Delays in implementing power projects, especially large power projects in Power Plan 8, will pose risks to long-term power security.

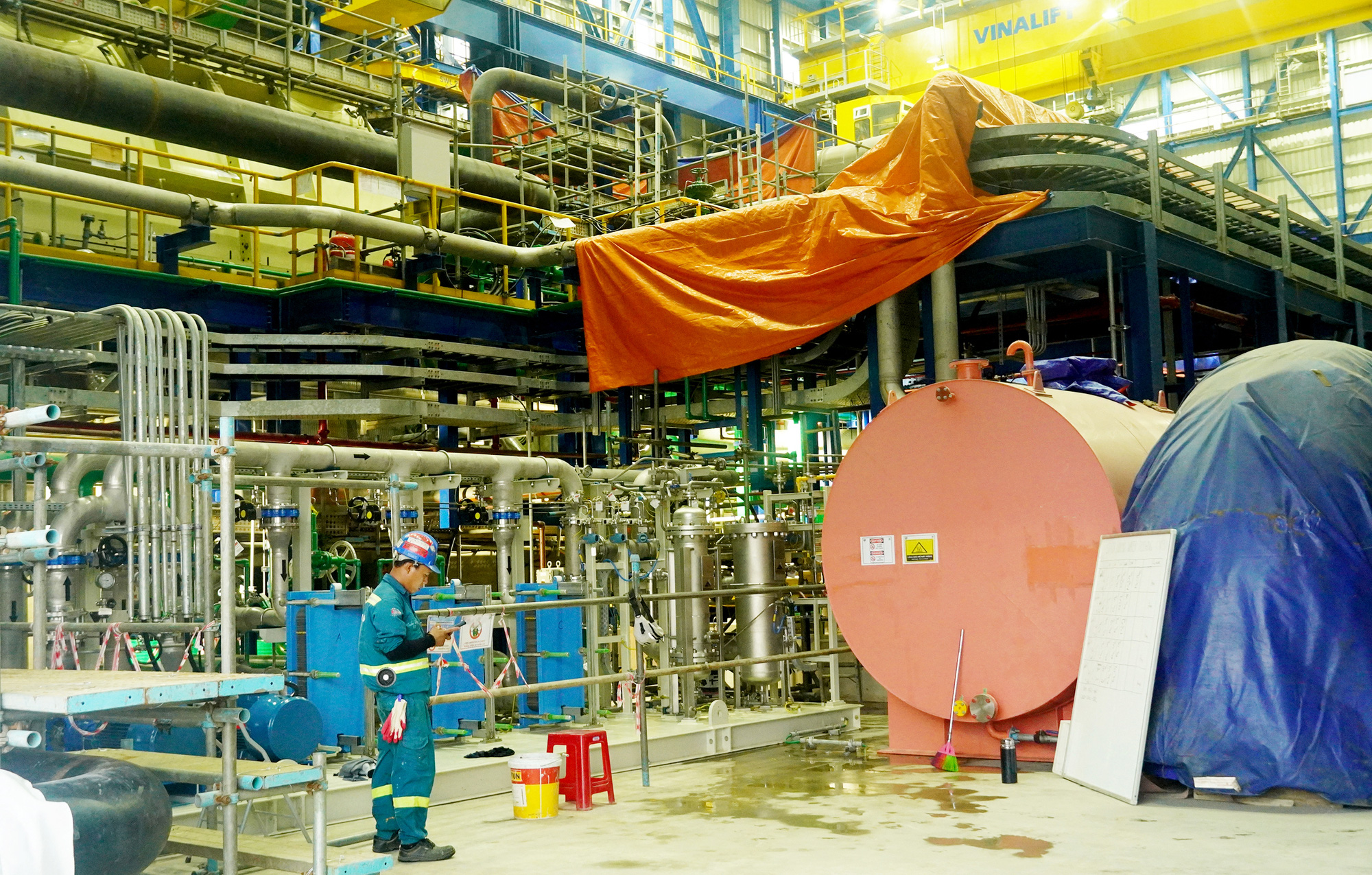

Nhon Trach 3 and 4 gas-fired thermal power plant projects are racing against time to be put into operation in mid-2025 - Photo: Ngoc An

The fact that retail electricity prices have not been adjusted according to fluctuations in input costs has caused concern for investors as Vietnam Electricity Group (EVN) has difficulty securing funds to pay for electricity purchases, reducing its attractiveness to power source investors.

That was the admission of a leader of the Ministry of Industry and Trade when talking to Tuoi Tre, at the same time saying that the electricity price mechanism will be revised to ensure that retail electricity prices are adjusted appropriately according to fluctuations in input parameters.

Worry about short-term contract purchasing of raw materials

Speaking with Tuoi Tre, Mr. Le Ba Quy - Director of Nhon Trach 3 and 4 Power Project Management Board - said that the project is closely following the progress so that the first electricity will be sent to the grid early next year.

Therefore, one of the biggest concerns of investors at this time is the commitment to long-term contract output (Qc), even though this project has signed a power purchase contract.

With a capacity of 1,624MW, when officially put into operation, Nhon Trach 3 and 4 gas-fired thermal power plants will provide an additional 9 - 12 billion kWh. Due to the lack of a clear commitment on long-term Qc, the plant cannot proactively calculate to purchase and import input gas sources.

Meanwhile, the plant uses liquefied natural gas, to buy a favorable gas source at a competitive price, it needs to place a long-term order that takes four months.

In case of not ordering under a long-term contract, the gas purchase price may be 30% higher. This is a disadvantage, pushing up the electricity price, reducing competitiveness when participating in the electricity market and mobilizing electricity sources.

Along with that, the minimum rate of electricity through long-term power purchase contracts (mobilized electricity output - PV) regulated by the Government at 70%, not exceeding seven years, can also pose risks to investors.

According to Mr. Quy, the current gas price and output guarantee mechanism is causing many difficulties for investors in proactively calculating input material import and operation options.

This could also cause obstacles for foreign investors when investing in power projects.

A leader of the Vietnam National Oil and Gas Group (PVN) said that according to tradition, the delivery of liquefied gas for the following year will be planned by suppliers around the world from July to October.

However, the Qc output for the following year of the new power plants has just been officially announced and in the first eight months of this year, the Qc of the power plants will be recalculated monthly.

Therefore, there will be a delay between the power generation plan and the gas receiving plan time, creating huge financial risks when there may be a lack of gas, excess gas, failure to meet operational requirements, and storage fees.

In addition, without long-term QC, the electricity seller has no basis to commit to long-term NLG volume and can only buy under contract with small volume, at least 20 - 30% of average electricity output, the rest will be purchased by trip (spot).

"This causes electricity prices to rise, affecting the Vietnamese electricity market and not ensuring electricity output when the system requires it.

According to calculations, if the case of buying trips accounts for 80%, the rate of electricity price increase can be up to 173% and if buying trips accounts for 40%, the price will increase by 131%," he said.

Remove policies, speed up project progress

According to a leader of the Ministry of Industry and Trade, in the Power Plan 8, the total capacity of 23 gas-fired power projects invested in construction and put into operation by 2030 is 30,424 MW.

Of which, the total capacity of power plants using domestically exploited gas is 7,900MW (10 projects) and the total capacity of gas power plants using LNG is 22,524MW (13 projects).

However, the investment and construction situation still faces many challenges. In addition to the O Mon I Thermal Power Plant (660MW) which has been operating since 2015, the O Mon IV Thermal Power Plant (1,050MW) which is expected to be commercially operational in the second quarter of 2028, only the Nhon Trach 3 and Nhon Trach 4 gas-fired thermal power projects, with a capacity of 1,624MW, using imported LNG, are under construction and expected to be operational in mid-2025.

According to this person, the possibility of the remaining projects being completed before 2030 is difficult if there are no fundamental solutions to remove important bottlenecks for LNG power development such as regulations on minimum mobilized output, converting gas prices to electricity prices...

Leaders of the Ministry of Industry and Trade also said that they have worked with EVN and PVN to complete the contents related to the mechanism and policies for developing gas-fired power plants in the Electricity Law project (amended).

Delays in implementing power source projects, especially large power source projects in Power Plan 8, will pose risks of long-term power insecurity, and may cause power shortages at certain times.

Along with the policy mechanism to promote electricity projects, the ministry will review the mechanism to adjust electricity prices and overcome current shortcomings to attract investors.

According to this person, investors' concerns when deciding to invest in power source projects in Vietnam may stem from the retail electricity price adjustment mechanism when it has not closely followed the electricity price developments according to the retail electricity price adjustment mechanism.

The fact that retail electricity prices have not been adjusted according to fluctuations in input costs also causes concern for investors as EVN may have difficulty securing funds to pay for electricity purchases, thereby reducing the attractiveness of power source investors.

"Therefore, the amendment of the electricity price mechanism must ensure harmony of factors, ensuring that investors in both the power source and the grid can recover costs and make reasonable profits, and ensuring that EVN has a retail electricity price that is adjusted appropriately according to fluctuations in input parameters," he said.

Making electricity an important source of power supply

On November 30, the National Assembly passed the Electricity Law (amended), with important content related to prioritizing the development of gas-fired thermal power using domestic gas sources and liquefied natural gas.

The goal is to gradually make electricity an important source of power supply, supporting the regulation of the power system.

The passed law also provides for a mechanism to mobilize thermal power projects using domestic natural gas to the maximum extent possible according to gas supply capacity and fuel constraints to ensure harmony of the overall national interests.

At the same time, there is a mechanism for developing thermal power plants using liquefied natural gas, suitable to the level of competitive electricity market and the interests of the State and people, and the macro economy in each period.

This includes long-term minimum contract electricity output and application period, electricity price calculation principles, investment project implementation guarantees, and policy duration for each case.

Source: https://tuoitre.vn/gia-dien-chua-hap-dan-nha-dau-tu-20241204085444348.htm

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)