ANTD.VN - The General Department of Taxation criticized tax departments for not being resolute in inspecting and supervising the issuance of electronic invoices for each sale at retail gasoline stores, conducting 10,000 inspections and supervisions but not detecting violations.

Surprise inspection, discovered many stores not complying with regulations

The General Department of Taxation has just sent a document to the Directors of the Tax Departments of provinces and centrally-run cities requesting to continue to strengthen inspection and supervision of the implementation of electronic invoices for each sale in the field of petroleum business and retail.

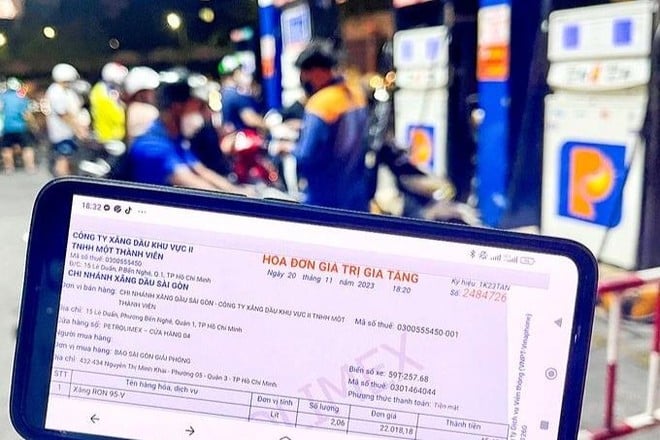

The General Department of Taxation said that this agency has organized working delegations to work at a number of tax departments and directly and unexpectedly inspected a number of stores regarding the implementation of regulations on issuing electronic invoices for each sale.

Through inspection, it was found that stores applying automatic connection solutions have data from each sale from the measuring column recorded and transmitted automatically and completely to the sales software and issue electronic invoices for each sale according to regulations.

However, for stores using POS machines/tablets, inspections show that these stores have not complied with regulations on issuing electronic invoices for each sale.

Specifically, the inspection team extracted data from each sales log in the measurement column and compared it with the issued and transmitted electronic invoices to the tax authority. The results showed discrepancies that did not correspond to the number of sales and quantity of goods sold. In particular, there was a store that, at the time of inspection, did not issue any electronic invoices compared to the sales logs recorded in the measurement column.

|

Only 47% of stores automatically connect with tax authorities |

According to the report of the Tax Departments, up to now, only 47% of stores nationwide have implemented automatic connection. This solution is considered the most optimal because data and information of each sale are recorded and automatically transferred from the petrol meter to a computer with an Internet connection to issue electronic invoices each time and transfer electronic invoice data to the tax authority, limiting human impact.

While the POS/tablet solution has many risks in implementing the regulation of issuing electronic invoices for each sale, because the data and information for each sale to issue electronic invoices depends on the manual data entry of the seller.

Tax departments have not yet inspected and supervised strictly.

The General Department of Taxation also said that by the end of October 2024, tax authorities at all levels had conducted or coordinated with local agencies to conduct nearly 10,000 inspections and supervisions of the issuance of electronic invoices for each sale at retail gasoline stores nationwide.

However, the General Department of Taxation believes that the implementation level of the Tax Departments is still different, generally not drastic, and the inspection method is not suitable for the characteristics of gasoline retail activities that require issuing electronic invoices for each sale. The Tax Departments mainly only send officers to the stores to directly supervise at certain times or to inspect and monitor and compare the number of invoices issued on the electronic invoice system at the tax agency.

“Most Tax Departments have not detected violations of regulations on issuing electronic invoices for each sale, or have detected them but have not strictly handled them according to regulations. Therefore, inspection and supervision work has not been really effective, and has not encouraged gas stations to switch to applying automatic connection solutions,” the General Department of Taxation commented.

In addition, 10 tax departments have a high rate of stores using POS machines/tablets but have not yet organized inspections and supervision of the implementation of regulations as directed by the General Department of Taxation. Therefore, the General Department of Taxation severely criticized the 10 Directors of the above Tax Departments.

In the document, the General Department of Taxation assigned the directors of tax departments to focus resources and resolutely carry out regular or surprise inspections and supervision of all retail gasoline stores in the area that have not applied automatic connection solutions to issue electronic invoices for each sale, promptly detect and strictly handle violations according to regulations.

At the same time, report to the Provincial and Municipal People's Committees to direct competent authorities to consider revoking the licenses of eligibility for petroleum business for stores and enterprises that intentionally violate the regulations, and publicly announce stores and enterprises that violate the regulations.

Coordinate with units to effectively operate inter-sectoral inspection and supervision teams and groups at stores to comply with this regulation, strictly handle businesses and stores that violate this regulation, or consolidate records and transfer them to the police for handling according to regulations.

The General Department of Taxation requires subordinate leaders to identify this as one of the key tasks in the last months of 2024 and early 2025, with the goal of achieving at least 95% of stores nationwide using automatic connection solutions to issue electronic invoices for each sale by the end of June 2025. This is a criterion for consideration of emulation and rewards for the individual Director of the Department.

Source: https://www.anninhthudo.vn/kiem-tra-dot-xuat-phat-hien-loat-cua-hang-xang-dau-vi-pham-quy-dinh-xuat-hoa-don-dien-tu-post597629.antd

Comment (0)