ANTD.VN - World gold prices fell, despite the USD also falling. Investors are waiting for two important US economic data to be released over the weekend.

After two consecutive sessions of price increases, this morning, domestic gold prices have turned to decrease again. Businesses commonly reduced the price of SJC gold by about 200,000 VND per tael.

Accordingly, at 9:30 a.m., Saigon Jewelry Company (SJC) listed the price of gold bars at 74.00 - 76.50 million VND/tael. Phu Nhuan Jewelry Company (PNJ) also listed the same price.

At DOJI Group, SJC gold is listed at 73.95 - 76.5 million VND/tael; Phu Quy SJC 74.05 - 76.40 million VND/tael; Bao Tin Minh Chau 74.05 - 76.35 million VND/tael...

Non-SJC gold also tends to decrease by about 100 - 200 thousand VND per tael.

Specifically, SJC 99.99 rings are listed at 62.70 - 63.90 million VND/tael; PNJ Gold is listed this morning at 62.75 - 64.05 million VND/tael; Bao Tin Minh Chau's Thang Long Dragon Gold is 63.58 - 64.68 million VND/tael...

|

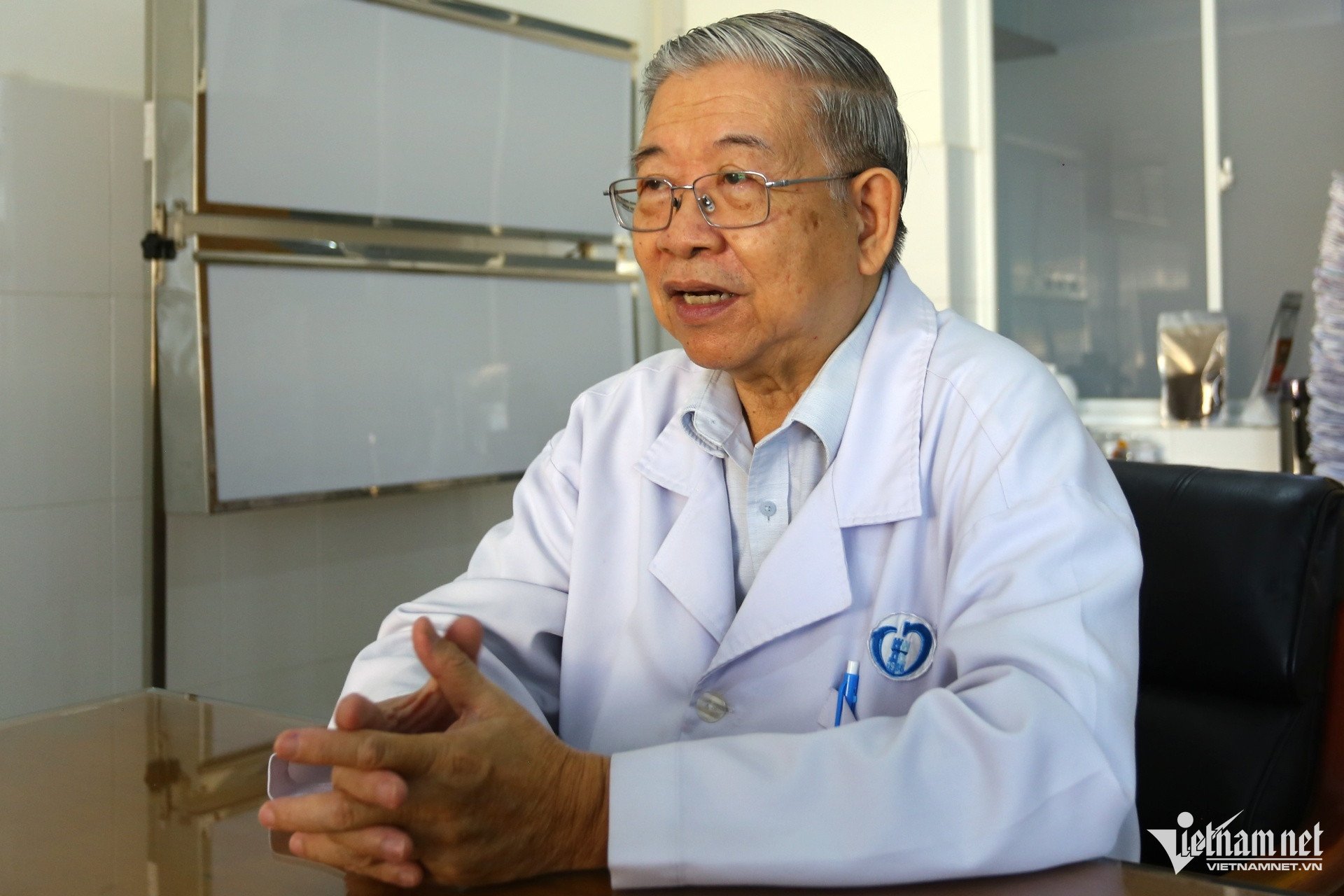

Gold prices are under selling pressure as the Fed may cut interest rates more slowly than expected. |

In the world, gold prices have witnessed a decrease of about 13 USD/ounce, currently trading around 2,016 USD/ounce.

Gold prices have fallen in an inexplicable way amid a falling dollar and falling US Treasury yields. Analysts believe this could be due to selling pressure from a large trader.

Investors are now looking ahead to two key economic reports later this week. The first reading on US GDP for the fourth quarter of last year will be released tonight Vietnam time, and the PCE report for December will be released on Friday.

If both data match estimates, it would suggest to the Federal Reserve that its restrictive monetary policy has brought inflation closer to its 2% target.

According to the CME FedWatch tool, there is just a 1.6% chance of a rate cut this month and a 41.3% chance of a 25 basis point rate cut in March – much lower than previously expected. The tool also shows an extremely high probability that the Fed will start cutting rates at the May FOMC meeting.

The slower-than-expected rate cut has made gold less attractive.

Meanwhile, in the US, the S&P and Nasdaq indices continued to hit record highs as risk appetite in the broader market has recently increased, a drag on the safe-haven metal.

However, in a significant development, China's central bank eased monetary policy on Wednesday, announcing it would cut the reserve requirement ratio for commercial banks by 50 basis points.

The move is expected to inject 1 trillion yuan ($140 billion) of liquidity into the Chinese market. Chinese and Hong Kong stocks rose on the news.

Some analysts said the move by China’s central bank was not enough and that the government needed to spend more to shore up the world’s second-largest economy. However, the news had an impact on China’s better demand for raw commodities, including precious metals.

Source link

![[Photo] Paris "enchanted" by the blooming flower season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/e967dc548ff74f9ca8e89d72c3608825)

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

Comment (0)