Oil prices today 02/04/2025 Oil prices close at 1-month low as US suspends tariffs on Mexico

Gasoline price today February 4, 2025

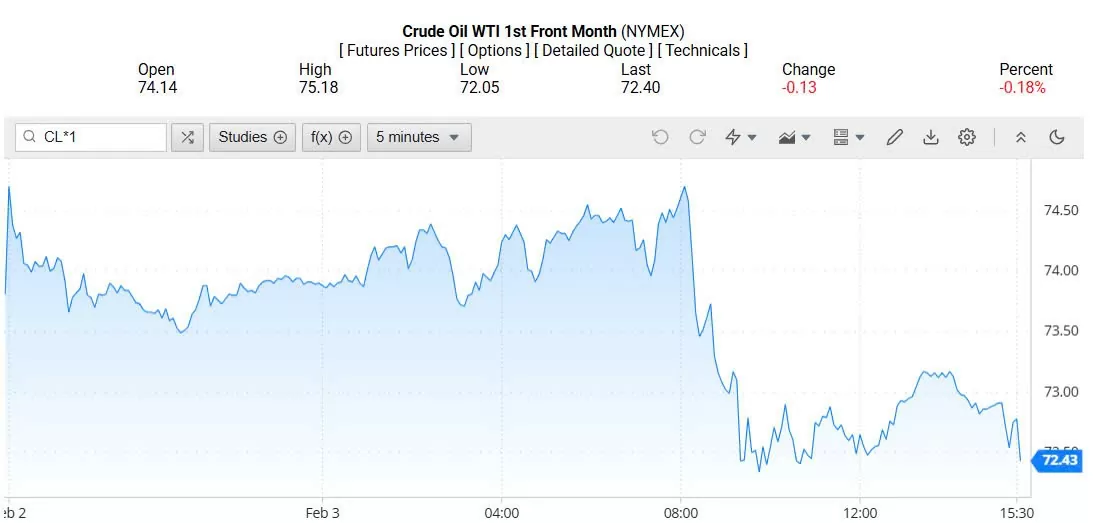

Recorded on Oilprice at 4:30 a.m. on February 4, 2025 (Vietnam time), WTI oil price was at 72.43 USD/barrel, down 0.18% (equivalent to a decrease of 0.13 USD/barrel).

|

| WTI oil price on the world market early morning February 4, 2025 (Vietnam time) |

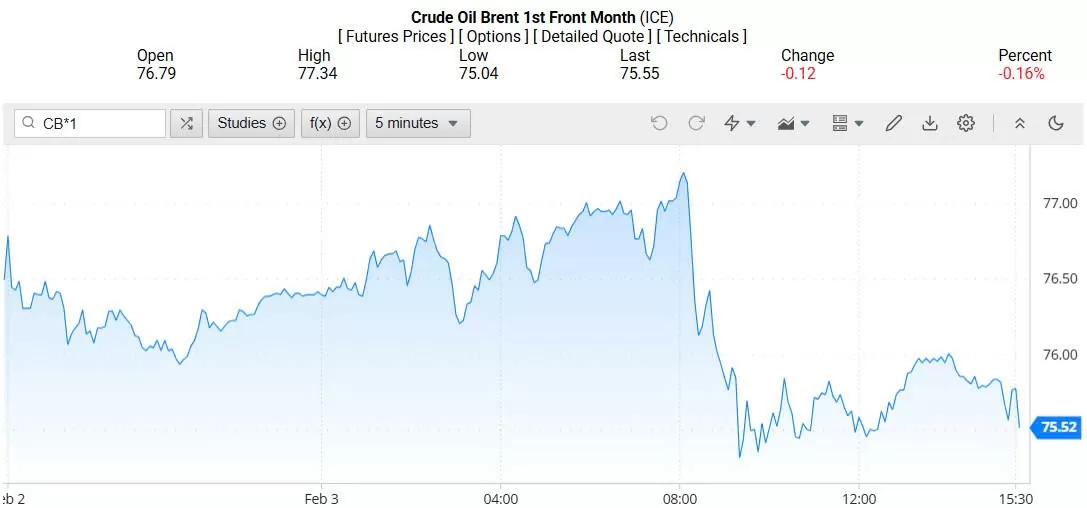

Similarly, Brent oil price was at 75.52 USD/barrel, down 0.16% (equivalent to a decrease of 0.12 USD/barrel).

|

| Brent oil price on the world market early morning February 4, 2025 (Vietnam time) |

Oil prices edged up in volatile trading on Monday but closed at a one-month low as higher-priced contracts expired, as the market digested U.S. President Donald Trump's plans to impose tariffs on Canada, Mexico and China.

Concerns about imports from two major crude suppliers to the United States pushed oil prices up more than $1 a barrel early in the session before Trump suspended new tariffs on Mexico for a month as Mexico agreed to reinforce its northern border to stem the flow of illegal drugs, particularly fentanyl.

Brent crude for April delivery rose 29 cents, or 0.4%, from Friday's contract's close to settle at $75.96 a barrel, while U.S. West Texas Intermediate (WTI) crude rose 63 cents, or 0.9%, to settle at $73.16.

It was the lowest close for Brent since January 2 when the lower-priced April contract was the first month to be delivered after the higher-priced March futures contract expired on Friday.

Trump's move to impose steep tariffs on goods from Mexico, Canada and China on Tuesday threatened to spark a trade war that could undermine global growth and stoke inflation.

The proposed tariffs include a 25% tariff on most goods from Mexico and Canada, a 10% tariff on energy imports from Canada and a 10% tariff on imports from China.

“Tariffs on energy imports from Canada could be more disruptive to the domestic energy market than tariffs on imports from Mexico and could even be counterproductive to one of the president’s key goals — reducing energy costs,” Barclays analyst Amarpreet Singh said in a note.

According to the U.S. Department of Energy, Canada and Mexico account for about a quarter of the oil that U.S. refineries process into fuels like gasoline and heating oil.

US manufacturing activity grew for the first time in more than two years in January, but the recovery may not last due to Trump's tariffs, which are likely to further increase raw material prices and disrupt supply chains.

Boston Federal Reserve President Susan Collins said the tariffs announced by the Trump administration could increase inflation, noting that there is a lot of uncertainty and the US central bank is in no hurry to change the direction of monetary policy.

Higher inflation could prompt the Fed to raise interest rates to counter rising prices. That could reduce energy demand by raising borrowing costs and slowing economic growth.

Industry sources said the tariffs would increase the cost of heavier crude grades that US refiners need to achieve optimal output.

Gasoline prices at gas stations in the United States will certainly increase due to the loss of crude oil for refineries and the loss of imported products, said Mukesh Sahdev at Rystad Energy.

Trump has warned that tariffs could cause "short-term" pain for Americans.

U.S. gasoline futures rose about 3% to a two-week high, helping lift the 3:2:1 crack spread, a gauge of refining margins, to its highest since August 2024.

The Organization of the Petroleum Exporting Countries and allies such as Russia, known collectively as OPEC+, agreed to maintain a policy of gradually increasing oil output from April and to exclude the U.S. government's Energy Information Administration from sources used to monitor output and compliance with supply pacts.

Russian Deputy Prime Minister Alexander Novak said the OPEC+ group's Joint Ministerial Monitoring Committee (JMMC) discussed Trump's call to increase oil production.

Global oil demand is likely to be close to current levels by 2040 in its long-term demand outlook, with rising consumption later this decade offset by a decline in the late 2030s, energy and commodities trading firm Vitol said.

Domestic retail gasoline prices on February 4, 2025 will be applied according to the adjustment session from 3:00 p.m. on February 1 by the Ministry of Finance - Ministry of Industry and Trade.

Item | Price (VND/liter/kg) | Difference from previous period |

RON 95 gasoline | 21,000 | -140 |

E5 RON 92 gasoline | 20,390 | -200 |

Diesel | 19,240 | -950 |

Oil | 19,430 | -608 |

Fuel oil | 17,500 | -250 |

Specifically, the price of RON 95-III gasoline (a popular type on the market) decreased by 140 VND, to 21,000 VND per liter. E5 RON 92 also decreased by 200 VND, to 20,390 VND. Compared to 7 days ago, diesel oil decreased by 950 VND, to 19,240 VND. Kerosene and fuel oil have new prices of 19,430 VND and 17,500 VND, respectively.

|

| Gasoline prices today February 4, 2025. Photo by Dinh Tuan |

In this management period, the Ministry of Industry and Trade - Ministry of Finance did not set aside or use the Petroleum Price Stabilization Fund for E5RON92 gasoline, RON95 gasoline, diesel oil, kerosene, and mazut oil.

Thus, from the beginning of 2025 until now, domestic gasoline prices have undergone 5 adjustment sessions, including 1 decrease, 3 increases and 1 opposite session.

Source: https://congthuong.vn/gia-xang-dau-hom-nay-04022025-cham-day-1-thang-372116.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)