Gold price today August 19, 2024, world gold price continuously jumped through many resistance levels and exploded at a historical peak of 2,500 USD/ounce. Experts and investors believe that the yellow metal will increase even higher, possibly surpassing this week's all-time high.

LIVE UPDATE TABLE OF GOLD PRICE TODAY 8/18 and EXCHANGE RATE TODAY 8/18

| 1. SJC - Updated: 08/16/2024 08:13 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 78,000 | 80,000 |

| SJC 5c | 78,000 | 80,020 |

| SJC 2c, 1c, 5 phan | 78,000 | 80,030 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 77,000 | 78,400 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 77,000 | 78,500 |

| Jewelry 99.99% | 76,950 | 77,950 |

| Jewelry 99% | 75,178 | 77,178 |

| Jewelry 68% | 50,661 | 53,161 |

| Jewelry 41.7% | 30,158 | 32,658 |

Update gold price today August 19, 2024

World gold prices continuously conquer new records.

At the end of last week's trading session (August 16), the world gold price skyrocketed, listed at 2,508.70 USD/ounce, an increase of 51.40 USD/ounce compared to the previous trading session, according to The Gioi & Viet Nam Newspaper.

Converted according to the USD exchange rate at Vietcombank on August 17, 1 USD = 25,230 VND, the world gold price is equivalent to 76.24 million VND/tael, 3.76 million VND/tael lower than the selling price of SJC gold.

Gold had one of its five best trading days of the year last week and ended with a bang – prices surged to new record highs in both the spot and futures markets.

Spot gold prices started the week at $2,429.49 an ounce, before rising sharply in trading sessions across Asia and Europe. The new highs kicked off, as trading fluctuated up and down, gradually conquering peaks, from $2,440.0 an ounce to $2,452.63 an ounce, then $2,481.0 an ounce...

The market seems to be ready for one of the strongest gold price increases, in the context of the geopolitical crisis in the Middle East and Eastern Europe with no clear direction, causing gold prices to continuously surge through many resistance levels overnight, continuing to conquer the threshold of 2,494.07 USD.

Gold prices then surged again, breaking above $2,500 an ounce for the first time - this time fueled by disappointing US economic data and less than 90 minutes after the release of dismal US housing data. After a few sessions of ups and downs, gold prices continued their steady rise, breaking above $2,500 an ounce.

The latest Kitco News weekly gold survey shows that a majority of industry professionals and retail investors believe gold prices could surpass this week’s all-time high.

Domestic gold prices fluctuated strongly for round, smooth gold rings - all increased.

The price of gold rings of Saigon Jewelry Company SJC increased by 550 thousand VND/tael for buying and 650 thousand VND/tael for selling. The price of gold rings increased simultaneously for other brands.

The price of SJC gold bars fluctuated slightly, closing the trading session last week (August 17), the same price was 78.0 - 80.0 million VND/tael at brands nationwide.

|

| Gold price today August 19, 2024: Will gold price 'break' the $2,500 threshold and increase even higher this week? (Source: Kitco) |

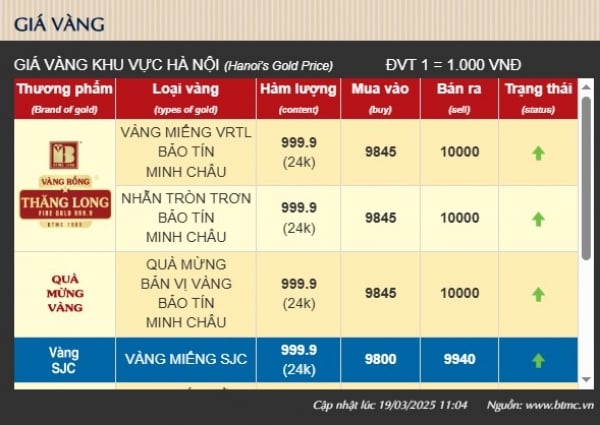

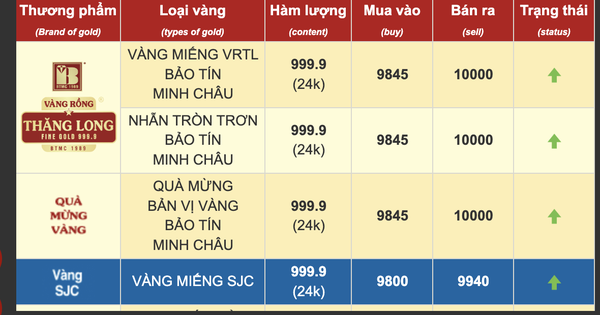

Summary of SJC gold bar and gold ring prices at major domestic trading brands at the closing time of August 17:

Saigon Jewelry Company: SJC gold bars 78.0 - 80.0 million VND/tael; SJC gold rings 77.0 - 78.4 million VND/tael.

Doji Group: SJC gold bars 78.0 - 80.0 million VND/tael; 9999 round rings (Hung Thinh Vuong) 77.0 - 78.4 million VND/tael.

PNJ system: SJC gold bars 78.0 - 80.0 million VND/tael; PNJ 999.9 plain gold rings at 77.0 - 78.39 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars: 78.2 - 80.0 million VND/tael; Phu Quy 999.9 round gold rings: 77.05 - 78.35 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 78.3 - 80.0 million VND/tael; Rong Thang Long gold brand is traded at 77.08 - 78.38 million VND/tael; jewelry gold price is traded at 76.35 - 78.15 million VND/tael.

Could Gold Prices Hit All-Time Highs This Week?

Believing in the bullish outlook for both gold and silver, expert Mark Leibovit, editor of VR Metals/Resource Letter, said he sees no reason to doubt the yellow metal's rise in the near future.

More cautiously, Adrian Day, president of Adrian Day Asset Management, said: "Gold is at a record high, there is a possibility that economic news or Federal Reserve officials will 'dampen the enthusiasm' for more rate cuts this year, starting next month, and that will send gold lower. But that is only in the short term. The odds are still in favor of a Fed rate cut in September, add in the cuts we have seen from many banks around the world and the long-term trend for gold is definitely up."

Marc Chandler, managing director at Bannockburn Global Forex , sees consolidation in the yellow metal ahead of a new record high. Looking ahead to Fed Chairman Powell’s speech at Jackson Hole, he said the likely shape for next month’s cut is not easier monetary policy but less restrictive. “I expect the consolidation in gold to eventually resolve with a new high,” said Marc Chandler.

Meanwhile, Darin Newsom, senior market analyst at Barchart.com, predicts gold prices will fall this week. “I may be premature with this, but from a technical standpoint, gold is overbought and may be approaching the top of the uptrend.”

This week, of the nine analysts who participated in the Kitco News Gold Survey, a majority see upside potential beyond this week’s all-time high. Five experts, or 56 percent, expect gold prices to rise next week, while three analysts, or 33 percent, see gold consolidating gains this week; only one analyst, or 11 percent, expects the precious metal to fall.

Meanwhile, in an online survey of 219 Main Street investors, the results were similar to the experts. 130 retail traders (59%) expect gold prices to rise next week; another 44 (20%) expect the yellow metal to trade lower; while the remaining 45 (21%) see prices trending sideways this week.

Source: https://baoquocte.vn/gia-vang-hom-nay-1982024-gia-vang-pha-vo-nguong-2500-usd-va-con-tang-cao-hon-nua-trong-tuan-nay-283024.html

Comment (0)