Update the latest gold price details today, April 3, 2025 in the domestic market

At the time of survey at 7:00 p.m. on April 3, 2025, the domestic gold price today, April 3, 2025, is witnessing a strong breakthrough, with the common selling price exceeding 102 million VND/tael. Below is a detailed update of the closing price of gold on April 3, 2025 from reputable units, providing a comprehensive view of the gold fever that is heating up the market today.

In Hanoi, the price of SJC gold bars was listed at VND99.5-102.2 million/tael (buy - sell), an increase of VND400,000/tael in both directions compared to yesterday. The difference between buying and selling prices remained at VND2.7 million/tael, reflecting the vibrant buying and selling in the capital. Meanwhile, DOJI Group also recorded a similar increase, with the price of SJC gold bars reaching VND99.5-102.2 million/tael (buy - sell) in Hanoi, Ho Chi Minh City and Da Nang, an increase of VND400,000/tael in both directions. The difference between buying and selling prices remained at VND2.7 million/tael, confirming the trend of uniform increase across the system.

At SJC Company, the price of 1L, 10L, 1KG gold bars is listed at 99.5-102.2 million VND/tael (buy - sell), an increase of 400 thousand VND/tael in both buying and selling directions. For SJC 99.99% gold rings (1 chi, 2 chi, 5 chi), the price is 99.4-102.0 million VND/tael, a sharp increase of 500 thousand VND/tael in both directions, showing the special attraction of this product line. Particularly at Mi Hong, the price of SJC gold bars is recorded at 99.7-101.7 million VND/tael (buy - sell), a decrease of 30 thousand VND/tael in buying direction, showing the caution of this unit in the context of hot gold prices.

PNJ continues to be the center of attention when listing the gold price today, April 3, 2025, at 99.5-102.2 million VND/tael (buy - sell) for both PNJ and SJC gold bars in Ho Chi Minh City, Hanoi, Da Nang and the Western region, up 400 thousand VND/tael in both directions. The difference between the buying and selling prices remained at 2.7 million VND/tael, reflecting the constant attraction of gold bars on a bustling trading day. For 999.9 jewelry gold, PNJ recorded 99.5-102.0 million VND/tael (buy - sell), up 400 thousand VND/tael in both directions, while 916 gold (22K) reached 91.03-93.53 million VND/tael, up 360 thousand VND/tael, highlighting the heat of the jewelry gold line.

Bao Tin Minh Chau surprised again when the price of SJC gold bars was listed at 99.0-102.2 million VND/tael (buy - sell), with the buying price decreasing by 100 thousand VND/tael but the selling price still increasing by 400 thousand VND/tael compared to the previous day. The difference between buying and selling prices was up to 3.2 million VND/tael, showing a strategic adjustment in the context of market fluctuations. Meanwhile, Phu Quy pushed the price of SJC gold bars to 99.0-102.2 million VND/tael (buy - sell), increasing by 300 thousand and 500 thousand VND/tael respectively, with the difference between buying and selling prices being 3.2 million VND/tael, affirming the strong upward momentum in the market.

Vietinbank Gold alone recorded a selling price of VND102.2 million/tael, an increase of VND400,000/tael, while the buying price was not specifically announced in this survey. For 9999 gold at DOJI Hanoi, the price reached VND98.5-101.3 million/tael (buy-sell), an increase of VND0 and VND800,000/tael, respectively, showing a positive fluctuation in the flow of gold.

In general, the closing price of gold on April 3, 2025 is witnessing a clear upward trend across the market, from SJC gold bars, gold rings to jewelry gold. This is the time when gold affirms its position as an attractive investment channel, especially when the price of 999 jewelry gold at PNJ reaches 98.58-101.08 million VND/tael, an increase of 400 thousand VND/tael, and 750 (18K) gold reaches 74.15-76.65 million VND/tael, an increase of 300 thousand VND/tael in both directions. For those who are looking for investment or storage opportunities, today's gold price on April 3, 2025 is a signal that cannot be ignored in the context of a feverish market.

As of 7:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.7 - 102.2 million VND/tael (buy - sell); an increase of 800 thousand VND/tael in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 99.1 - 102.3 million VND tael (buy - sell); increased by 300 thousand VND/tael for buying and increased by 500 thousand VND/tael for selling.

The latest gold price update table today, April 3, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 99.5 | ▲400 | 102.2 | ▲400 |

| DOJI Group | 99.5 | ▲400 | 102.2 | ▲400 |

| Red Eyelashes | 100,200 | ▲200 | 101.7 | ▲200 |

| PNJ | 99.5 | ▲400 | 102.2 | ▲400 |

| Vietinbank Gold | 102.2 | ▲400 | ||

| Bao Tin Minh Chau | 99.0 | ▼100 | 102.2 | ▲400 |

| Phu Quy | 99.0 | ▲300 | 102.2 | ▲500 |

| 1. DOJI - Updated: April 3, 2025 19:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 99,500 ▲400 | 102,200 ▲400 |

| AVPL/SJC HCM | 99,500 ▲400 | 102,200 ▲400 |

| AVPL/SJC DN | 99,500 ▲400 | 102,200 ▲400 |

| Raw material 9999 - HN | 98,500 | 101,300 ▲800 |

| Raw material 999 - HN | 98,400 | 101,200 ▲800 |

| 2. PNJ - Updated: April 3, 2025 19:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,500 ▲400K | 102,200 ▲400K |

| HCMC - SJC | 99,500 ▲400K | 102,200 ▲400K |

| Hanoi - PNJ | 99,500 ▲400K | 102,200 ▲400K |

| Hanoi - SJC | 99,500 ▲400K | 102,200 ▲400K |

| Da Nang - PNJ | 99,500 ▲400K | 102,200 ▲400K |

| Da Nang - SJC | 99,500 ▲400K | 102,200 ▲400K |

| Western Region - PNJ | 99,500 ▲400K | 102,200 ▲400K |

| Western Region - SJC | 99,500 ▲400K | 102,200 ▲400K |

| Jewelry gold price - PNJ | 99,500 ▲400K | 102,200 ▲400K |

| Jewelry gold price - SJC | 99,500 ▲400K | 102,200 ▲400K |

| Jewelry gold price - Southeast | PNJ | 99,500 ▲400K |

| Jewelry gold price - SJC | 99,500 ▲400K | 102,200 ▲400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 99,500 ▲400K |

| Jewelry gold price - Jewelry gold 999.9 | 99,500 ▲400K | 102,000 ▲400K |

| Jewelry gold price - Jewelry gold 999 | 99,400 ▲400K | 101,900 ▲400K |

| Jewelry gold price - Jewelry gold 99 | 98,580 ▲400K | 101,080 ▲400K |

| Jewelry gold price - 916 gold (22K) | 91,030 ▲360K | 93,530 ▲360K |

| Jewelry gold price - 750 gold (18K) | 74,150 ▲300K | 76,650 ▲300K |

| Jewelry gold price - 680 gold (16.3K) | 67,010 ▲270K | 69,510 ▲270K |

| Jewelry gold price - 650 gold (15.6K) | 63,950 ▲260K | 66,450 ▲260K |

| Jewelry gold price - 610 gold (14.6K) | 59,870 ▲240K | 62,370 ▲240K |

| Jewelry gold price - 585 gold (14K) | 57,320 ▲230K | 59,820 ▲230K |

| Jewelry gold price - 416 gold (10K) | 40,080 ▲160K | 42,580 ▲160K |

| Jewelry gold price - 375 gold (9K) | 35,900 ▲150K | 38,400 ▲150K |

| Jewelry gold price - 333 gold (8K) | 31,310 ▲130K | 33,810 ▲130K |

| 3. SJC - Updated: 04/03/2025 19:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 99,500 ▲400 | 102,200 ▲400 |

| SJC gold 5 chi | 99,500 ▲400 | 102,220 ▲400 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 99,500 ▲400 | 102,230 ▲400 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 99,400 ▲500 | 102,000 ▲500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 99,400 ▲500 | 102,100 ▲500 |

| Jewelry 99.99% | 99,400 ▲500 | 100,700 ▲500 |

| Jewelry 99% | 97,693 ▲495 | 100,693 ▲495 |

| Jewelry 68% | 66,312 ▲340 | 69,312 ▲340 |

| Jewelry 41.7% | 39,563 ▲208 | 42,563 ▲208 |

Update gold price today April 3, 2025 latest on the world market

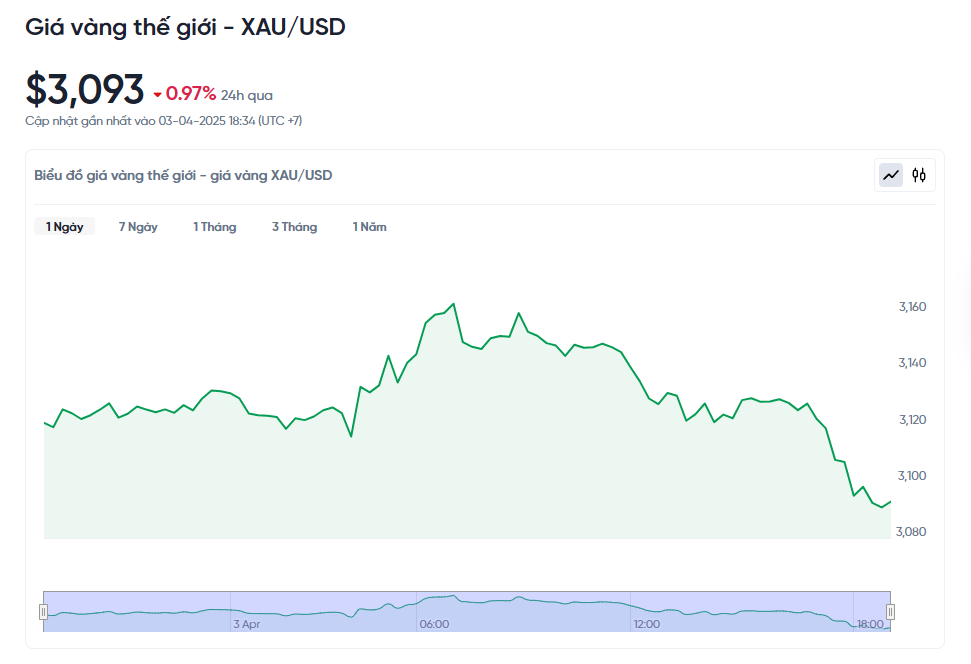

At the time of trading at 7:00 p.m. on April 3, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,093.89 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 97.82 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (99.5-102.2 million VND/tael), the SJC gold price is currently about 4.3 million VND/tael higher than the international gold price.

On April 3, a major decision by President Donald Trump sent shockwaves around the world, from Washington to Beijing to Brussels. Trump announced that he would impose tariffs on all imports into the United States, regardless of whether they came from friendly or hostile countries. Like someone throwing a large rock into a calm lake, this decision angered many countries and prompted warnings of retaliation. As a result, global trade tensions increased, commodity prices threatened to escalate, and many began to fear that the world economy could fall into a difficult situation, even a recession.

The decision was announced on Wednesday, and it immediately sent shockwaves through financial markets around the world. Leaders from many countries spoke out against it, saying it threatened the era of free trade that had helped the world grow for decades. Specifically, Mr. Trump wanted to impose a basic tariff of 10% on all goods imported into the US, but for some major countries, the figure was much higher. According to Fitch Ratings, the average US import tariff has now jumped to 22%, compared to just 2.5% in 2024. This is the highest level in more than 100 years, since around 1910, which surprised many people.

By Thursday, as the situation began to sink in, stock markets in Beijing and Tokyo plunged to multi-month lows. In Europe, shares fell sharply early in the morning, especially in Germany, a major exporter of goods. Across the Atlantic, the U.S. market fared no better, as investors rushed to sell stocks, which were seen as risky, and buy bonds and gold, which are perceived as safer assets when things get uncertain.

China, the world's second-largest economy, now faces tariffs of up to 54% on its goods sold to the US. It quickly said it would not stand idly by and was ready to retaliate. The European Union (EU) is also not willing to stand idly by. Whether allies or rivals of the US, all are opposed, fearing that global trade will be severely damaged. EU leader Ursula von der Leyen warned that millions of people around the world could suffer the consequences. She added that the EU is preparing to retaliate if it fails to sit down and talk with the US. Meanwhile, US Treasury Secretary Scott Bessent said that if countries retaliate, the situation will only get worse.

Even countries that are friendly to the US are not exempt. The EU is being taxed at 20%, Japan at 24%, South Korea at 25%, and Taiwan at 32%. Even some small landmasses and uninhabited islands in Antarctica are being taxed, according to the White House’s announcement on social media X. Australian Prime Minister Anthony Albanese, who heads a country that is a close friend of the US in Asia, could not hide his disappointment. He said that this is not the way a friend should behave, and that the tax is illogical and goes against the spirit of cooperation between the two countries.

In short, Trump’s tariffs are causing concern around the world. They could send commodity prices soaring, drag countries into a tit-for-tat, and threaten global economic stability. For ordinary people, this means that everything in life could become more expensive, and the future could become more uncertain in the coming months.

Gold price forecast for tomorrow, April 4, 2025, domestic gold price will still be at a safe level

At 7:00 p.m. on April 3, 2025 (Vietnam time), the world gold price was at 3,097 USD/ounce, down slightly by 0.9% compared to the previous day. Converted according to the USD exchange rate on the free market (25,910 VND/USD), the world gold price is equivalent to about 97.82 million VND/tael, excluding taxes and fees. Meanwhile, the domestic SJC gold bar price is about 4.3 million VND/tael higher than the international gold price. This difference shows that domestic gold prices remain high despite signs of cooling down in the world market.

The slight decrease in gold prices was due to investors deciding to sell to take profits after the price of gold just set a new record. Previously, the price of gold increased sharply due to the psychology of seeking safe assets, especially after US President Donald Trump imposed heavy import tariffs on all trading partners. This decision further intensified the global trade war, pushing many people to seek gold as a safe haven. However, when the information about the tax became clear, some investors began to sell, causing the price of gold to be under pressure to decrease in the short term.

Still, experts remain optimistic about gold’s prospects. Tai Wong, a metals expert, said higher-than-expected tariffs could weaken the dollar and trigger a sell-off in assets, giving gold a chance to surge to $3,200 an ounce. Matt Simpson, of City Index, said gold was in a good bull run, making those waiting to buy feel impatient. He said the uptrend could continue until there is a major change that changes the market.

In general, gold is still considered a safe choice amid uncertainty. Since the beginning of the year, gold prices have increased by more than 19% thanks to factors such as trade tensions, the possibility of interest rate cuts, geopolitical conflicts and demand from central banks. With such a global trend, domestic gold prices, especially SJC gold, are likely to increase in the morning trading session on April 4, 2025, although there are signs of slowing down today.

Source: https://baoquangnam.vn/tin-tuc-du-bao-gia-vang-ngay-mai-4-4-2025-gia-vang-trong-nuoc-van-se-o-muc-an-toan-3152051.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)