Domestic gold price today April 7, 2025

Domestic gold prices are showing signs of a temporary break on the Hung Kings' Commemoration Day holiday, with prices stable compared to yesterday. Specifically, SJC gold bar prices at large enterprises such as DOJI, SJC, and Bao Tin Minh Chau are all listed at 97.1-100.1 million VND/tael, unchanged from the previous trading session. However, looking back at the whole week, gold prices have decreased slightly, with a decrease of 1.3 million VND/tael in buying and 600 thousand VND/tael in selling.

For 9999 round gold rings, prices also tended to decrease slightly. At DOJI, the price of gold rings was listed at 96.7-100.1 million VND/tael, down 1.7 million VND/tael for buying and 600 thousand VND/tael for selling compared to last week. Similarly, Bao Tin Minh Chau also recorded a decrease of 1.4 million VND/tael for buying and 400 thousand VND/tael for selling.

According to experts, gold prices may continue to fluctuate slightly in the coming time due to the influence of global economic factors and investor psychology. Although gold prices are showing signs of a slight decrease, this is also a good opportunity for those who want to invest in the long term, especially when the world gold market is still supported by factors such as inflation and monetary policy.

Investors should closely monitor market developments and consider carefully before making a decision. If you are planning to buy gold, pay attention to the difference between buying and selling prices, currently at 3-3.4 million VND/tael, to optimize profits.

Gold price April 2, 2025 is a top topic of interest, and understanding the trend will help you make smarter investment decisions.

The latest gold price list today, April 7, 2025 is as follows:

| Gold price today | April 7, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 97.1 | 100.1 | - | - |

| DOJI Group | 97.1 | 100.1 | - | - |

| Red Eyelashes | 99.3 | 100.8 | +600 | +300 |

| PNJ | 97.1 | 100.1 | - | - |

| Vietinbank Gold | 100.1 | - | ||

| Bao Tin Minh Chau | 97.2 | 100.1 | - | - |

| Phu Quy | 97.3 | 100.1 | +200 | - |

| 1. DOJI - Updated: April 7, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 97,100 | 100,100 |

| AVPL/SJC HCM | 97,100 | 100,100 |

| AVPL/SJC DN | 97,100 | 100,100 |

| Raw material 9999 - HN | 96,500 | 99,200 |

| Raw material 999 - HN | 96,400 | 99,100 |

| 2. PNJ - Updated: April 7, 2025 04:30 - Time of website supply source - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 97,500 | 100.100 |

| HCMC - SJC | 97,100 | 100.100 |

| Hanoi - PNJ | 97,500 | 100.100 |

| Hanoi - SJC | 97,100 | 100.100 |

| Da Nang - PNJ | 97,500 | 100.100 |

| Da Nang - SJC | 97,100 | 100.100 |

| Western Region - PNJ | 97,500 | 100.100 |

| Western Region - SJC | 97,100 | 100.100 |

| Jewelry gold price - PNJ | 97,500 | 100.100 |

| Jewelry gold price - SJC | 97,100 | 100.100 |

| Jewelry gold price - Southeast | PNJ | 97,500 |

| Jewelry gold price - SJC | 97,100 | 100.100 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 97,500 |

| Jewelry gold price - Jewelry gold 999.9 | 97,500 | 100,000 |

| Jewelry gold price - Jewelry gold 999 | 97,400 | 99,900 |

| Jewelry gold price - Jewelry gold 9920 | 96,800 | 99,300 |

| Jewelry gold price - Jewelry gold 99 | 96,600 | 99,100 |

| Jewelry gold price - 916 gold (22K) | 89,200 | 91,700 |

| Jewelry gold price - 750 gold (18K) | 72,650 | 75,150 |

| Jewelry gold price - 680 gold (16.3K) | 65,650 | 68,150 |

| Jewelry gold price - 650 gold (15.6K) | 62,650 | 65,150 |

| Jewelry gold price - 610 gold (14.6K) | 58,650 | 61,150 |

| Jewelry gold price - 585 gold (14K) | 56,150 | 58,650 |

| Jewelry gold price - 416 gold (10K) | 39,250 | 41,750 |

| Jewelry gold price - 375 gold (9K) | 35,150 | 37,650 |

| Jewelry gold price - 333 gold (8K) | 30,650 | 33,150 |

| 3. SJC - Updated: 4/7/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 97,100 | 100,100 |

| SJC gold 5 chi | 97,100 | 100,120 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 97,100 | 100,130 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 97,000 | 100,000 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 97,000 | 100,100 |

| Jewelry 99.99% | 97,000 | 99,700 |

| Jewelry 99% | 95,712 | 98,712 |

| Jewelry 68% | 64,952 | 67,952 |

| Jewelry 41.7% | 38,729 | 41,729 |

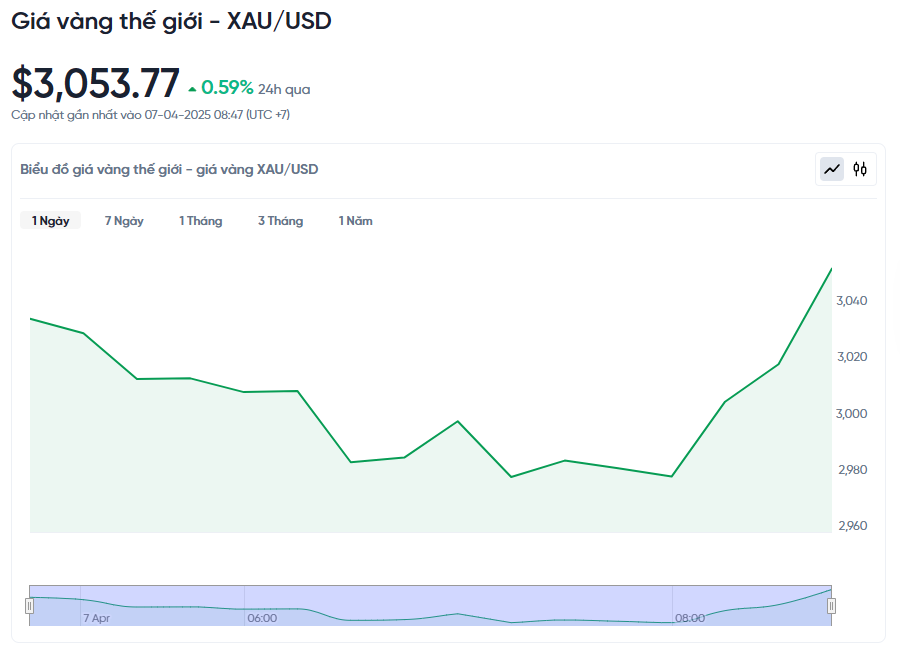

World gold price today April 7, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,053.77 USD/ounce. Today's gold price is unchanged from yesterday and increased by 18.01 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (25,960 VND/USD), the world gold price is about 96.61 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.4 million VND/tael higher than the international gold price.

The world gold price fell 1.8% last week, ending a five-week streak of consecutive increases. However, gold still maintained an important support level around $3,000/ounce, showing better resilience than the stock market. However, many experts warned that if selling pressure continued to increase, the gold price could fall to $2,800/ounce.

The decline was largely driven by investors selling gold and silver to cover losses in their portfolios as the stock market plunged, according to Everett Millman of Gainesville Coins. This is a common practice during periods of market stress and illiquidity. Millman also noted that there is no clear support level if stocks continue to fall. For gold prices to stabilize, the market needs positive signals from monetary policy, such as a commitment from the Fed to lower interest rates or new economic stimulus packages. If the situation worsens, prices

Kevin Grady of Phoenix Futures and Options said the market is very chaotic right now. Many investors are selling profitable positions to replenish margin as stocks plunge. He also shared that major banks were on the sidelines before Trump announced tariffs and are now waiting for more clarity. Grady predicted that gold is unlikely to rise sharply next week as investors deal with margin call pressure, while commodities are also taking profits after a strong rally since the beginning of the year. He said the market needs more time to stabilize and determine a specific direction.

Grady also expressed concerns about the risk of a global recession, which would negatively impact demand for commodities, including gold. In the uncertain environment, many investors are choosing to hold cash instead of taking risks in investing.

This week, the market will closely monitor important economic data from the US. The minutes of the March FOMC meeting will be released on Wednesday, followed by CPI inflation on Thursday and PPI on Friday. In addition, the University of Michigan's preliminary consumer confidence index will be released on Friday morning, reflecting Americans' views on the economic outlook.

Overall, the gold market is in a period of high volatility and needs more time to stabilize. Factors such as monetary policy, economic data and investor sentiment will continue to play an important role in guiding gold prices in the coming time.

Gold Price Forecast

Gold prices are attracting a lot of attention from both individual investors and professionals amid the volatile global market. According to Chris Vecchio, chief strategist at Tastylive.com, the sharp sell-off in the stock market is understandable, especially when former President Donald Trump's global tax policy is considered a major shock to global trade. Vecchio said that the factors that pushed gold prices above $3,000 an ounce are still intact, and the current price is a good opportunity for those who want to invest for the long term, especially when many central banks are looking to reduce their dependence on the US dollar.

However, the latest Kitco News weekly gold survey shows that sentiment among experts is shifting from bullish to cautious. Of the 16 experts surveyed, only five see gold prices rising next week, while eight see further declines. The remaining three see gold moving sideways around its current lows. Still, retail investor sentiment remains relatively stable, with 61% of the 273 online survey respondents expecting gold prices to rise, 26% expecting prices to fall, and the remainder expecting prices to move sideways.

Marc Chandler, managing director at Bannockburn Global Forex, said gold is losing its safe-haven status as it sells off alongside stocks. This comes despite a falling dollar and falling bond yields, which are typically supportive for gold. Chandler said gold’s decline this week was largely a reversal of its earlier gains. If gold breaks below $3,054 an ounce, prices could fall to $3,030 and then $3,000. Current technical indicators are also sending negative signals.

David Morrison, senior market analyst at Trade Nation, said that while the gold sell-off was steeper than expected, the move was not surprising. Momentum indicators show prices are trading in overbought territory. However, he added that he does not expect the rally to end, even if prices move lower.

Gold price on April 8, 2025 is facing both opportunities and challenges. While long-term factors still support gold, the short-term may continue to witness strong fluctuations. Investors need to closely monitor market developments and consider carefully before making investment decisions.

Source: https://baodaknong.vn/gia-vang-hom-nay-7-4-2025-moi-nhat-gia-vang-the-gioi-dang-co-tin-hieu-lac-quan-248546.html

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Reliving the heroic memories of the nation in the program "Hanoi - Will and belief in victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19ce7bfadf0a4a9d8e892f36f288e221)

Comment (0)