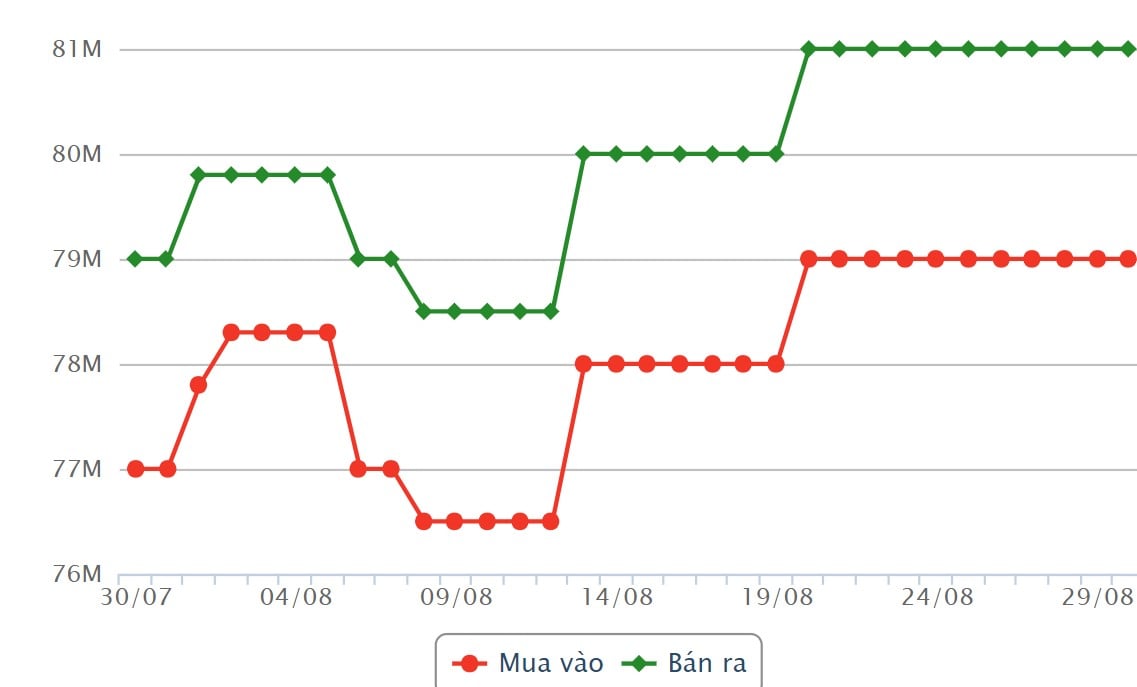

SJC gold bar price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 79 - 81 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 79 - 81 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

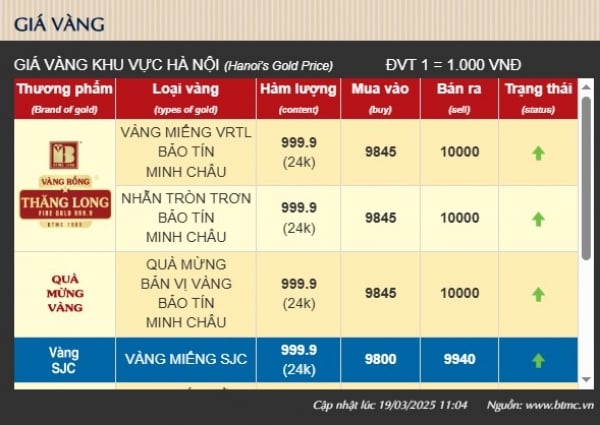

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 77.55 - 78.65 million VND/tael (buy - sell); both buying and selling prices remained unchanged.

Saigon Jewelry Company listed the price of gold rings at 77.4 - 78.65 million VND/tael (buy - sell); an increase of 50,000 VND/tael for both buying and selling.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,514.9 USD/ounce, up 1.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices remained unchanged in the context of the USD index not changing much. Recorded at 9:00 a.m. on August 30, the US Dollar Index, which measures the greenback's fluctuations against 6 major currencies, was at 100.302 points (up 0.02%).

World gold prices fluctuate strongly when there are many conflicting factors.

Gold prices fell sharply yesterday after the US announced 231,000 unemployment claims, down from the initial estimate of 233,000.

This data shows that US inflation is under control, increasing the possibility that the US Federal Reserve (FED) will cut interest rates lower than expected by 50 basis points. This will be disadvantageous for gold prices.

In addition, precious metals are also under pressure from the gradually strengthening USD. At the same time, profit-taking pressure from investors has also caused gold to lose its investment advantage in recent times.

Investors are now waiting for the personal consumption expenditures (PCE) index, the Fed's preferred inflation gauge, to be released on Friday.

According to experts, this wait-and-see mentality also slows down gold buying, even causing gold prices to drop in the remaining sessions of the week.

Some experts said that if inflation data is released, it will further strengthen the case for the Fed to cut interest rates less sharply at its September meeting.

According to CME's FedWatch tool, the market is pricing in a 66.5% chance of a 25 basis point cut in US interest rates and a 34.5% chance of a 50 basis point cut in September.

However, in the medium and long term, most experts believe that the FED's move to lower interest rates, combined with the net buying trend of central banks and continued geopolitical tensions in the Middle East, act as fundamental factors for the increase in gold prices.

The market is pricing in a rate cut by the Fed regardless, says Gainesville Coins chief market analyst Everett Millman. The question now is how much the Fed will cut.

He believes that the gold market will not have many major fluctuations before the next FED meeting and the factor that will play a supporting role for gold is concerns about geopolitical tensions.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-308-giang-co-manh-co-nen-mua-vao-1386874.ldo

Comment (0)