DNVN - On November 26, gold prices on the international market did not fluctuate much, amid many conflicting signals about the geopolitical situation.

Specifically, the spot gold price was recorded at 2,626.83 USD/ounce. At the same time, the US gold futures price edged up 0.1% to 2,621.30 USD/ounce.

Earlier, on November 25, the world gold price plummeted, losing $100/ounce, when the market witnessed a wave of sell-offs due to expectations of a ceasefire agreement in the Middle East. In addition, President-elect Donald Trump's selection of Scott Bessent as Treasury Secretary also reduced the appeal of gold as a safe haven.

Peter Grant, senior strategist at Zaner Metals, said investor sentiment has improved following the ceasefire between Israel and Hezbollah. However, he warned that concerns over the Russia-Ukraine conflict remain a drag on the market. He forecast gold prices to likely trade between $2,575 and $2,750 an ounce in the short term.

Gold continues to be seen as a safe-haven asset amid economic uncertainty and geopolitical risks, especially during times of global trade tensions.

Trump’s pledge to impose tariffs on Canada, Mexico and China is believed to spark a trade war, which could boost the appeal of gold. However, analysts have stressed that inflation could limit interest rate cuts from the US Federal Reserve (Fed), which could have a significant impact on gold prices.

According to US economic experts, domestic inflationary pressure, especially from the new administration's expected policies, will cause the Fed to face many challenges in 2025.

Although inflation in the US has fallen to around 2.5% from more than 9% in mid-2022, experts say it is too early to conclude that inflation is completely under control.

Richard Roberts, an economics professor at Monmouth University and former Fed official, said the Fed’s move to cut rates in September and then again in November 2024 was premature. He asserted that there are many signs that inflation is still present and on the rise again.

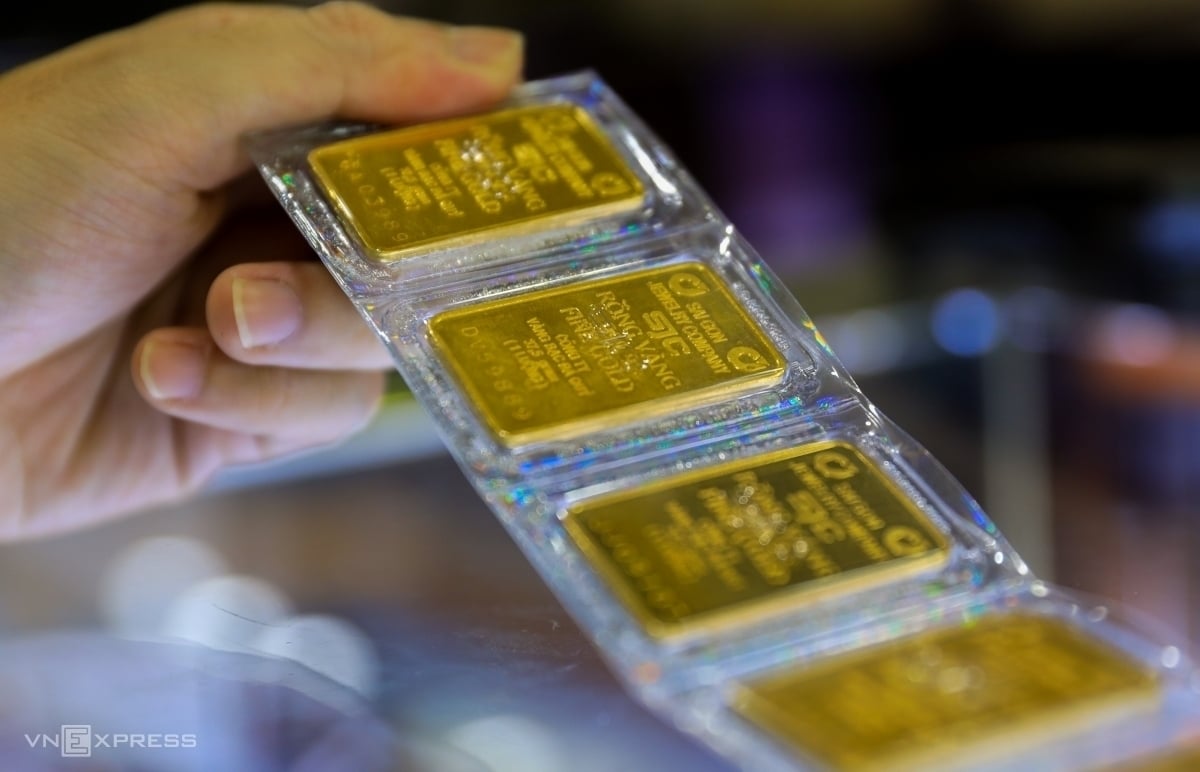

In Vietnam, at 4:30 p.m. on November 26, Saigon Jewelry Company listed the price of SJC gold at 82.70 - 85.20 million VND/tael (buy - sell).

Cao Thong (t/h)

Source: https://doanhnghiepvn.vn/kinh-te/gia-vang-the-gioi-va-nhan-dinh-chuyen-gia-ngay-27-11-on-dinh-truoc-nhung-tin-hieu-dia-chinh-tri-trai-chieu/20241127090901361

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)