Land prices in Ho Chi Minh City increased dozens of times with the new price list; Vincom Retail maintained its net profit of thousands of billions

Hanoi applies new land price adjustment coefficient; Long An seeks investors for two social housing areas; Tin Nghia Industrial Park sees net profit increase 5 times; Nam Long achieves revenue of 456 billion VND thanks to Southgate and Izumi projects.

That's some of the real estate news highlights from last week.

Ho Chi Minh City rebuilds land price list, many areas increase prices dozens of times

The Department of Natural Resources and Environment of Ho Chi Minh City is seeking comments on the draft Decision to amend Decision No. 02/2020/QD-UBND on land price list in the area.

The new table is expected to be applied from August 1 to December 31, 2024. After that, the agencies will summarize and assess the economic and social impacts to continue adjusting the land price table applied from January 1 to December 31, 2025.

|

| With the new land price list, Le Loi Street will have land prices up to 810 million VND/m2, 5 times higher than the current price. Photo: Le Toan |

In the draft, it is expected that in the last 5 months of 2024, Dong Khoi, Nguyen Hue and Le Loi streets will have new land prices of about 810 million VND/m2, 5 times higher than the previously regulated level.

Some neighboring areas such as Ton Duc Thang Street (from Me Minh Square to Nguyen Tat Thanh Bridge) also have land prices up to 528 million VND, an increase of 422.4 million VND/m2 compared to the current price frame. Pham Hong Thai Street has land prices of 418 million VND/m2, an increase of 334.4 million VND/m2 compared to before.

In Thu Duc City, the current land price framework only stipulates prices ranging from 5 to 7 million VND/m2, with some places reaching over 20 million VND/m2. However, the numbers have now skyrocketed. For example, on Tran Nao Street, land prices are expected to reach 149 million VND/m2, a sharp increase from 13 to 22 million VND/m2 according to the old calculation method.

Even the roads in the “rich area” of Thao Dien ward previously had land prices of only about 7.8 million VND/m2. Currently, the price calculated according to the land price list has increased to 88 - 120 million VND/m2.

Hanoi applies new land price adjustment coefficient

From July 29, 2024, Hanoi will apply new regulations in Decision No. 45/2024/QD-UBND on land price adjustment coefficients in 2024 for cases applying coefficients according to the provisions of law.

Specifically, the coefficient for adjusting prices of agricultural land, forestry land, and land with water surface for aquaculture is 1.0.

The coefficient for adjusting agricultural land prices (including garden land and ponds adjacent to residential land) is the basis for determining the difference between the land use fee collection price for the new purpose and the agricultural land use fee collection price: K = 1.0.

The coefficients for adjusting prices of land for non-agricultural production and business, and commercial and service land in the Hoan Kiem, Ba Dinh, Dong Da, and Hai Ba Trung districts are 1.40 and 1.70, respectively; in the Cau Giay, Thanh Xuan, and Tay Ho districts are 1.35 and 1.60, respectively; in the Long Bien, Hoang Mai, Ha Dong, Bac Tu Liem, and Nam Tu Liem districts are 1.28 and 1.50, respectively.

In addition, the land price adjustment coefficient is the basis for collecting land use fees for households and individuals whose land use rights are recognized by the State and allowed to change land use purposes for residential land areas exceeding the limit as prescribed in Clause 3, Article 3 of Decree No. 45/2014/ND-CP.

Accordingly, the coefficient in Hoan Kiem, Ba Dinh, Dong Da, Hai Ba Trung districts is 2.00. Cau Giay, Thanh Xuan, Tay Ho districts is 1.75. Long Bien, Hoang Mai, Ha Dong, Bac Tu Liem, Nam Tu Liem districts is 1.70...

In case some land locations are auctioned for land use rights in the same area or route with profitable characteristics, land use coefficient (construction density, building height, etc.) different from the average level of the area or route, Hanoi City assigns the People's Committees of districts, towns, and cities to review and report to the Department of Finance to synthesize, develop, and advise on adjusting the land price adjustment coefficient issued according to regulations.

Hanoi seeks investors for two urban areas in Thanh Tri district

According to the announcement of the Hanoi Department of Planning and Investment seeking investors, the new urban area C3-1 has a scale of more than 27 hectares located in Dai Ang commune, Thanh Tri district. The current status of the land is mainly agricultural land for growing rice, irrigation canals and a part of residential land (excluding the planned road area and existing schools).

The project is expected to provide 580 low-rise apartments (villas, townhouses) 4-5 stories high, two 17-story apartment towers and an 8-story social housing building with more than 520 apartments. The population is nearly 6,800 people. The total investment capital of this project is nearly 4,500 billion VND.

In addition, the Hanoi Department of Planning and Investment is also looking for investors for the new Lien Ninh urban area in Lien Ninh commune, Thanh Tri district, with a scale of more than 30 hectares.

The land for project implementation is agricultural land of households and individuals assigned according to Decree 64 of the Government, and intra-field ditch and cemetery land managed by the People's Committees of Lien Ninh, Ngoc Hoi, and Ngu Hiep communes.

The project is expected to provide the market with more than 270 villas, townhouses, 4-5 floors high and a 30-storey social housing building with more than 800 apartments. The population is about 4,500 people. The total investment capital of the project is nearly 3,200 billion VND.

The two projects have an operating period of 50 years, with implementation progress from now until 2028 - 2029. After completion, the two projects will form a new urban area with synchronous technical and social infrastructure, meeting the housing needs of local people, and generating budget revenue from land use rights auctions.

Long An seeks investors for two social housing projects in Duc Hoa district

The Department of Planning and Investment of Long An province is inviting interested investors to submit applications for a 9.53-hectare social housing project in Duc Hoa Dong commune, Duc Hoa district. Upon completion, the project will provide 2,895 apartments to the market. It is expected to be home to about 7,283 people. The total investment capital of the project is more than VND3,708 billion.

Also in Duc Hoa Dong commune, Duc Hoa district, the Department of Planning and Investment of Long An province is looking for investors to build a social housing area of about 9.62 hectares with 2,991 apartments. The population here is 7,505 people. The total investment capital of the project is more than 3,935 billion VND.

Both of the above projects have a duration of 50 years, calculated from the date the investor is granted land allocation, land lease, or land use purpose change. The project implementation progress is 4 years, from the date of the investor approval decision.

Vincom Retail still maintains its net profit of thousands of billions in the second quarter of 2024

Vincom Retail JSC (VRE) has just announced its financial report for the second quarter of 2024 with consolidated revenue reaching VND 2,478 billion, an increase of 14% over the same period last year.

In which, real estate leasing activities Investment and provision of related services is still the "golden goose", bringing in nearly 1,940 billion VND, not much different from the same period. However, real estate transfer activities brought in twice as much revenue, up to 466 billion VND.

|

| Vincom Retail opened 4 shopping malls in June 2024. Photo: VRE |

In addition, financial revenue in the second quarter of 2024 also increased by 51%, reaching VND420 billion. Most of the revenue comes from interest on deposits, loans and deposits.

In the end, Vincom Retail had a net profit of VND1,021 billion, a slight increase of 2% compared to the same period. This achievement marked the 6th consecutive quarter that the company had a profit after tax of over VND1,000 billion.

In the first 6 months of this year, Vincom Retail recorded net revenue of VND4,733 billion, up 15% over the same period last year. Profit after tax reached VND2,104 billion, up slightly by 4%. With the above results, the company has completed 49% of the revenue target and 47% of the profit target.

As of June 30, 2024, the company's total assets reached nearly VND 52,328 billion, an increase of about 10% compared to the end of last year. Of which, the company's liabilities increased by 25%, to VND 12,397 billion. Owner's equity was VND 39,930 billion, an increase of about 5%.

The company's inventory has dropped sharply, from VND639 billion at the end of last year to VND228 billion at the end of the second quarter of 2024. This is mostly the cost of building and developing commercial townhouses for sale.

In June 2024 alone, Vincom Retail opened 4 more shopping malls, including 3 new projects: Vincom Mega Mall Grand Park in Ho Chi Minh City (technical opening), Vincom Plaza Dien Bien Phu and Vincom Plaza Ha Giang. At the same time, the company also reopened Vincom Plaza 3/2 in Ho Chi Minh City after a renovation period.

According to Vincom Retail, these shopping malls all had an occupancy rate of 85-92% at the time of opening. The company currently has a total of 86 shopping malls in 46/63 provinces and cities nationwide, with more than 1.81 million square meters of retail floor area (GFA) across the system.

In addition to the above projects, the recent financial report also shows that Vincom Retail is investing in the construction of a series of new projects such as Bac Ninh Hotel, Vincom Plaza Dien Bien, Vincom Plaza Bien Hoa 2, Vincom Plaza Dong Ha Quang Tri. Of which, the Bac Ninh hotel project is costing the most with 281 billion VND, as of June 30, 20204.

Tin Nghia Industrial Park's net profit increased 5 times in the second quarter of 2024

The second quarter 2024 financial report of Tin Nghia Industrial Park Development JSC (TIP) has shown a very positive picture of the “health” of the enterprise. Accordingly, the company's net revenue reached 40.7 billion VND, an increase of 7% over the same period last year.

This increase comes from service revenue at Tam Phuoc Industrial Park (Dong Nai). This is the result of wood businesses – TIP’s customers – having orders again and operating more stably.

In addition, the company's financial revenue also skyrocketed to VND67 billion in the second quarter of 2024, from VND5 billion the previous year. This revenue comes from cooperation with Phuoc An Port Investment and Exploitation Petroleum JSC.

In addition, thanks to TIP reducing its ownership ratio of Olympic Coffee Company, the company has reversed its financial investment provisions in this unit. Thereby, the company's financial expenses in the second quarter of 2024 have decreased 15 times, down to VND 105 million.

After deducting expenses, TIP's profit after income tax reached 68 billion VND, an increase of nearly 5 times compared to the same period last year.

In the first 6 months of this year, the company's net revenue was about 79 billion VND, up 14% over the same period last year. Profit after tax reached 96 billion VND, up 3.7 times over the previous year.

Compared with the annual business plan, the company has achieved 48% of the revenue target and 57% of the profit target.

As of the end of the second quarter of 2024, TIP's total assets were VND2,072 billion, up 4.7% compared to the beginning of the year. Owner's equity reached VND1,806 billion, up slightly by 3%.

Payables increased by 12% to VND265 billion. The biggest increase came from short-term unrealized revenue, up from VND5.6 billion at the beginning of the year to VND32.5 billion. Most of the money came from land rental and infrastructure usage fees.

In addition, the report also revealed that as of June 30, 2024, the company had bank deposits of up to VND 78.4 billion. This deposit has a term of 6 months and interest rates ranging from 2.9 - 4.8% / year.

In addition to the above financial items, the company also invested in two affiliated companies, Tin Nghia Security Services JSC and Phuoc Tan Company (real estate sector). In addition, TIP also "invested" in two other units, Long Khanh Industrial Park JSC and Olympic Coffee JSC. The total investment for all four enterprises is 419 billion VND.

The company's inventory as of the end of the second quarter of 2024 was VND146 billion, down 3% compared to the same period last year. Of which, the cost of unfinished production and business of the Thanh Phu residential area project (Dong Nai) is the most expensive item, with an amount of up to VND59 billion. This is a project invested by a subsidiary - Tin Khai Joint Stock Company.

Regarding the company's orientation in 2024, TIP's board of directors said that it will focus on exploiting utility services at Tam Phuoc Industrial Park. At the same time, the company will survey and consider investing capital in enterprises investing in industrial park infrastructure in the province and the Southeast region that still have land funds and have good development directions...

Nam Long achieved revenue of 456 billion VND thanks to Southgate and Izumi projects

In the second quarter of 2024, Nam Long Investment Corporation (NLG)'s net revenue reached VND 252 billion, down 3.7 times compared to the same period last year.

However, Nam Long's financial revenue increased sharply from VND40 billion in the second quarter of 2023 to VND249 billion in the last quarter. Of which, the revenue mainly came from NLG completing the transfer of 25% of its ownership in Paragon Dai Phuoc Company. The profit from this transaction is worth up to VND230 billion.

Ultimately, the company's after-tax profit fell to around VND159 billion, down about 45% year-on-year.

In the first 6 months of this year, the company's net revenue was VND456 billion, down 160% compared to last year. Of which, revenue from selling land, apartments, townhouses and villas accounted for 81% of the revenue structure, reaching VND371 billion. The above amount mainly came from sales activities from key projects such as Southgate (Long An) and Izumi (Dong Nai).

Profit after tax in the first half of the year also only fell to about 94.8 billion VND, down 2.6 times compared to the same period.

Previously, NLG set a target of VND6,657 billion in net revenue for the whole year and VND821 billion in after-tax profit. Thus, the company is still far from its set business target.

As of June 30, 2024, NLG's inventory was approximately VND19,231 billion, an increase of about 10% compared to the end of last year. In particular, the projects with the largest value in this category are Izumi (VND8,655 billion), Waterpoint Phase 1 (Long An) (VND3,837 billion), Hoang Nam Akari (HCMC) (VND2,425 billion)...

The financial report also said that by the end of the second quarter of 2024, Nam Long had spent about VND23,217 billion to build office buildings. In addition, the company spent VND13,463 billion to build An Thanh market.

In financial investment, the company has poured about VND 1,529 billion into associated companies and joint ventures such as Paragon Dai Phuoc, NNH Mizuki, Anabuki NL. At the same time, the enterprise is also investing capital in another unit, Hong Phat Financial Investment Company, with an amount of VND 2.4 billion.

Nam Long's total assets are currently around VND29,731 billion, up 3% compared to the end of last year. Liabilities increased by about 9%, reaching VND16,425 billion. Owner's equity is VND13,305 billion, unchanged compared to the end of 2023.

In the previous shareholders’ meeting, Nam Long’s board of directors said that revenue in 2024 will mainly come from the Akari Phase 2 and Southgate projects. Some other projects with legal problems have also found solutions.

For example, the Izumi project, after many efforts, is expected to have its 1/500 planning approved in December 2024 - the first quarter of 2025. As for the Paragon project, the planning has been extended until 2027. NLG will soon submit a new planning for the above project.

During the 2024-2026 period, the company estimates that it can launch 15,000 products to the market. Currently, the company has a land fund of about 681 hectares, enough to develop the project until 2030.

According to the roadmap to 2030, Nam Long will have to complete 14 strategies. In 2024 alone, the company will focus on 3 important strategies, including investment and investment management, overall finance (including capital mobilization); M&A and growth.

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

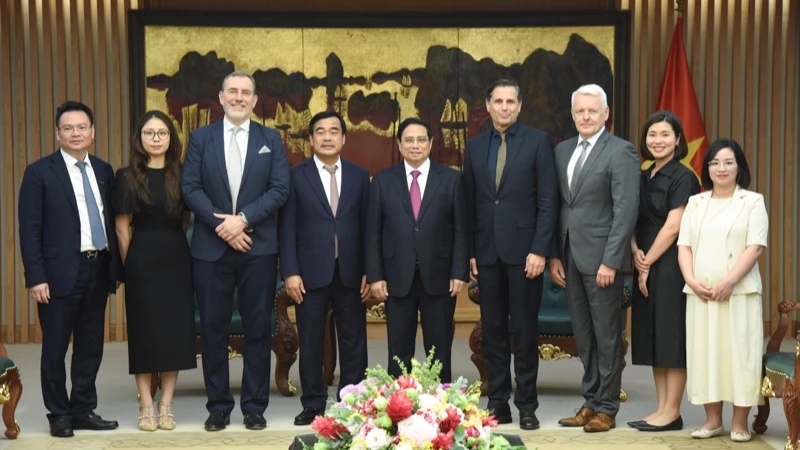

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

![[6pm News] Thanh Hoa still has nearly 9,000 households in mountainous districts in need of housing support](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/f67bbe1ab09943bead5a009e47703c5b)

Comment (0)