The era of cheap money may soon end.

The era of low interest rates may be over. Policymakers are signaling they don't expect low borrowing costs to return anytime soon.

The Fed decided to keep interest rates at their highest level in two decades and left the door open for another rate hike before the end of the year. But there is still a key factor lurking in the newly released economic forecasts.

Fed officials don’t expect rates to tighten too much this year, but things could change from 2024 onwards. Experts predict short-term rates will remain above 5% next year, and by the end of 2025 they will be closer to 4%, nearly double the level at the end of 2019.

By 2026, the Fed expects inflation to be completely suppressed and economic growth to stabilize back to its long-term trend — with interest rates still expected to be higher than before COVID-19 struck.

In other words, higher interest rates are likely to persist for years.

That conclusion stems in part from a simple observation: The Fed has been raising interest rates aggressively for the past year and a half, with policy lags that are too long.

Professor Gabriel Chodorow-Reich (Harvard University) commented: "They were surprised by the level of growth of the US economy this year. The economic strength is still maintained, suggesting that interest rates may need to be higher to put pressure on growth. The Fed's policy is not as tight as we thought."

Consequences

The Fed’s monetary policy and interest rates affect the rest of the economy, making it more expensive to borrow money to buy a car, a house or expand a business. Mortgage rates, for example, are now above 7%, up sharply from a low of around 2.7% before the Fed began its anti-inflation campaign.

High interest rates can also be a problem for borrowers with large debts, a problem that both commercial real estate companies and the U.S. government are facing.

The US stock market remains depressed. The S&P 500 index fell 1.6%. The longer interest rates remain high, the more they will erode corporate profits.

But for the economy as a whole, higher interest rates could bring some positive changes.

The Fed’s economic management tools don’t work well in a time of low interest rates. Officials struggled to boost the economy enough in the years after the 2007-2009 recession, as even near-zero interest rates failed to attract capital and stimulate demand. The recovery has been sluggish for years. Raising interest rates could make it easier to stimulate growth in tough economic times. Higher rates could also be good news for people who have been trying to save.

Of course, analysts predict that the Fed's interest rate hike may not come true.

The Fed’s economic forecasts have been criticized for being unreliable, especially over the long term. If the economic recovery stalls in the coming months and U.S. unemployment spikes, policymakers may be forced to cut interest rates more than expected.

When asked why Fed officials expect interest rates to remain higher through 2026, Chairman Powell cited the recent strong growth of the US economy. However, the leader did not draw a conclusion on how long interest rates will remain.

Source

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

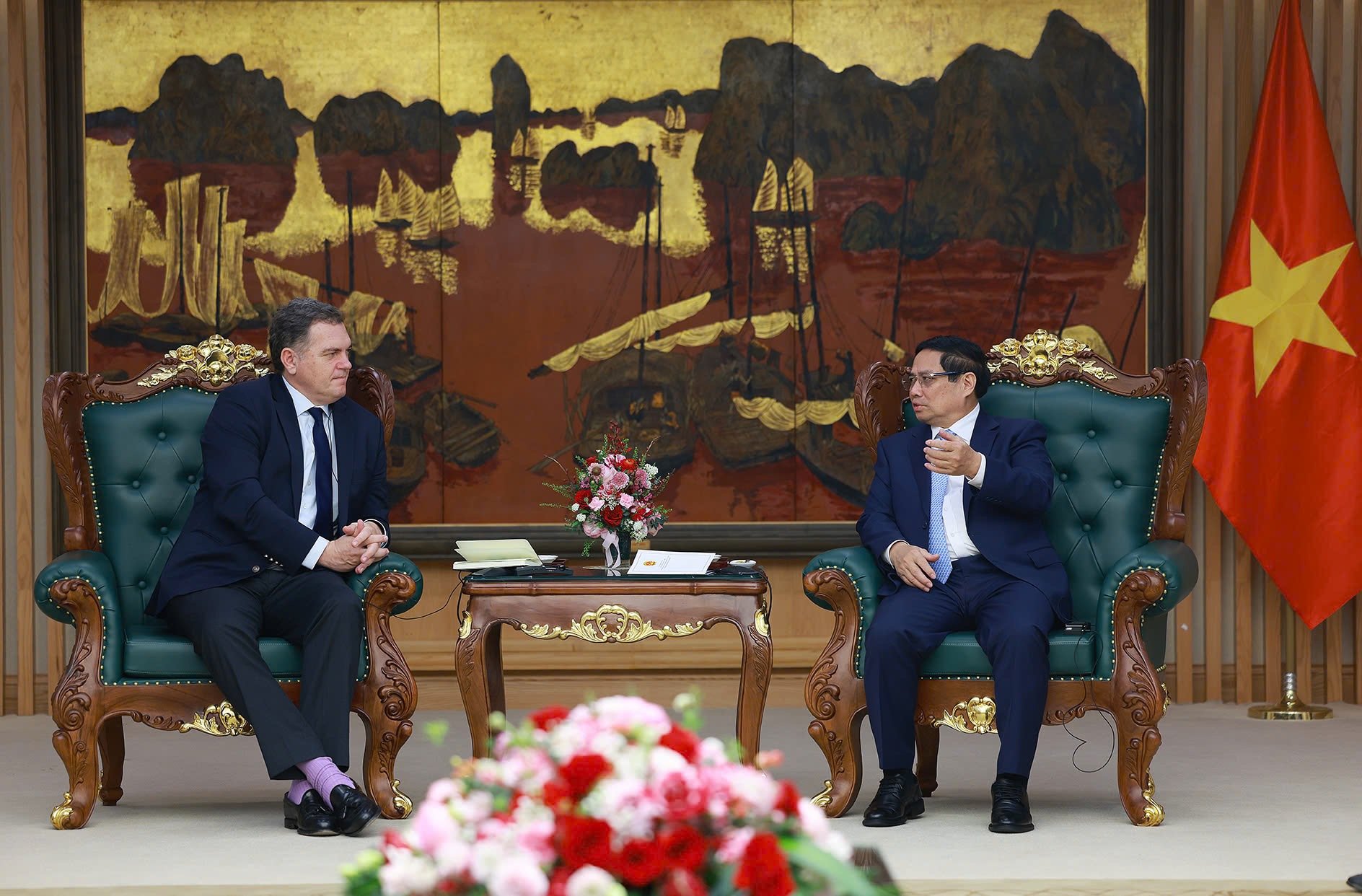

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

Comment (0)