DNVN - The strong increase in world gold prices has been narrowed and only slightly increased in the trading session on December 19. Meanwhile, the price of SJC gold rings and gold bars in the domestic market on the morning of December 20 still decreased significantly.

Domestic gold price

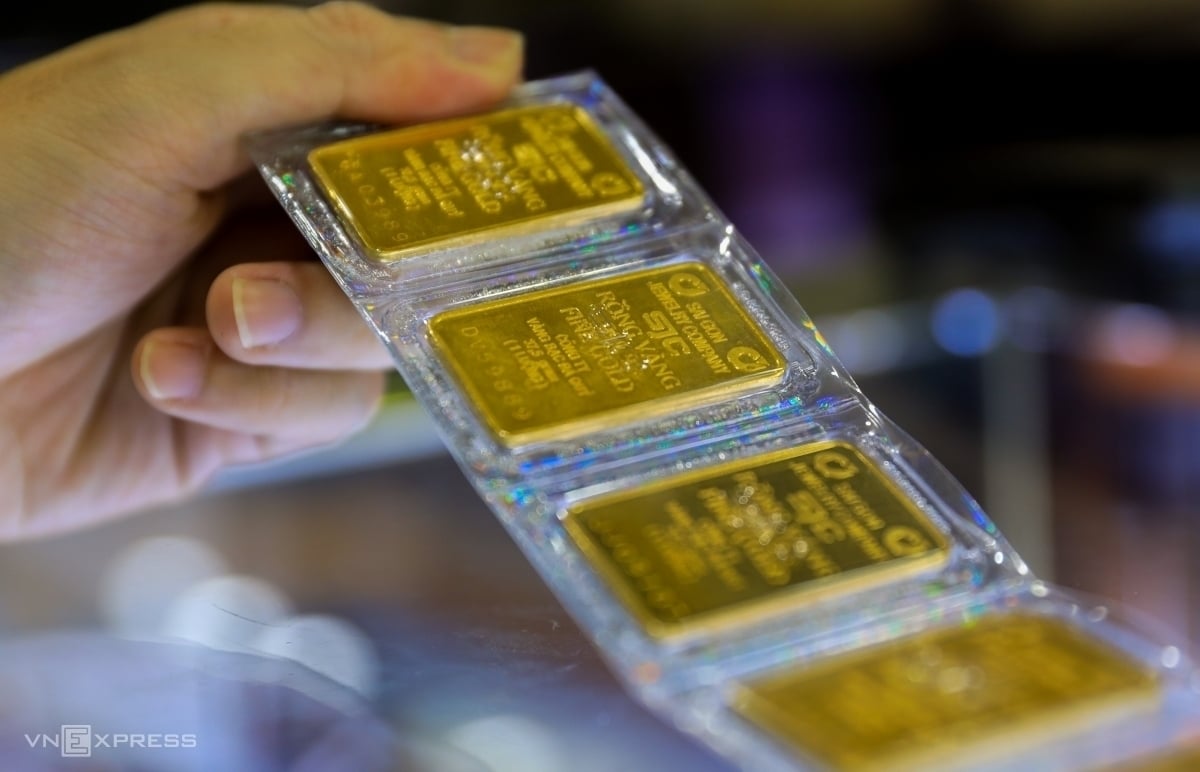

At 9:05 a.m., Saigon Jewelry Company (SJC) listed the buying and selling prices of SJC gold bars at VND81.6 - 83.6 million/tael, respectively, down VND500,000/tael in both directions compared to the end of the previous session.

At the same time, DOJI Gold and Gemstone Group announced the buying and selling price of SJC gold bars at 81.6 - 83.6 million VND/tael, also down 500,000 VND/tael compared to the previous closing price.

Not only gold bars, the price of gold rings has also been adjusted down sharply. Accordingly, DOJI Group has set the price of gold rings at 82.55 - 83.55 million VND/tael (buy - sell), down to 1.15 million VND/tael in both directions.

At SJC Company, the price of gold rings this morning was listed at 81.6 - 83.3 million VND/tael (buy - sell), down 500 thousand VND/tael in both trading directions.

World gold price

In the international market, gold prices, after a sharp increase earlier, slowed down and only increased slightly in the session on December 19. US economic data reinforced predictions that the US Federal Reserve (Fed) will be more cautious in easing monetary policy next year.

At 2:51 a.m. on December 20, Vietnam time, the spot gold price recorded an increase of 0.4% to 2,598.20 USD/ounce. In contrast, the gold futures price in the US decreased by 1.7% and closed at 2,608.10 USD/ounce.

Earlier, US economic data showed GDP growth in the third quarter exceeded expectations, along with a sharper-than-expected drop in unemployment claims. Mr. Bart Melek, commodity strategist at TD Securities, said that these figures showed that the US economy is in a strong state. This reduces the chance of the Fed easing monetary policy, which has a negative impact on precious metals such as gold.

Gold prices fell more than 2% in the previous session, hitting a one-month low after the Fed expressed caution about easing monetary policy due to persistent inflation. However, the decline attracted investors to buy, causing gold prices to rebound 1.5% shortly after.

According to Alex Ebkarian, CEO of Allegiance Gold, the sharp decline in gold prices in the short term has created an attractive buying opportunity for long-term investors. He said that gold prices still have long-term growth potential due to factors such as public debt, the possibility of a US government shutdown and efforts to control the financial deficit in the future. Gold has always been considered a safe haven asset in the context of economic uncertainty and low interest rates.

Investors are now awaiting the US core personal consumption expenditure (PCE) index report on December 20. This is the inflation measure preferred by the Fed and will provide further signals on the economic outlook in the coming period.

Cao Thong (t/h)

Source: https://doanhnghiepvn.vn/kinh-te/gia-vang-ngay-20-12-2024-tiep-tuc-xu-huong-giam-sau/20241220094835951

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)