The truth about the trick of selling apartments at a loss

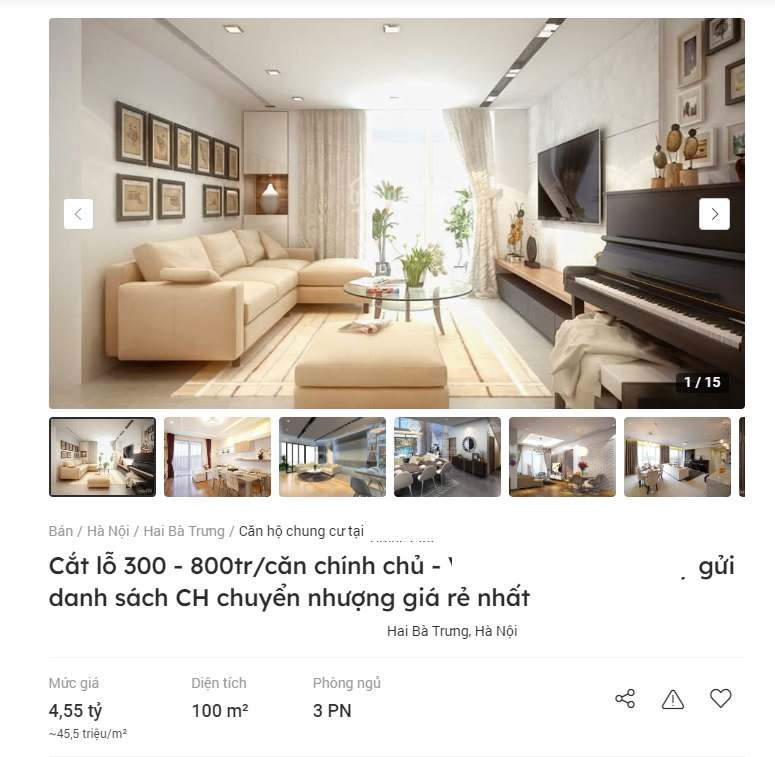

At a project considered “luxury” in Hai Ba Trung district, some “homeowners” are selling apartments at a loss of 300 million - 800 million VND. For example, a fully furnished apartment with an area of 100m2 and 3 bedrooms in this project, at the beginning of 2022, cost over 5 billion VND, but now the “homeowner” has agreed to cut the loss by 500 million VND to 4.5 billion VND, a price of about 45 million VND/m2.

Also in this project, a 1-bedroom apartment with an area of 48 square meters previously had a selling price of 3 billion VND, but now the "homeowner" has agreed to reduce it to 2.5 - 2.7 billion VND.

Many “homeowners” accept losses of up to 300 - 400 million VND/unit, some even “play big” and cut losses of up to 800 million VND. (Photo: BDS)

Speaking to reporters of the Journalist and Public Opinion Newspaper, Mr. Do Kien Hung, director of a real estate trading floor in Thanh Xuan district, shared: Since 2020, the situation of "cutting losses" in apartments has continuously appeared. There are also some cases of real "cutting losses", but most of them are just tricks of real estate brokers.

Mr. Hung shared that in the context of the apartment supply gradually decreasing over the years, especially affordable apartment products, priced under 25 million VND/m2 almost disappearing in Hanoi, there is no such thing as cutting losses on apartments.

“Most of the apartment segment priced under VND35 million/m2 in Hanoi is increasing in price in both the primary and secondary markets,” said Mr. Hung.

For example, in the primary market, an urban project in Nam Tu Liem district, in June last year, the selling price of apartments in this project fluctuated between 41 - 42 million VND/m2, but now it has increased to 45 - 47 million VND/m2, depending on the location.

Or, another urban project in Gia Lam, in June 2022, had a selling price ranging from 30 - 32 million VND/m2, but now the investor also listed a new price of over 35 million VND/m2.

Meanwhile, in the secondary market, a new project handed over in 2020, located right on Quang Trung Street (Ha Dong District), when it opened for sale, had a price of about 26 - 29 million VND/m2, depending on the location, but now the owners are selling it for over 40 million VND/m2. Thus, in just 3 years, this project has increased in value by nearly 40%.

"Thus, in the current context of severe supply shortage, apartment prices increase easily, but are difficult to decrease," said Mr. Hung.

Batdongsan.com.vn's first quarter report this year shows that 43% of people with real estate needs are continuing to wait for real estate prices to decrease.

However, Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, commented that apartment prices in the coming time will hardly decrease deeply because types of real estate serving real housing needs are still the bright spot of the real estate market.

Mr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, said that housing prices in Hanoi are on a downward trend, but in reality, this is not the case. In addition, current housing prices are much higher than when the investor started implementing the project, so high discounts are considered the investor's business strategy.

"This year, the apartment segment in the Hanoi market will receive more attention than low-rise products, because the prices of low-rise products are at a high level," Mr. Dinh said.

In addition, according to Mr. Dinh and many experts, the same opinion is that the supply crisis in the market cannot be resolved in the short term and according to the market rules, when demand is high but products become rarer, of course prices will increase and cannot decrease.

There are real cases of cutting losses.

As Mr. Hung shared, there are also some cases of real loss cutting, but they are rare. For example, the homeowner is in a loss-making business and needs money urgently, so he accepts to sell at a "loss" to recover capital.

“With the economic downturn, there are many cases where businessmen have to sell their houses and cars to raise money to maintain their companies. There are cases like this, but not many. Most homeowners will sell to acquaintances at a good price,” said Mr. Hung.

There are some real cases of “cutting losses”, but most are just tricks of real estate brokers. (Photo: MD)

Second, projects with "scandals", such as apartments with quality not commensurate with the price, or projects with many violations in construction and design leading to not meeting the standards for granting "red books" or "pink books" to residents, also make many people accept "cutting losses" to find other projects.

“In Hanoi, there is no shortage of apartment projects with construction and design violations. Many homebuyers have not received their red books for decades. In this case, many people will cut their losses and look for other projects,” said Mr. Hung.

Third, there are cases where homeowners buy apartments with a 50-year ownership contract, and after about 10-15 years accept to "cut losses" to find another project.

“This case is not common, but it does happen. Because apartment projects with long-term or permanent ownership will have higher prices than apartments with 50-year ownership. During the usage process, depreciation will be deducted from the selling price, so there is a situation of cutting losses,” Mr. Hung said.

Finally, the most obvious case is high-end apartment projects with sky-high prices that are "unsold" and cannot be sold, so they have to "cut" losses to push the goods out quickly.

“The apartment segment structure in Vietnam has a serious shortage of affordable products, but an excess of high-end apartments. Due to supply exceeding demand, when transferring, homeowners have to accept losses,” Mr. Hung shared.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)