FECON failed to complete its business plan for 5 consecutive years

FECON JSC (Code: FCN) is a well-known unit in the field of construction works, having won many large contracts ranging from hundreds of billions to thousands of billions of VND. On the stock market, FECON of Chairman Pham Viet Khoa is famous for making business plans "for fun" but implementing them to no avail.

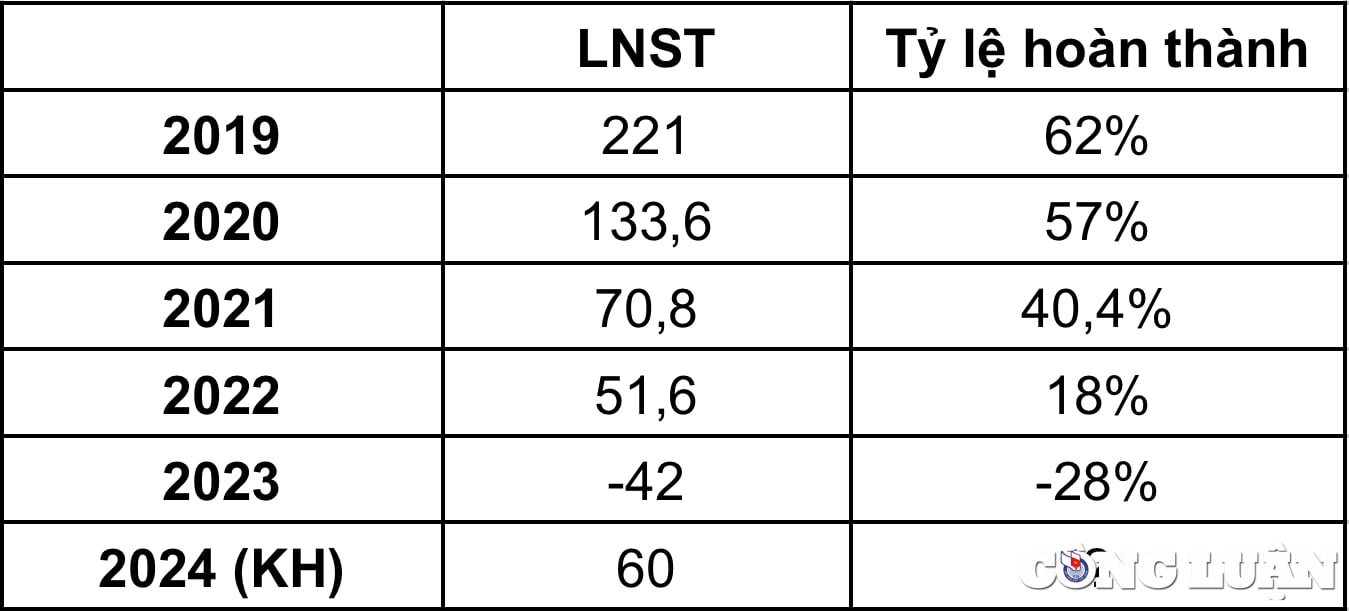

Specifically, in the period 2019-2023, FECON continuously broke its annual business plan. In 2019, the company only achieved a profit of 221 billion VND, completing 62% of the year's target. In 2020, the profit dropped 40% to 133.6 billion VND, equivalent to completing 57% of the plan.

FECON's plan completion rate is decreasing, not even once in 5 years has the plan been achieved.

In 2021, FECON's profit plummeted another 47%, to only 70.8 billion VND, equivalent to 40.4% of the year's target. This is 3 years of the COVID-19 pandemic, so it is understandable that FECON's business activities are affected.

However, entering 2022 when the epidemic situation has been controlled, FECON set an ambitious target of 280 billion VND in profit. In fact, the results only reached 51.6 billion, equivalent to 18% of the year's target.

In 2023, business results were even worse, FECON reported a loss of 42 billion VND, 28% lower than the plan set at the beginning of the year.

Will the "tradition" of broken business plans enter its 6th year?

In 2024, FECON continues to set a very high target with revenue of VND 4,000 billion, an increase of 39% compared to the previous year and profit after tax of VND 60 billion. However, the poor business results in the first quarter of 2024 show that the company is likely to enter the 6th year of breaking its business plan.

FECON's Q1/2024 business results report recorded revenue of VND611.6 billion, unchanged from the previous year. Increased cost of goods sold caused gross profit to decrease by 21.2% to VND96.8 billion.

FECON (FCN) of Chairman Pham Viet Khoa and the risk of failing the plan for the 6th consecutive year (Photo TL)

Financial revenue recorded in the period was VND9 billion. Financial expenses were reduced to only VND48 billion, with the majority of the structure being interest expenses. However, selling expenses and business management expenses both increased, accounting for VND5.2 billion and VND49.7 billion, respectively.

After deducting all expenses and taxes, FECON had 635 million VND in after-tax profit, down 77.4% compared to the same period. The after-tax profit of the parent company's shareholders was even negative 7.4 billion VND.

With the above results, FECON has only completed more than 1% of the annual profit plan. If there is no breakthrough from now until the end of the year, FECON will almost certainly fail its business plan for the 6th consecutive year.

News of winning a trillion-dollar bid, FCN shares still 'dive' to the bottom

In the last month of 2023, FECON announced good news to shareholders about the company winning bids for a series of new projects, with a total value of more than 3,300 billion VND.

In the infrastructure construction sector, FECON has received a letter of award for the "Phoenix Terminal - Vung Ang Port Investment Project" (terminals 5 and 6) worth 1,000 billion VND. The Phoenix Terminal - Vung Ang Port project is located in the Vung Ang Economic Zone in Ky Loi commune, Ky Anh town, Ha Tinh province.

In addition, FECON also joined forces with Javico and Tung Phat to sign a contract to build a railway overpass connecting National Highway 1A with Le Duan Street, Phu Ly City, Ha Nam Province, worth 230 billion.

The company also announced that it won the contract to build the Quang Ninh Provincial Police Headquarters and the administrative headquarters at 10 Tran Kim Xuyen - Hanoi. The total value of these two packages is over 1,000 billion.

Another notable project is the Construction of underground structures and electromechanical parts and Construction of superstructure, interior finishing and landscape at CT2 Co Linh Long Bien Hanoi Building Project - Residential area and Tu Dinh Sports and Entertainment Area. The total contract value is over 900 billion.

Finally, the joint venture VINACO - FECON - Thanh Ngan - Nam Hai received package No. 14 for the entire construction and equipment of the B5 resettlement area project belonging to the infrastructure of the new urban area of Thuan An, Hue. The project value is 87.3 billion VND.

Receiving many new high-value projects, but ensuring FECON's capital structure is really worrying. At the end of the first quarter of 2024, FECON recorded a debt of VND 5,109 billion, nearly twice as high as its current equity.

The amount of debt in the capital structure is at a high level, causing the interest rate to escalate. The total short-term and long-term debt at the end of the first quarter was up to VND 2,815 billion, much higher than the equity. The company also had to pay VND 47.6 billion in interest in the first quarter alone.

Given the above developments, FECON's FCN stock continued to "dive" to the bottom. At the trading session on July 29, 2024, FCN code recorded a price of VND 13,100/share, down 30% compared to the peak reached in September 2023.

Source: https://www.congluan.vn/fecon-fcn-cua-chu-tich-pham-viet-khoa-va-nguy-co-vo-ke-hoach-kinh-doanh-6-nam-lien-tiep-post305325.html

Comment (0)