Gold price today August 25, 2024, gold price increased sharply, experts and retail investors believe that the precious metal will rise above the all-time high set recently. The $3,000/ounce mark is not far away. Gold ring price goes up.

LIVE UPDATE TABLE OF GOLD PRICE TODAY 8/25 AND EXCHANGE RATE TODAY 8/25

| 1. SJC - Updated: 08/23/2024 08:16 - Website time of supply source - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 79,000 | 81,000 |

| SJC 5c | 79,000 | 81,020 |

| SJC 2c, 1c, 5 phan | 79,000 | 81,030 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 77,100 ▲100K | 78,400 ▲100K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 77,100 ▲100K | 78,500 ▲100K |

| Jewelry 99.99% | 76,950 ▲100K | 77,950 ▲100K |

| Jewelry 99% | 75,178 ▲99K | 77,178 ▲99K |

| Jewelry 68% | 50,661 ▲68K | 53,161 ▲68K |

| Jewelry 41.7% | 30,158 ▲41K | 32,658 ▲41K |

Update gold price today 8/25/2024

Domestic gold prices fluctuated strongly last week.

On the morning of August 19, domestic gold ring prices turned down slightly while SJC gold bar prices remained unchanged. Specifically, Saigon Jewelry Company (SJC) announced the selling price of SJC gold bars at 78 - 80 million VND/tael (buy - sell), keeping the listed price unchanged in both buying and selling directions compared to the closing price at the end of last week. DOJI Gold and Gemstone Group listed the price of gold rings at 76.85 - 78.2 million VND/tael (buy - sell), down 150 thousand VND/tael in buying and down 200 thousand VND/tael in selling compared to the closing price of the previous session.

After 3 sessions of strong fluctuations in the middle of the week, in the morning session of August 23, in the same direction as the world gold price, the domestic gold ring price decreased slightly while the SJC gold bar price remained stable. Specifically, Saigon Jewelry Company (SJC) announced the selling price of SJC gold bars at 79 - 81 million VND/tael (buy - sell), keeping the listed price unchanged in both buying and selling directions compared to the previous session's close. DOJI Gold and Gemstone Group listed the gold ring price at 77 - 78.2 million VND/tael (buy - sell), down 150 thousand VND/tael in both buying and selling directions compared to the previous session's close.

|

| Gold price today August 25, 2024. (Source: Shutterstock) |

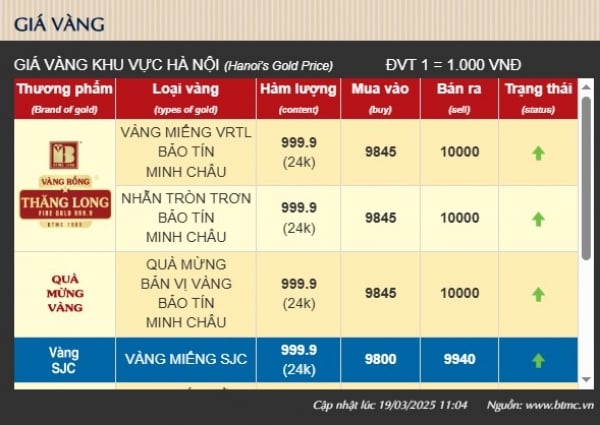

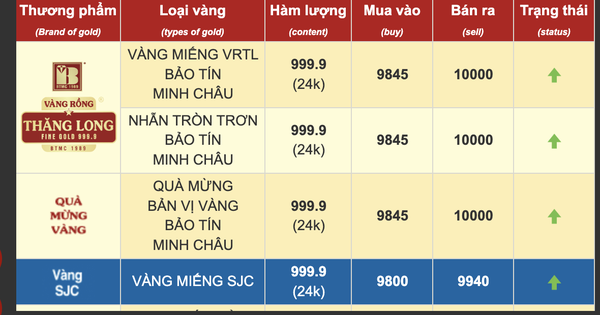

Summary of SJC gold bar and gold ring prices at major domestic trading brands at the closing time of August 24:

Saigon Jewelry Company: SJC gold bars 79.0 - 81.0 million VND/tael; SJC gold rings 77.1 - 78.4 million VND/tael.

Doji Group: SJC gold bars 79.0 - 81.0 million VND/tael; 9999 round rings (Hung Thinh Vuong) 77.2 - 78.4 million VND/tael.

PNJ system: SJC gold bars 79.0 - 81.0 million VND/tael; PNJ 999.9 plain gold rings at 77.2 - 78.4 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars: 79.0 - 81.0 million VND/tael; Phu Quy 999.9 round gold rings: 77.15 - 78.45 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 79.0 - 81.0 million VND/tael; Rong Thang Long gold brand is traded at 77.23 - 78.43 million VND/tael; jewelry gold price is traded at 76.40 - 78.20 million VND/tael.

Thus, compared to the session on August 23, the price of Doji Group's gold rings on August 24 increased by VND 200,000/tael in both buying and selling directions, while the price of SJC gold bars remained the same.

According to The Gioi & Viet Nam Newspaper , at 3:54 p.m. on August 24 (Vietnam time), the world gold price at goldprice.org was at 2,512.8 USD/ounce, an increase of 24.8 USD/ounce compared to the previous trading session.

Converted according to the USD price at Vietcombank on August 24, 1 USD = 25,150 VND, the world gold price is equivalent to 76.14 million VND/tael, 4.6 million VND/tael lower than the selling price of SJC gold.

World gold prices increased by more than 1% in the last trading session of this week, when the USD and US government bond yields decreased after the speech of US Federal Reserve Chairman Jerome Powell signaled the possibility of lowering interest rates next September.

At the end of the trading session on August 23, spot gold prices increased by 1.2% to $2,511.91/ounce, but were lower than the record high of $2,531.60/ounce recorded on August 20. Gold futures prices also increased by 1.2% to $2,546.30/ounce.

The dollar index fell 0.8% against a basket of major currencies, while 10-year US government bond yields also fell after Mr. Powell's speech, making gold more attractive to holders of other currencies.

“Gold will be higher ahead of the September Fed meeting and the dot plot will show how many rate cuts are likely this year,” said Tai Wong, an independent metals trader in New York.

Gold prices have risen more than 20% so far this year and are on track for their best year since 2020. Fueling the rally are robust central bank buying, strong demand in China and safe-haven demand amid geopolitical uncertainty.

According to data as of May 2024 from the World Gold Council, the country holding the most gold is the United States, with 8,133 tons worth $628 billion. Germany ranks second with 3,351 tons, followed by Italy with 2,452 tons.

Central banks bought 483 tonnes of gold in the first half of 2024, a new record high. Türkiye was the biggest buyer in the first half of the year, buying a total of 45 tonnes. India ranked second, buying a total of 37 tonnes in the first six months.

China has traditionally been the world’s top buyer of gold, but has recently slowed its purchases of the precious metal, pausing purchases in May and June. Prior to that, the People’s Bank of China (PBoC, the central bank) had increased its gold reserves for 18 consecutive months.

According to Mr. Doshi, gold prices could jump to $2,600 an ounce by the end of this year and $3,000 an ounce by the middle of next year. The world's largest gold-backed exchange-traded fund, SPDR Gold Trust GLD, said its holdings had risen to 859 tonnes as of August 19, a seven-month high.

The latest Kitco News weekly gold survey shows that a majority of industry professionals and retail investors believe gold will rise above its recent all-time high this week.

“Gold hit a record high of nearly $2,531.75 an ounce on Tuesday in the spot market and consolidated for the rest of the week,” said Marc Chandler , general manager at Bannockburn Global Forex. “The weekly low was set on Thursday, just below $2,471 an ounce.”

“Higher,” said Adam Button , head of currency strategy at Forexlive.com. “There’s no point in fighting the rally.”

Meanwhile, Darin Newsom , senior market analyst at Barchart.com, said he expects gold prices to trend lower in the coming days. “The market will remain bearish for another week based on the idea that the short-term trend of December gold (daily close only) has been bearish,” he said. “The downside target is near $2,493/oz.”

Kevin Grady , president of Phoenix Futures and Options, said the gold market is focused entirely on the expected Fed rate cut. “You’ve got central banks buying … You’ve got a fresh environment, ripe for gold. I think gold is going to hit new highs in the future,” he said.

This week, 12 analysts participated in the Kitco News Gold Survey, with the majority of Wall Street predicting that gold prices will rise above this week’s new record high. Seven experts, or 58%, expect gold prices to rise next week, while two analysts, or 17%, see gold prices falling next week. The remaining three experts, or 25% of the total, predict that the precious metal will fall sideways.

Meanwhile, 225 votes were cast in Kitco’s online poll, with Main Street investors more bullish on balance than other professionals. 146 retail traders, or 65%, expect gold prices to rise next week. Another 41, or 18%, expect the yellow metal to fall, while 38 respondents, or 17%, see prices consolidating next week.

James Stanley , senior market strategist at Forex.com, said he expects gold prices to trend lower next week. “I think we’ll see some profit-taking and a pullback to test below $2,500 an ounce, but I don’t expect any sustained declines at this point. More of a pullback than a reversal,” he said.

Source: https://baoquocte.vn/gia-vang-hom-nay-2582024-gia-vang-tang-vot-vang-nhan-gay-bat-ngo-khong-phai-trung-quoc-day-moi-la-quoc-gia-mua-vang-nhieu-the-gioi-283762.html

Comment (0)