According to MXV, the market witnessed green color all over the metal price board in yesterday's trading session. Notably, in the base metal market, COMEX copper price continued to increase by 1.32% to an unprecedented record - 11,487 USD/ton.

COMEX copper is one of the fastest-growing commodities in the metals market, up about 25-28% since the beginning of the year. It is currently at a record high amid concerns about US President Donald Trump's tariffs and further Chinese stimulus measures announced last week.

The industrial metal is becoming increasingly important as demand for electrification of battery-powered vehicles increases, artificial intelligence (AI) booms and the world transitions to renewable energy.

Late last month, the US President signed an executive order asking US Commerce Secretary Howard Lutnick to launch an investigation into copper imports into the country. The White House said the investigation would assess the national security threat posed by the country’s increasing dependence on imported copper and its products. Immediately after the news was released, COMEX copper prices rose to over $10,000 per tonne.

In addition, China's retail sales data showed a 4% increase in the first two months of this year - the fastest pace since October last year. In addition, both industrial output and fixed asset investment grew more than estimated in February, which has had a significant impact on market sentiment.

China is the world’s largest producer and consumer of copper and a “core” of the global green energy transition. The US moves, along with this positive Chinese economic data, have added to the upward momentum in copper prices.

In the precious metals market, at the end of yesterday's trading session, silver prices reversed and increased by 2.22%, reaching 34 USD/ounce. Meanwhile, platinum also increased by 1.07% to 974.7 USD/ounce. Cash flow is shifting to the precious metals group as investors are concerned that US President Donald Trump's tough tariff policies could weaken economic growth prospects and increase inflation risks. Demand for safe havens increased sharply after the Bipartisan Policy Center (BPC) warned that the US could default on part of its $36.6 trillion debt between mid-July and early October this year if Congress does not quickly raise the debt ceiling.

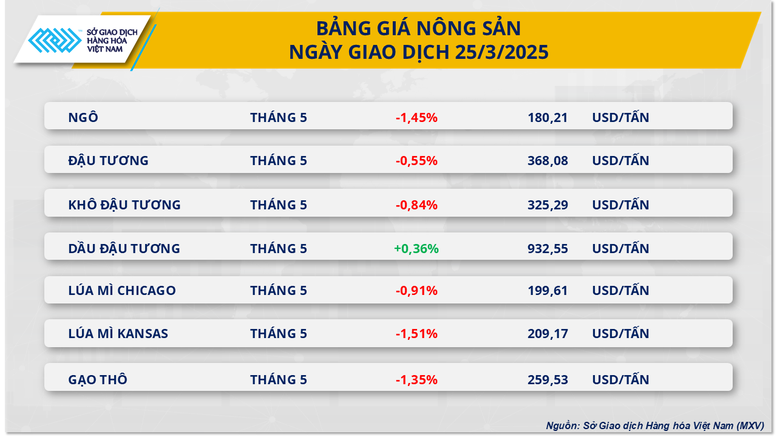

At the end of yesterday's trading session, the agricultural market continued to be dominated by red. The soybean market continued to decline with a decrease of 0.55% to 368 USD/ton in yesterday's trading session. According to MXV, trade tensions between the US and major partners, especially China, continued to be the main driving factor, while positive signals from the European market and concerns about supply from Brazil were not strong enough to reverse the trend.

Source: https://baochinhphu.vn/gia-dong-comex-len-muc-ky-luc-102250326092044069.htm

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

Comment (0)