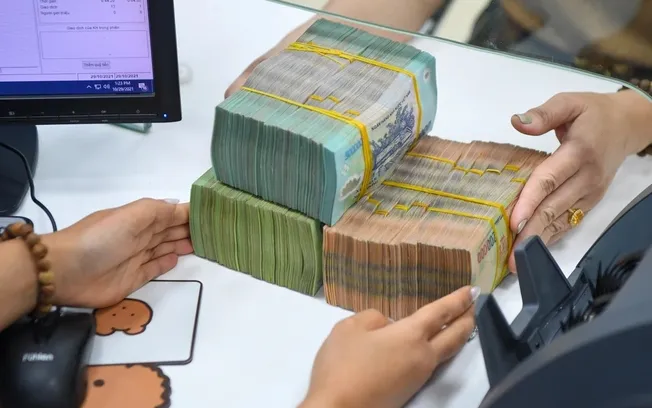

Domestically, after a session of strong fluctuations, with an increase of 3 million VND/tael (on July 18), in the past week (from July 22 to 26), the price of SJC gold decreased by 500,000 VND/tael, currently trading at 77.5 million VND/tael for buying and 79.5 million VND/tael for selling.

The market also recorded a rapid drop in gold ring prices amid a plunge in world gold prices, reaching their lowest level in more than two weeks.

Meanwhile, in the international market, at the end of last week, the world gold price could not maintain the important resistance level of 2,400 USD/ounce, after investors sold off strongly in the last two sessions.

In addition, gold was also under great pressure after the US announced that GDP in the second quarter increased by 2.8%, far exceeding the expected figure of 2%. The unexpected increase in GDP shows that the US economy has become stronger, while inflation is still in a downward trend, which is an excuse for the US Federal Reserve (Fed) to delay the time to cut interest rates.

Kevin Grady, president of Phoenix Futures and Options, attributed much of the price action over the past week to weak earnings reports and the rollover between futures contracts.

He said that there are two possibilities happening in the gold market: the precious metal is in a major reinvestment phase and the August contract will be transferred to December. These developments have an important impact on investors and credit institutions at the present time.

The US Commerce Department reported last week that its core personal consumption expenditures index rose 0.2% in June, in line with market expectations. The latest inflation data did not change expectations around the Fed's monetary policy, further cementing the market's bet that the US central bank will cut interest rates in September.

According to Przemysław Radomski, CEO of Sunshine Profits, the latest interest rate forecasts from the CME FedWatch tool show that there is a 93% chance that the Fed will keep rates on hold at its next meeting, but a 100% chance that it will cut in September. In addition, the market also expects additional rate cuts in November and December.

The driving force for gold price increase

Although the global gold market failed to hold the initial support level of $2,400/ounce last week, it is important that gold has not fallen below $2,350/ounce, according to analysts. This shows that gold can still create new upward momentum.

Despite the short-term volatility, analysts note that gold remains firmly in an uptrend as markets increasingly expect the Fed to cut interest rates by the end of the third quarter.

According to the CME FedWatch Tool, the market is 100% certain that the Fed will cut interest rates in September.

George Milling-Stanley, head of gold strategy at State Street Global Advisors, said he also expects gold prices to continue rising, citing the Fed’s move to cut interest rates in September and begin a new easing cycle. This will weaken the dollar and create favorable conditions for gold.

The biggest positive for the precious metal, analysts say, is a rate cut in September, even if inflation remains above the 2% target. This would send gold prices higher.

Economists expect slowing growth in the US labor market will prompt the Fed to cut interest rates further in November and December.

The Fed is not the only central bank holding a monetary policy meeting early next month. The Bank of England will announce its decision to cut interest rates on August 1. The Bank of Japan will also consider cutting rates later on July 30.

Source: https://vietnamnet.vn/gia-vang-nhay-mua-kho-luong-cho-dong-thai-tu-nuoc-my-2306394.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)