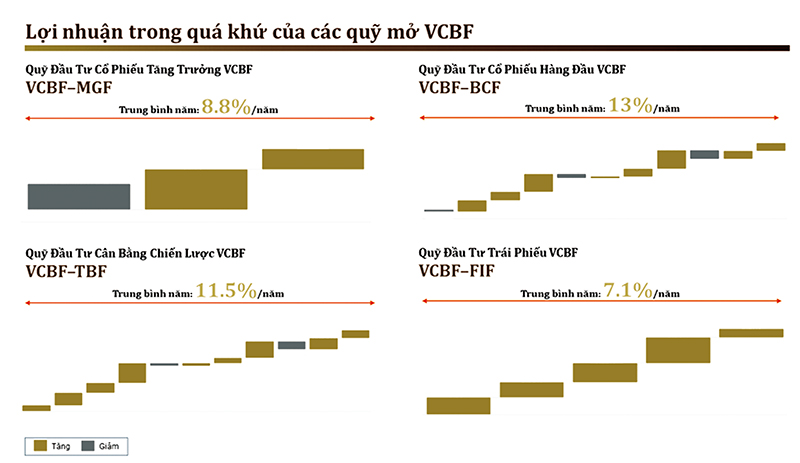

Vietcombank Securities Investment Fund Management Company Limited (VCBF) provides a range of open-end fund products, helping non-professional investors seek profits in the stock market. Whether you are following the conservative trend or profit growth, you can choose a VCBF open-end fund that suits your risk appetite, with the average annual profit of the funds in the past reaching 7-13%/year*. With a history of managing open-end funds for over 10 years, VCBF has proven that VCBF is an asset management partner you can trust.

VCBF Bond Investment Fund (VCBF-FIF) is for cautious investors who want to increase profits compared to bank savings without taking on volatility risks.

VCBF Leading Equity Fund (VCBF-BCF) is for investors who want long-term returns from stocks, with medium to high risk as the fund invests in leading companies.

VCBF Growth Equity Fund (VCBF-MGF) is suitable for investors who want to invest in small and medium-sized companies with outstanding long-term growth potential, accepting greater short-term fluctuations.

VCBF Strategic Balanced Fund (VCBF-TBF) is for investors who want to invest in a diversified portfolio of large-cap, mid-cap stocks and bonds without having to diversify themselves into many different funds.

The above advice helps new investors to have a long-term view, be more disciplined and intelligent in accumulating assets to build financial prosperity.

To learn more about VCBF open-end fund, you can visit www.vcbf.com or follow the open-end fund on the VCBF Open-end Fund Fanpage. VCBF Open-end Fund is also available on VCBF Mobile, VCB Digibank, Fmarket, MoMo and VNSC by Finhay.

Source: https://baodautu.vn/nam-loi-khuyen-dau-tu-tich-san-tu-cac-chuyen-gia-tai-chinh-cua-vcbf-d218539.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)