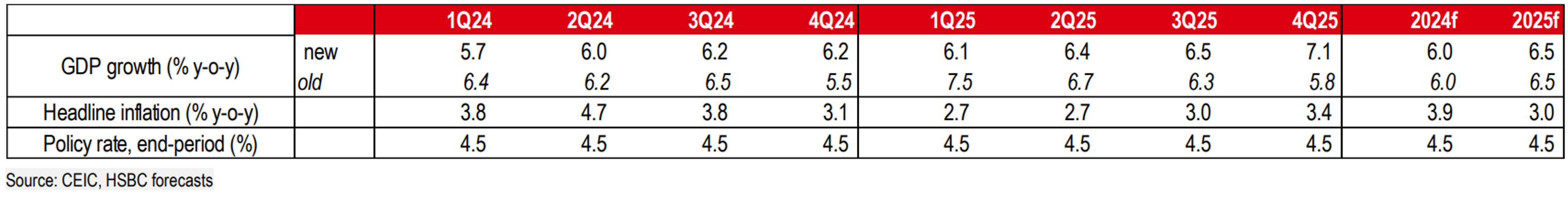

HSBC Global Research has just released the Vietnam at a glance report, in which it stated that although the GDP growth rate in the first quarter (up 5.7%) was lower than market expectations, the recovery story is still "intact" and it will take time for the recovery to spread widely.

|

Q1 not as expected, but many positive indicators

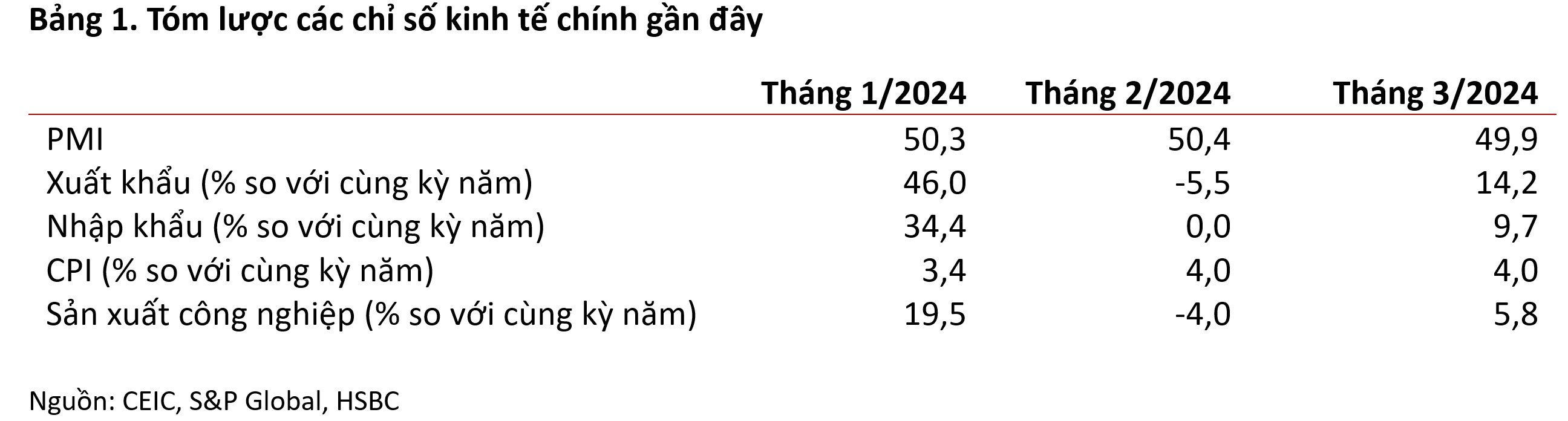

Although Vietnam will see better growth prospects in the Year of the Dragon, GDP growth in Q1/2024 will be slower than expected, at 5.7% compared to the same period last year. This increase is lower than HSBC's and the market's forecast (6.4%).

This does not mean that the recovery is affected, but the recovery story is uneven. “This result does not mean that the recovery story is ‘off-beat’. In fact, Vietnam is still firmly on the recovery path led by a brighter trade outlook,” said Ms. Yun Liu, economist in charge of ASEAN markets, HSBC Global Research.

|

| Yun Liu, Economist, HSBC Global Research |

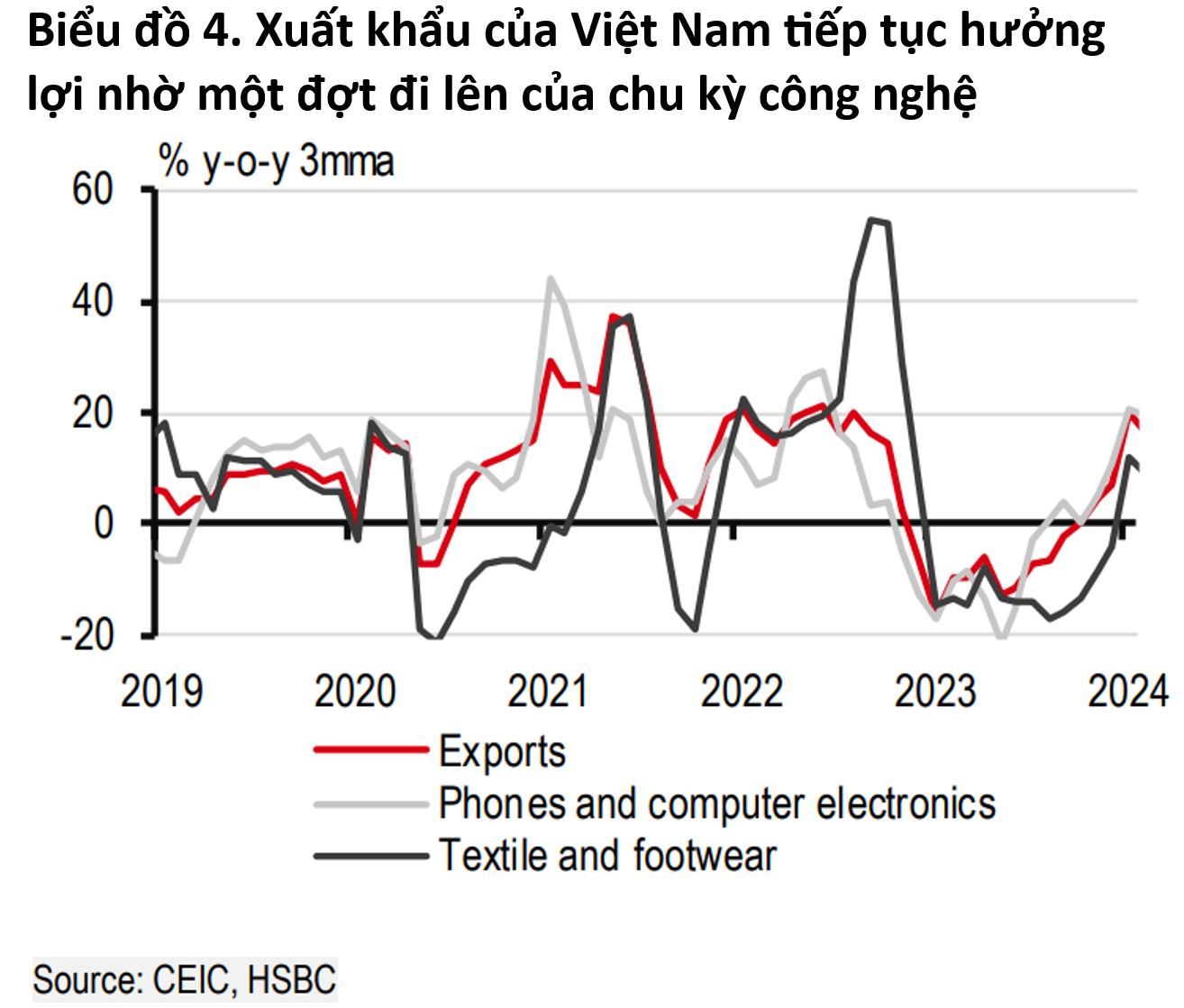

High frequency indicators continue to point to a positive trade outlook, driven largely by the electronics cycle. Exports in March grew by more than 14% year-on-year, bringing the quarter’s growth to 17% year-on-year.

According to HSBC experts, the main reason is an upturn in the electronics cycle, benefiting from its role as a key production hub for Samsung smartphones. Besides electronics, the export recovery continues to expand to other industries such as textiles and footwear, although its contribution to economic growth remains low.

Furthermore, although import growth also recovered to double digits in Q1/2024, the trade surplus increased to over USD 8 billion, exceeding the monthly average of 2023 by over 10%. Not only has the short-term trade cycle reversed, but the positive long-term FDI outlook continues to persist.

New FDI capital in the first quarter of 2024 increased by nearly 60% compared to the same period last year, and up to 65% of it was focused on the pillar sector of manufacturing, the rest was in real estate. When looking at the origin of investment capital, it is interesting that Singapore took the throne as the largest FDI provider to Vietnam, with an impressive rate of 50%.

|

Uneven recovery

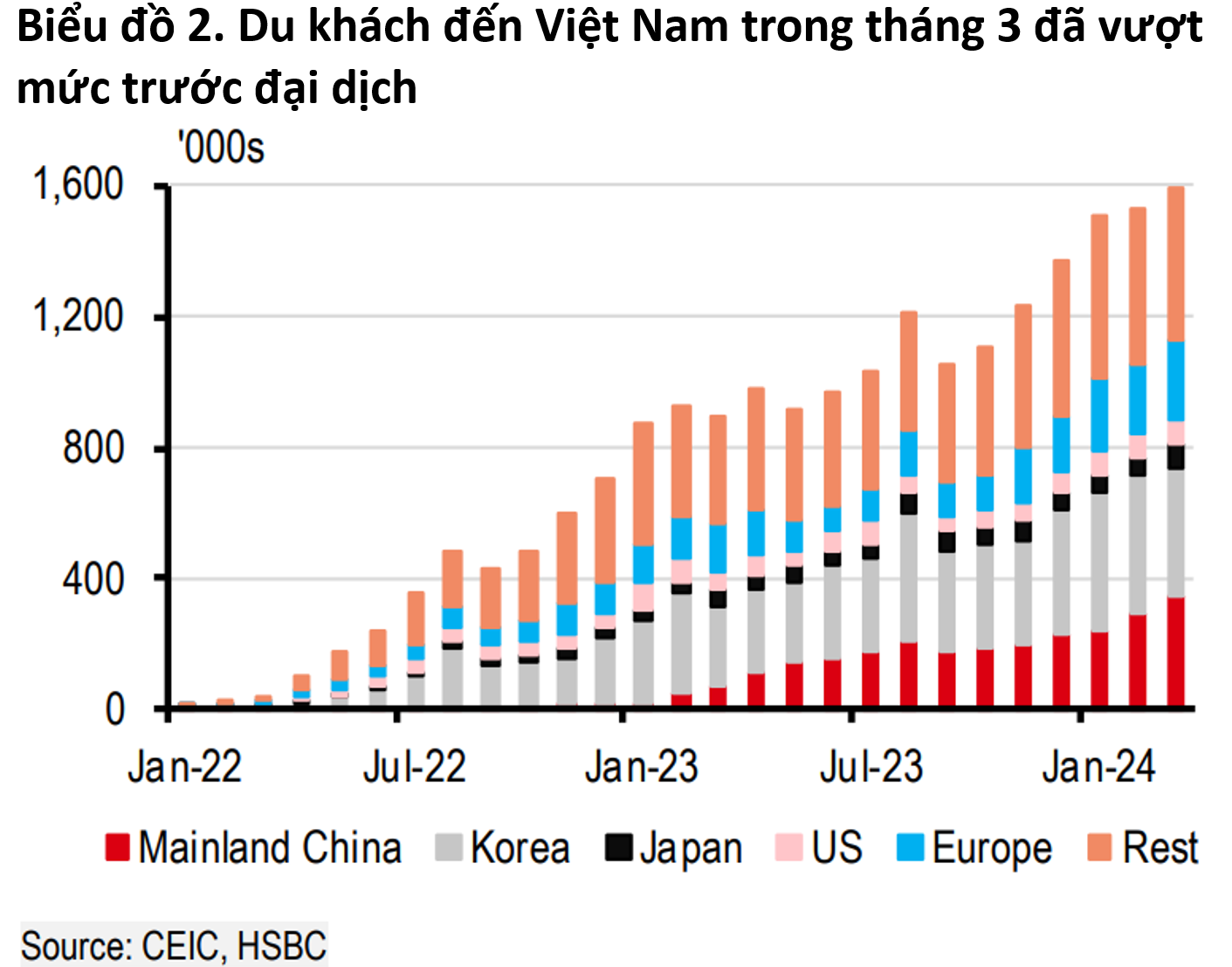

The export manufacturing sector is on track to regain its previous “form”. And that is one of the bright spots in the service sector. In addition, tourism-related services continue to maintain positive growth momentum. For the first time since COVID-19, the number of monthly visitors to Vietnam nearly reached 1.6 million in March, surpassing the pre-pandemic level by 13%. Although the base effect is also partly to blame, the strong return of mainland Chinese tourists also provides much-needed support.

|

This is partly due to Vietnam’s ongoing efforts to restore flights to mainland China, which are now close to 80% of pre-pandemic levels. While Chinese tourist arrivals to ASEAN have recently picked up, there is still room for further improvement. Encouragingly, authorities are considering expanding the visa exemption list.

However, returning to the uneven recovery story mentioned above, the “unevenness” can be seen most clearly in the service sector. “The most surprising decline came from the service sector, when this sector grew by only 6.1% in Q1/2024 compared to the same period last year,” HSBC’s report stated.

Accordingly, the recovery in the service sector continues to take place in many different directions. In particular, domestic sectors are lagging behind external sectors. Specifically, "information and communication", financial and professional services have slowed down since Q4/2023, while the real estate industry still contributes little to economic growth, reflecting the prolonged weakness in the real estate cycle.

|

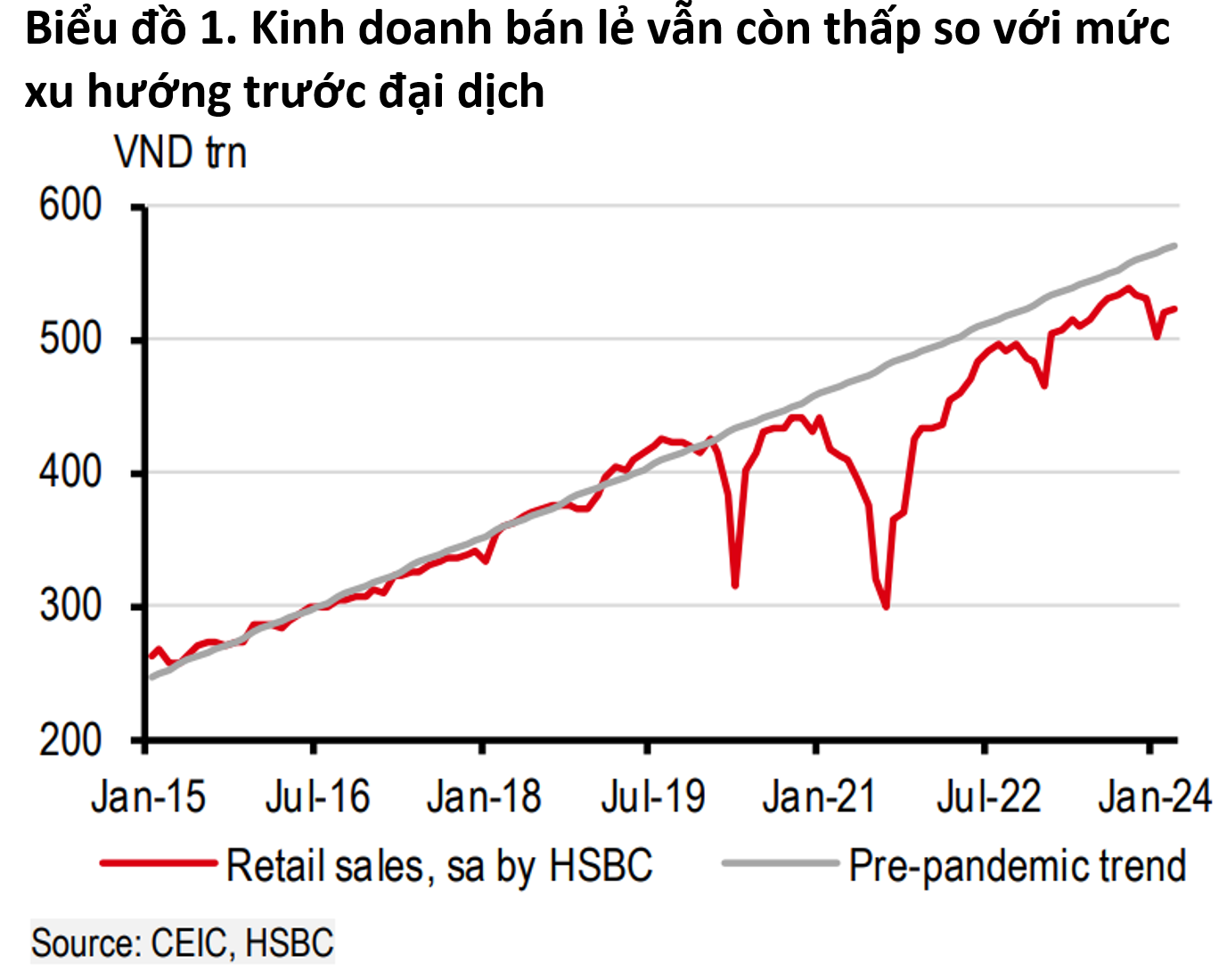

Meanwhile, retail sales growth has not yet returned to pre-pandemic levels, and is still down significantly by about 10%. Although Vietnam’s export cycle has begun to show signs of recovery, it is still not enough to translate into a significant boost for domestic sectors. “To regain pre-pandemic growth, Vietnam needs to spread growth from the trade sector to domestic services,” said economist Yun Liu.

Maintain growth forecast, cautious on price pressures

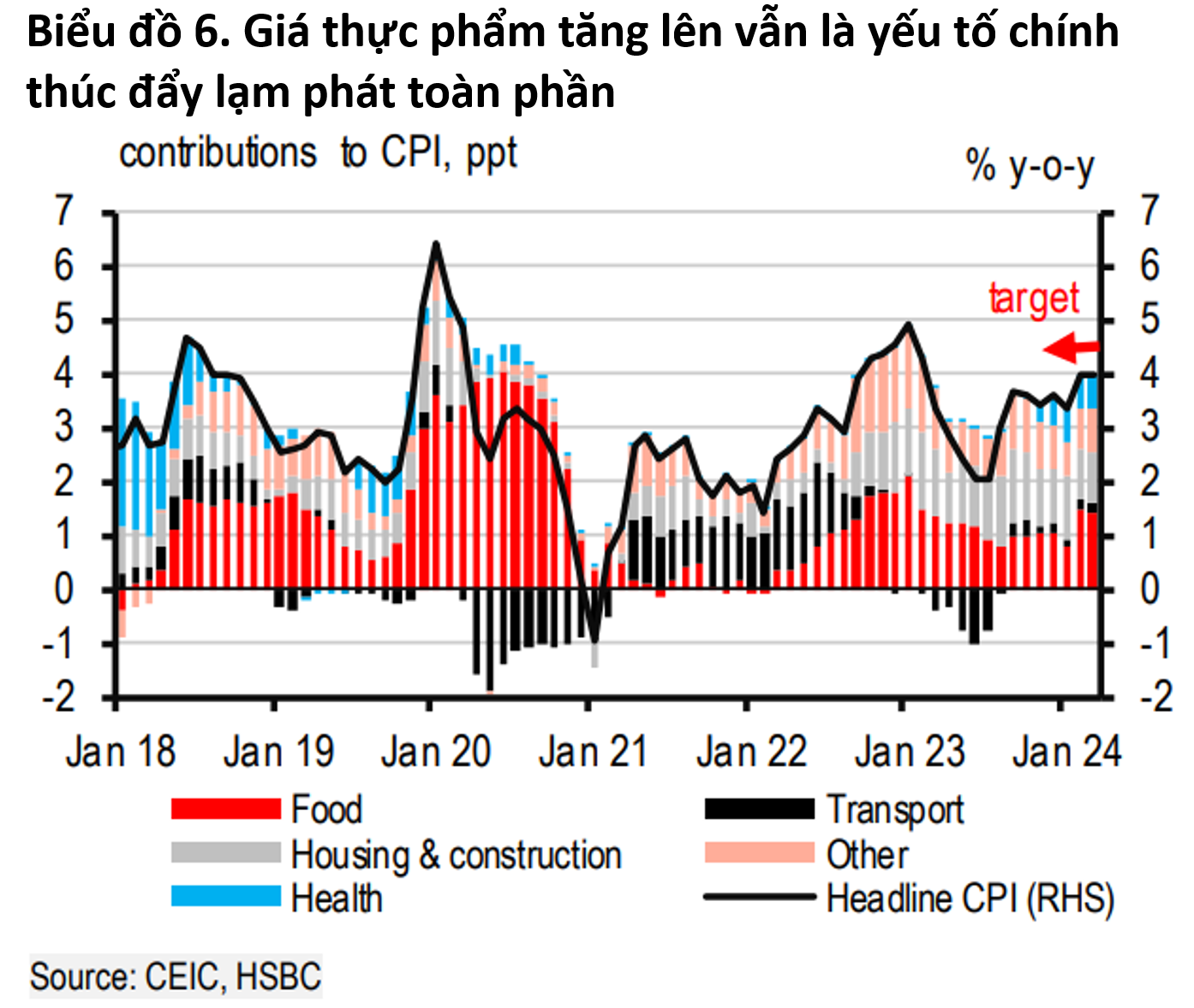

Headline inflation in March saw a 0.2% month-on-month decline due to price adjustments during the Tet holiday, leading to a 4% year-on-year increase. Although lower than HSBC and market forecasts (forecast of 4.2%), the rate remained elevated. Details show that all groups declined, except for the “housing and construction materials” and “other goods and services” groups.

|

Vietnam’s inflation has remained largely stable, staying below the 4.5% inflation ceiling. However, risks to inflation remain. This is partly due to double-digit rice price inflation, which shows the impact of global rice prices on domestic rice prices even for a rice-exporting country like Vietnam. Meanwhile, although energy inflation has eased, it still needs to be closely monitored.

“We expect average inflation to remain at around 3.9%, although rising but still below the inflation ceiling. Therefore, we do not expect the SBV to loosen monetary policy in the near future. We forecast that the SBV will keep the policy interest rate stable at 4.5% during this period and until 2025,” the report stated.

|

Source link

Comment (0)