Experts recommend learning technical and fundamental analysis, diversifying your portfolio, determining your risk tolerance and cutting your losses.

I recently tried playing stocks, there were profits and losses. I realized that I do not have the skills to recognize which codes are being sold off and I am not decisive in cutting losses. Now I would like to ask the experts for some experience and advice. Thank you, experts.

Vodanh1201

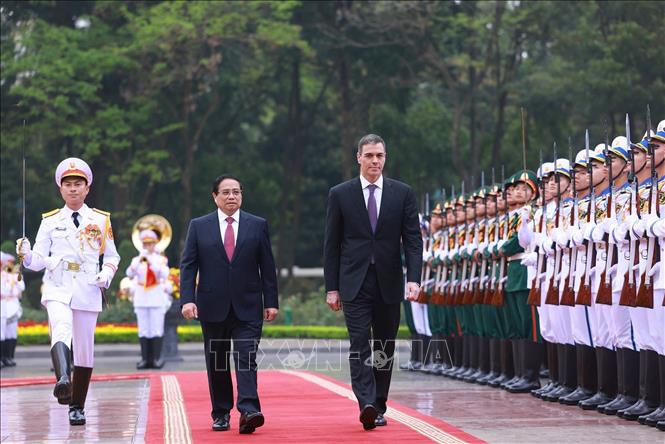

Investors are watching the stock market, February 2022. Photo: Quynh Tran

Consultant:

First, remember that investing in stocks is a long-term journey that requires patience, continuous learning and determination. Making decisions in stock investment is not simply based on a simple indicator or signal, but must synthesize many factors and make your own accurate judgment. Within the scope of this article, I will give some specific suggestions so that you can learn and exploit more detailed information.

Research and learn

Start by reading and learning about how the stock market works. This includes understanding how to buy and sell stocks, the concept of indices, charts, and technical analysis. This will help you understand and identify the meaning behind the market movements through a chart.

Technical analysis has many different schools and requires time to study and practice. However, as a beginner, you need to understand basic technical concepts such as tops and bottoms, support and resistance levels, the relationship between price and volume, market segments including uptrend, downtrend, sideways. After a period of mastery, you can choose to learn and study more.

Technical analysis is a form of studying patterns that have repeated in the past and tend to continue to repeat in the future with the thesis that trading psychology, regardless of the market, investors will not change. Therefore, studying this method helps investors better understand the laws of psychology and supply and demand in stock trading.

You should also learn how to assess the macro impacts on the stock market, companies, and industries you are interested in. This will help you better understand the opportunities and risks associated with specific stocks. This method is called fundamental analysis.

While technical analysis ignores the intrinsic factors of the stock code and the impacts of the economy, fundamental analysis offers a different perspective. We must put ourselves in the position of shareholders to learn and make decisions to accompany the business. When studying this method, you will understand what risks the business you choose will have when operating and how those risks will affect sales.

For example, with a real estate business, when bank interest rates increase, it will lead to a situation where you have to pay more interest. This is also an industry that typically uses large financial leverage. At that time, they will increase interest expenses and reduce profits. This research method will help you choose a good business and have quick reactions to macro factors that can affect the business's production and business activities.

Diversify your portfolio

Instead of having to think about “exiting” or knowing when to “exit,” take an important risk-control action: Don’t put all your money into a single stock or sector.

Diversify your portfolio by owning different types of assets such as stocks, bonds and mutual funds. This helps reduce the risk of losing money when one part of the market cannot be fixed. For a new stock investor, trading too much when the knowledge base is not solid or with the FOMO (fear of missing out) mentality is extremely dangerous. Instead, controlling the appropriate allocation ratio and holding stocks for a long time will be a sure solution, helping you feel more comfortable and secure.

Determine your risk tolerance and stop loss

Once you have diversified your investments, determine your investment goals. Do you want to invest for short-term or long-term gains? What level of risk are you willing to accept?

For example, a young person investing in stocks may be able to accept a higher level of risk than someone approaching retirement age. Therefore, your investment strategy will need to be adjusted based on your own circumstances. Another example is, if you want to make a 20% profit, how much of a stop loss are you willing to accept? This is extremely important.

In the investment world, there is often a "high risk - high return" principle. That means when entering the stock market, you must identify the risks that may occur and manage them.

Cutting losses is a method that can be used by most people because it is an insurance policy for your investment assets. Let's say you have the discipline to cut your losses at 7%, that means you only need to enter a new opportunity that gains 7.5% to break even. But if you cut your losses at 50%, you will need a 100% return on investment to get back to the starting point.

If you don't cut your losses, you're making a fatal mistake that will cost you your trading psychology, time, and energy in an ineffective investment. A commonly used rule is to not invest more than 2-5% of your total assets in a single stock. This helps ensure that you don't lose too much if a stock suddenly drops in price.

Learn from experience

No one becomes an expert right away. It is important to learn from your mistakes and successes and those of others. Investment opportunities arise in the market every day. You try to understand why you made those decisions and learn from them.

Remember that investing in stocks is a long-term journey and requires patience. If you feel uncertain or impatient, consider seeking assistance from a professional investment advisor or expert. Good luck and success in developing your investing skills.

Tran Manh Hoang Viet

Personal financial planning expert

FIDT Investment Consulting and Asset Management Company

Source link

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)