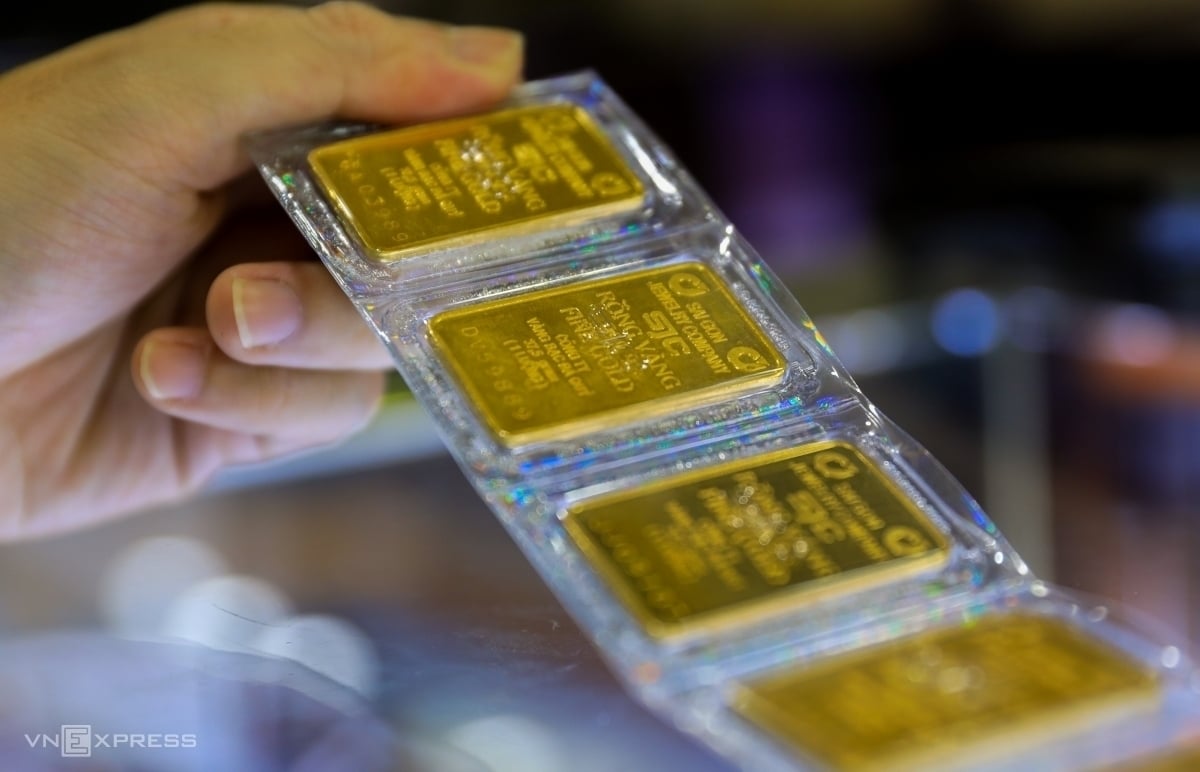

SJC gold bar price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 79.8-81.8 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold price at DOJI decreased by 200,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 79.8-81.8 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC decreased by 200,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 78-79.1 million VND/tael (buy - sell); the buying price remained the same and the selling price decreased by 100,000 VND/tael.

Saigon Jewelry Company listed the price of gold rings at 77.8-79.1 million VND/tael (buy - sell); down 100,000 VND/tael for both buying and selling.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 8:45 a.m., the world gold price listed on Kitco was at 2,552.8 USD/ounce, down 20.6 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell sharply amid an increase in the USD index. Recorded at 8:45 a.m. on September 19, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 101.112 points (up 0.5%).

The sharp drop in gold prices has left many people wondering why the US Federal Reserve (FED) decided to cut interest rates quite strongly.

According to Kitco, the statement of the Federal Reserve Open Market Committee (FOMC) meeting just released showed that the US central bank has reduced its key interest rate - the FED funds rate - to a range of 4.75% to 5.0%.

The FOMC statement said the US economy has made progress in lowering inflation but it remains high. The market is now eagerly awaiting a press conference and comments from Fed Chairman Jerome Powell.

The Bank of England and the Bank of Japan will hold regular monetary policy meetings today (September 19).

Robert Minter, chief investment strategist at Abrdn, said that in an easing cycle, it is only a matter of time before gold prices break $3,000 an ounce. Minter explained that historically, rate-cut cycles have driven higher demand from gold investors and exchange-traded fund buyers.

However, this time around central bank demand, as well as physical gold demand from China and India, the world's two largest retail gold markets, is very high.

In a recent commentary, ANZ analysts forecast that gold prices will rise to $2,900 an ounce by the end of the year as investment demand, which was lackluster in the first half of 2024, rebounds.

The bank's experts also stressed that rising prices would not deter central banks from buying.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-199-giam-manh-mot-cach-kho-hieu-1395842.ldo

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)