Domestic gold price today April 8, 2025

At the time of survey at 4:30 a.m. on April 8, 2025, the domestic gold price is forecast to drop below 100 million VND. Specifically, the current domestic gold price:

DOJI Group listed the price of SJC gold bars at 97.1-100.1 million VND/tael (buy - sell), keeping both buying and selling prices unchanged. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed at 97.1-100.1 million VND/tael (buy - sell), remaining unchanged in both buying and selling directions. The difference between buying and selling prices was at 3 million VND/tael.

SJC gold price at Bao Tin Minh Chau Company Limited listed SJC gold bar price at 97.3-100.1 million VND/tael (buy - sell), increased by 100 thousand VND/tael for buying and kept unchanged for selling. The difference between buying and selling price is at 2.8 million.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 96.7-100.1 million VND/tael (buy - sell), unchanged. The difference between buying and selling is at 3.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 97.6-100.3 million VND/tael (buy - sell), down 100 thousand VND/tael for buying and down 200 thousand VND/tael for selling. The difference between buying and selling is 2.7 million VND/tael.

The latest gold price list today, April 8, 2025 is as follows:

| Gold price today | April 8, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 97.1 | 100.1 | - | - |

| DOJI Group | 97.1 | 100.1 | - | - |

| Red Eyelashes | 98.7 | 100.7 | -600 | -100 |

| PNJ | 97.1 | 100.1 | - | - |

| Vietinbank Gold | 100.1 | - | ||

| Bao Tin Minh Chau | 97.3 | 100.1 | +100 | - |

| Phu Quy | 97.3 | 100.1 | - | - |

| 1. DOJI - Updated: April 8, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 97,100 | 100,100 |

| AVPL/SJC HCM | 97,100 | 100,100 |

| AVPL/SJC DN | 97,100 | 100,100 |

| Raw material 9999 - HN | 96,500 | 99,200 |

| Raw material 999 - HN | 96,400 | 99,100 |

| 2. PNJ - Updated: April 8, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 97,500 | 100.100 |

| HCMC - SJC | 97,100 | 100.100 |

| Hanoi - PNJ | 97,500 | 100.100 |

| Hanoi - SJC | 97,100 | 100.100 |

| Da Nang - PNJ | 97,500 | 100.100 |

| Da Nang - SJC | 97,100 | 100.100 |

| Western Region - PNJ | 97,500 | 100.100 |

| Western Region - SJC | 97,100 | 100.100 |

| Jewelry gold price - PNJ | 97,500 | 100.100 |

| Jewelry gold price - SJC | 97,100 | 100.100 |

| Jewelry gold price - Southeast | PNJ | 97,500 |

| Jewelry gold price - SJC | 97,100 | 100.100 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 97,500 |

| Jewelry gold price - Jewelry gold 999.9 | 97,500 | 100 thousand |

| Jewelry gold price - Jewelry gold 999 | 97,400 | 99,900 |

| Jewelry gold price - Jewelry gold 9920 | 96,800 | 99,300 |

| Jewelry gold price - Jewelry gold 99 | 96,600 | 99,100 |

| Jewelry gold price - 916 gold (22K) | 89,200 | 91,700 |

| Jewelry gold price - 750 gold (18K) | 72,650 | 75,150 |

| Jewelry gold price - 680 gold (16.3K) | 65,650 | 68,150 |

| Jewelry gold price - 650 gold (15.6K) | 62,650 | 65,150 |

| Jewelry gold price - 610 gold (14.6K) | 58,650 | 61,150 |

| Jewelry gold price - 585 gold (14K) | 56,150 | 58,650 |

| Jewelry gold price - 416 gold (10K) | 39,250 | 41,750 |

| Jewelry gold price - 375 gold (9K) | 35,150 | 37,650 |

| Jewelry gold price - 333 gold (8K) | 30,650 | 33,150 |

| 3. SJC - Updated: 4/8/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 97,100 | 100,100 |

| SJC gold 5 chi | 97,100 | 100,120 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 97,100 | 100,130 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 97,000 | 100,000 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 97,000 | 100,100 |

| Jewelry 99.99% | 97,000 | 99,700 |

| Jewelry 99% | 95,712 | 98,712 |

| Jewelry 68% | 64,952 | 67,952 |

| Jewelry 41.7% | 38,729 | 41,729 |

World gold price today April 8, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 2,985.63 USD/ounce. Today's gold price decreased by 50.29 USD/ounce compared to yesterday. Converted according to the USD exchange rate in the free market (25,910 VND/USD), the world gold price is about 93.91 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 6.18 million VND/tael higher than the international gold price.

The sharp decline in global gold prices could last until mid-week, but prices will recover somewhat later thanks to strong buying from central banks.

During the trading session, gold lost more than 1% at one point and hit its lowest level since March 13. Notably, last weekend's session saw gold plunge more than 3% after US President Donald Trump announced new tariffs on Chinese goods, causing shockwaves in the global market.

China responded by imposing a 34% tariff on US goods and restricting exports of some rare earth metals. IG strategist Yeap Jun Rong said the market was confused as there was no sign of a cooling off in the trade conflict, while many believed there would be no quick solution.

Although gold is often considered a safe-haven asset, its price has fallen sharply this time, believed to be due to investors taking profits to cover losses in other portfolios or to meet margin calls. This comes as the US stock market has just lost nearly $6 trillion in market capitalization due to recession fears.

However, central bank demand for gold remains strong. The People's Bank of China continued to buy gold in March, marking the fifth consecutive month of increasing its gold reserves. According to KCM Trade expert Tim Waterer, this inflow is an important factor in helping gold prices maintain a long-term upward trend.

Mr. Ole Hansen from Saxo Bank also commented that when the market stabilizes, it is the demand from central banks that will help gold recover and strengthen investor confidence.

Meanwhile, while gold fell, silver rallied 2.2% to $30.19 an ounce after hitting a seven-month low. Platinum and palladium both edged up to $928.19.

Gold Price Forecast

Kevin Grady of Phoenix Futures and Options said the market was in turmoil, with many investors forced to sell gold to replenish their margin positions as stocks fell sharply. He also noted that major banks were on the sidelines before President Trump announced his tax policy and are now waiting to assess the situation further.

Grady said that gold prices are unlikely to rebound in the coming week. Investors are struggling with margin pressure, while commodities in general are taking profits after a long rally since the beginning of the year. He stressed that the market needs more time to stabilize and determine a clearer trend.

He also expressed concern about the risk of a global recession, which could reduce demand for commodities, including gold. Many investors are now choosing to hold cash because they have not found a safe place for their capital.

In the long term, Grady believes that gold prices could recover once the market is certain that the tariffs are no longer affecting gold. However, this process will not happen quickly and will take time for the market to absorb all the confusing information.

Marc Chandler of Bannockburn Global Forex also said that gold prices could continue to fall in the short term. Although central banks are buying, individual investors are seeing gold as a risky asset. In the context of a weak US dollar and falling interest rates, gold is still being sold off along with stocks. If gold falls below the threshold of $ 3,054 / ounce, it is likely to continue to fall to the $ 3,030 or $ 3,000 area.

Everett Millman, an expert at Gainesville Coins, said the current price decline is the result of investors selling gold and silver to cover losses in their portfolios. If the stock market continues to decline, gold will have a hard time holding its current support level. According to him, for gold to stabilize, the market needs a clear signal from policy, such as the Federal Reserve committing to lower interest rates or launching a new stimulus package. He also did not rule out the possibility that gold prices could fall to $ 2,900 / ounce if the situation worsens.

Experts at CPM Group advise investors to maintain their current positions and wait for buying opportunities when prices fall further. They believe the recent volatility is mainly due to concerns about the negative impact of President Trump's tax policy. Gold had surged to nearly $3,196 an ounce but quickly plummeted to $3,073 as global markets sold off.

According to CPM, the new tax policy is increasing concerns about inflation and recession, which makes gold continue to be a favorite safe-haven asset. However, they do not recommend buying or selling at this time, but only consider buying when the price falls to or below $3,050.

Source: https://baoquangnam.vn/gia-vang-hom-nay-8-4-2025-gia-vang-trong-nuoc-va-the-gioi-tiep-tuc-giam-manh-den-giua-tuan-3152276.html

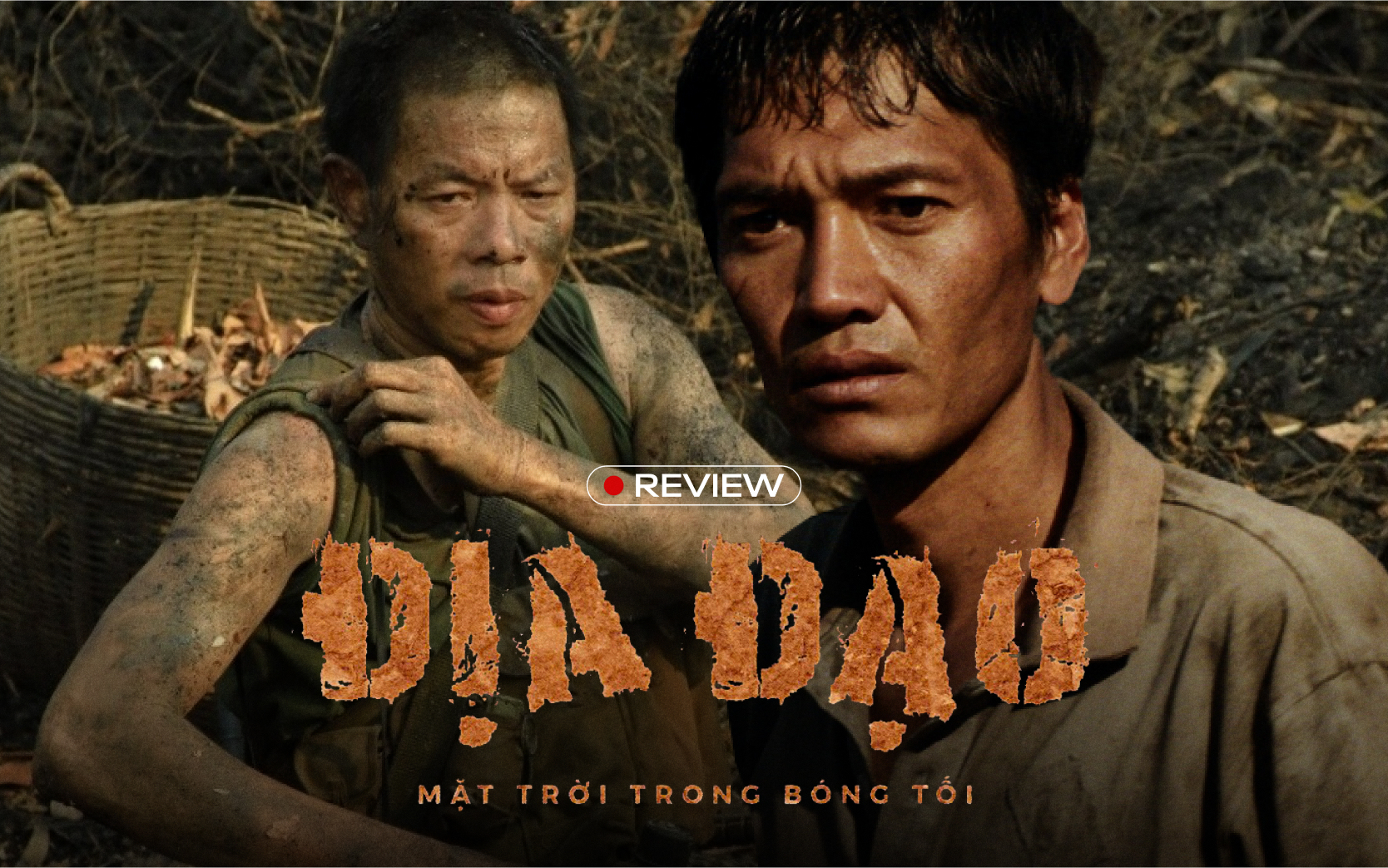

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)