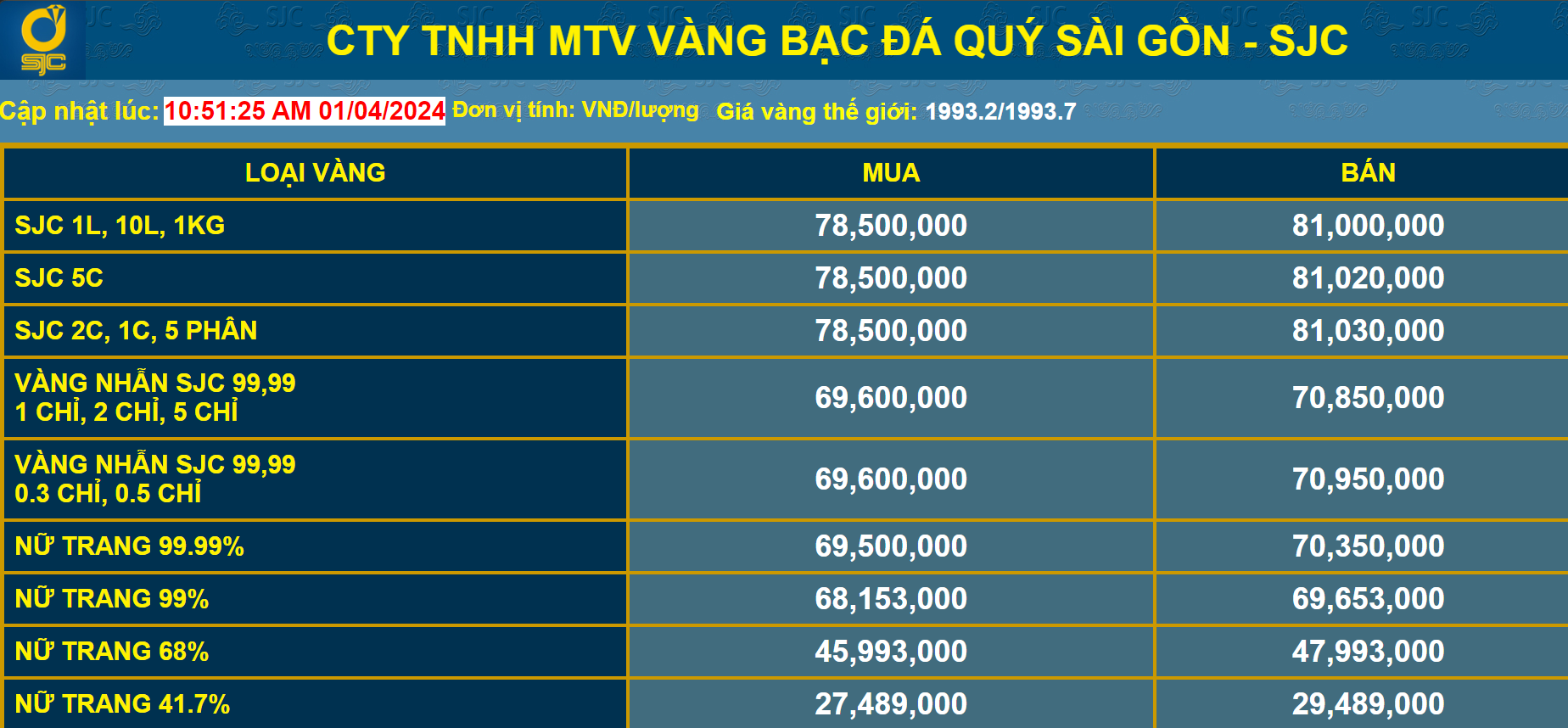

At 3:00 p.m. on April 1, 2024, the domestic SJC gold price was adjusted up in both directions compared to the early morning of the same day. Saigon Jewelry Company Limited listed the afternoon SJC gold price at 78.5 million VND/tael for buying and 81 million VND/tael for selling.

Compared to the early morning of the same day, the price of SJC gold at this unit was adjusted up 200,000 VND for buying and up 20,000 VND for selling.

The difference between the buying and selling price of gold at this unit is currently at 2.5 million VND.

|

| Gold price listed at Saigon Jewelry Company Limited - SJC. Website screenshot at 3:00 p.m. on April 1, 2024 |

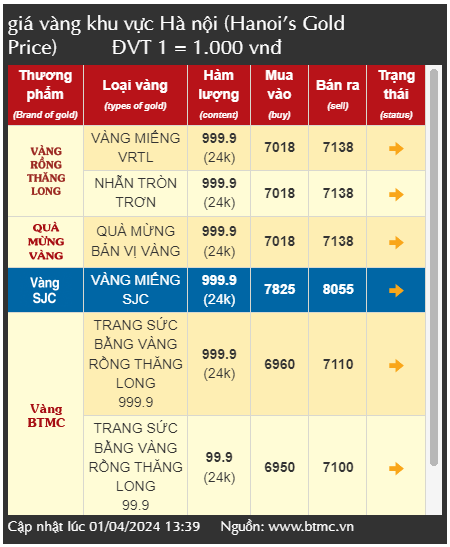

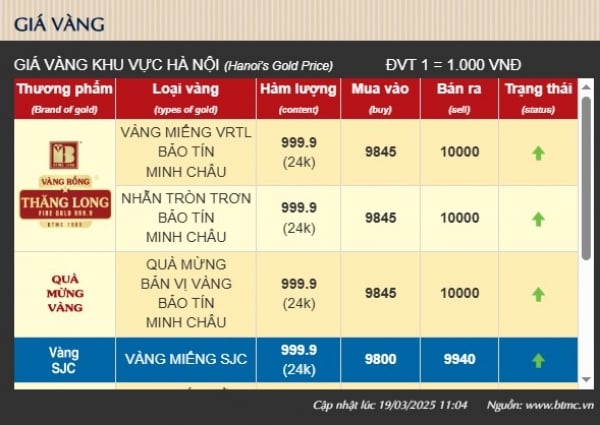

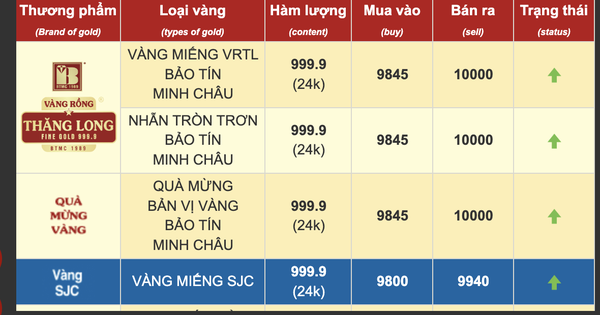

At the same time, Bao Tin Minh Chau listed the price of SJC gold at 78.25 million VND/tael for buying and 80.55 million VND/tael for selling. However, compared to the early morning of the same day, the price of SJC gold at this unit was adjusted down by 650,000 VND for buying and down by 250,000 VND for selling.

The difference between buying and selling prices at Bao Tin Minh Chau is currently at 2.3 million VND/tael.

|

| Gold price listed at Bao Tin Minh Chau. Website screenshot at 3:00 p.m. on April 1, 2024 |

After 2 days of weekend, the world gold price continued to increase, setting a new record. At 13:04 on April 1, Vietnam time, the world spot gold price was at 2,260 USD/ounce, up 27 USD/ounce compared to the closing price last week. Converted according to the current exchange rate at Vietcombank, the world gold price is currently over 68.03 million VND/tael (excluding taxes and fees).

The main reason could be that central banks around the world continue to buy physical gold. The increased demand has had a direct impact on gold prices, pushing them to record highs.

The global gold market is expected to be volatile this week in response to important US economic data. In addition to the inflation data released last Friday, the market is also interested in the March non-farm payrolls report. Experts say that if the US labor market is stronger than expected, combined with "persistent" inflation, it may force the Fed to delay the start of its easing cycle. This will negatively impact the precious metal. On the contrary, if the employment report is weaker than expected, it will strengthen the possibility of a policy pivot, thereby promoting the recovery of this precious metal to new records.

|

| The difference between the buying and selling prices of domestic gold is around 2.3-2.5 million VND/tael. This difference is considered very high. Investors face the risk of loss when investing in the short term. Illustrative photo |

According to economic experts, the difference between the buying and selling prices of domestic gold is currently listed at around 2.3 - 2.5 million VND/tael. This difference is considered very high. Investors face the risk of loss when investing in the short term.

Ms. Nguyen Vy (Thanh Xuan, Hanoi) shared that gold is a long-term investment asset, at least for 6 months to 1 year. If calculated in the short term, investors will certainly suffer a big loss. For example, if buying SJC gold at Saigon Jewelry Company Limited SJC on March 24 at 5:00 p.m. for VND80.3 million/tael, selling it this afternoon for VND78.5 million, investors will immediately lose VND1.8 million.

At the same time, if buying SJC gold from Bao Tin Minh Chau, investors will also lose 1.6 million VND.

Giving advice to gold investors during this period, experts recommend that gold investors and people should be cautious, because domestic gold prices often follow world prices. This week, gold prices will continue to increase as the market expects a deeper interest rate cut cycle by the US Federal Reserve (Fed). Therefore, if you intend to invest in gold, experts recommend that investors wait for a new price reduction.

A representative of Bao Tin Minh Chau also said that the domestic gold price this morning SJC "stayed still" while Rong Thang Long gold increased. According to Bao Tin Minh Chau's records at gold and silver trading establishments, this morning the number of customers buying and selling had a ratio (55% of customers buying and 45% of customers selling). A representative of Bao Tin Minh Chau recommends that investors and people should consider before trading and regularly monitor gold prices on official channels to make the most correct decisions.

Source

Comment (0)