Experts say that to avoid market liquidity congestion, it is necessary to reconsider the regulation prohibiting individual investors from participating in the bond market. In case the ban is still in place, it is necessary to create an escape route by removing barriers that limit institutional investors from participating in the market.

|

| The market is completely absent of bonds issued by manufacturing enterprises. Photo : shutterstock |

Non-bank corporate bond issuance remains sluggish

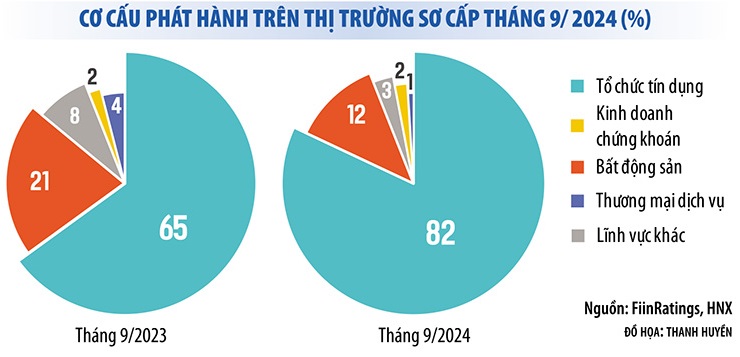

FiinRatings' report shows that the primary corporate bond market in September recorded a total issuance value of VND45,300 billion, with 39 issuances. In the first 9 months of the year, the total issuance value reached VND313,600 billion, up nearly 58% over the same period last year. The growth figures seem to show that the corporate bond market is recovering positively, in which private issuance alone increased by 62%.

However, in reality, the corporate bond market in the first 9 months of this year only improved in the banking group. Meanwhile, non-bank bond issuance in the first 9 months of this year decreased by 26.3% compared to the same period last year.

Non-bank bonds are not only sluggishly issued, but also have a high rate of late payment. According to FiinRatings, the rate of late payment of bonds in the whole market is currently at 18.9%, entirely belonging to the group of non-bank enterprises, mainly enterprises whose financial health has weakened in recent years.

In other words, the bond market in the first 9 months of the year still recorded a "one-man market" situation for banks. Up to 83% of corporate bonds issued in September 2024 were bank bonds. In the first 9 months of the year, bank bonds accounted for 74% of the total value of bonds issued. Meanwhile, bonds issued by manufacturing enterprises were completely absent.

This reality shows that the corporate bond market has not really recovered, while the pressure to mature bonds is very high. According to statistics from the Vietnam Bond Market Association, in the last 3 months of the year, businesses had to mature nearly 80,000 billion VND of bonds, 44% of which were in the real estate sector. If the situation does not improve, the situation of overdue bond payments will not improve. In September 2024 alone, the market recorded nearly 30 more bonds with overdue principal and interest payments.

|

The market is at risk of "lack" of liquidity.

In the context of the corporate bond market, especially non-bank bonds, not yet recovering, the amendment and supplement of the Securities Law in the direction of prohibiting individual investors from participating in the corporate bond market (except bank bonds) has caused many people to worry.

Besides tightening restrictions on individual investors, other "valves" need to be opened so that market liquidity is not clogged.

Besides tightening restrictions on individual investors, other "valves" need to be opened so that market liquidity is not clogged.

Currently, banks are the largest holders of corporate bonds, followed by individual investors (individuals own 30% of individual corporate bonds). The participation of investment funds in the bond market is still very small (about 8%). Therefore, if investors are eliminated from the corporate bond market, liquidity will decrease significantly, affecting the ability of enterprises to mobilize capital.

Instead of preventing it, some members of the National Assembly's Economic Committee said that the Government should specify the standards and conditions for identifying professional individual investors, ensuring that professional individuals can assess the level of risk of individual corporate bonds when participating in bond investment.

Similarly, speaking to reporters from Dau Tu Newspaper, Professor and Doctor Tran Ngoc Tho, a member of the National Financial and Monetary Policy Advisory Council, also said that the above regulation should be reconsidered. In fact, many countries such as Singapore, Thailand, Malaysia, the United States, etc. still allow professional investors to participate in the private bond market.

According to this expert, the drafting agency and the National Assembly can still keep the private bond option as a playground for institutional investors, but loosen the rules to allow individual professional investors to participate in buying and selling and trading private bonds on the secondary market, instead of completely banning it.

Meanwhile, leaders of many credit rating companies in Vietnam support the removal of individual investors from the bond market. However, according to these companies, in addition to tightening restrictions on individual investors, other “valves” need to be opened to prevent market liquidity from being clogged.

Mr. Nguyen Quang Thuan, General Director of FiinRatings, proposed a number of solutions to attract more institutional investors to participate in this market, such as promoting credit ratings, removing regulations restricting investment in corporate bonds of some organizations, building index sets for the bond market, allowing the establishment of bond guarantee companies or bond guarantee funds, etc.

“Many foreign funds want to invest in bonds in Vietnam, but it is difficult because the bonds are not rated. The rate of rated corporate bonds in ASEAN is more than 50%, while this rate in Vietnam is almost zero,” said Mr. Thuan.

According to this expert, it is necessary to promote credit ratings for all bonds to target institutional and foreign investors. Then, market liquidity will be better, making up for the shortage of individual investors.

Source: https://baodautu.vn/mo-loi-thoat-hiem-cho-thanh-khoan-thi-truong-trai-phieu-d227745.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)