9 out of 10 quarters profit margin has not exceeded 1%

Fecon Corporation (FCN) of Chairman Pham Viet Khoa, a major contractor in the construction sector, is implementing many large contracts worth hundreds of billions to thousands of billions of VND. However, in recent quarters, this unit has continuously recorded symbolic profits, not commensurate with its revenue of hundreds of billions.

In the second quarter of 2024, Fecon recorded net revenue of VND 815.9 billion, up 21% over the same period. Of which, the high cost of goods sold accounted for VND 728.2 billion, causing the company's gross profit to only VND 87.8 billion, down 29.8% over the previous year.

Fecon (FCN) spent 100 dong but did not get 1 dong in profit, this situation has lasted for a long time. (Photo TL)

Financial revenue during the period increased to VND7.4 billion. On the contrary, financial expenses were reduced by nearly half but still accounted for VND36.9 billion. Of which, VND35.9 billion was interest expense.

Business management costs and sales costs increased slightly compared to the same period, accounting for VND51.9 billion and VND4.9 billion, respectively. It is easy to see that although interest expenses have been reduced, they are still high, equivalent to nearly 70% of business management costs. This further shows that balancing interest expenses for loans is still a problem for Fecon.

After deducting all expenses and taxes, Fecon recorded a net profit of only 720 million VND, equivalent to a net profit margin of only 0.09%. This means that Fecon's 100 VND of revenue brought in less than 1 VND of net profit.

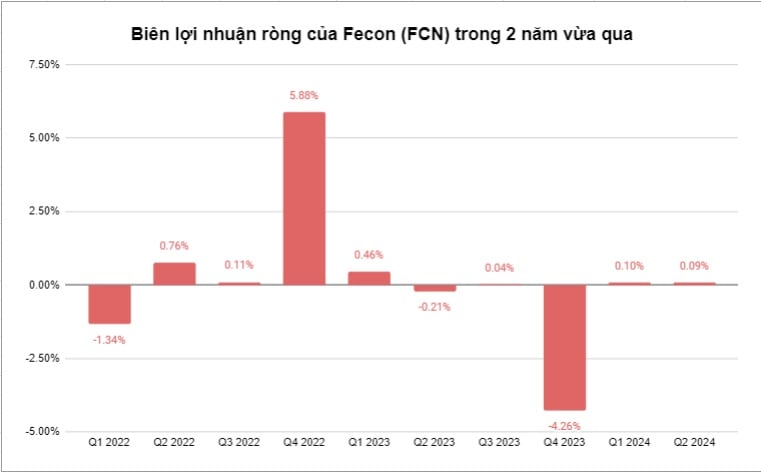

Fecon's "for show" profit situation has been too familiar to shareholders in the past 2 years.

Specifically, from the first quarter of 2022 to now, Fecon only recorded a net profit margin of 5.9% in the fourth quarter of 2022. For the remaining 9 business quarters, Fecon's net profit margin was just under 1%.

Even in Q1/2022, Q2/2023 and Q4/2023, Fecon's net profit margin was negative, at -1.3%, -0.002% and -4.3% respectively.

'Tradition' breaks business plans year after year

With its "poor" profit margin, many shareholders question how Fecon, chairperson Pham Viet Khoa, will accomplish its annual business goals?

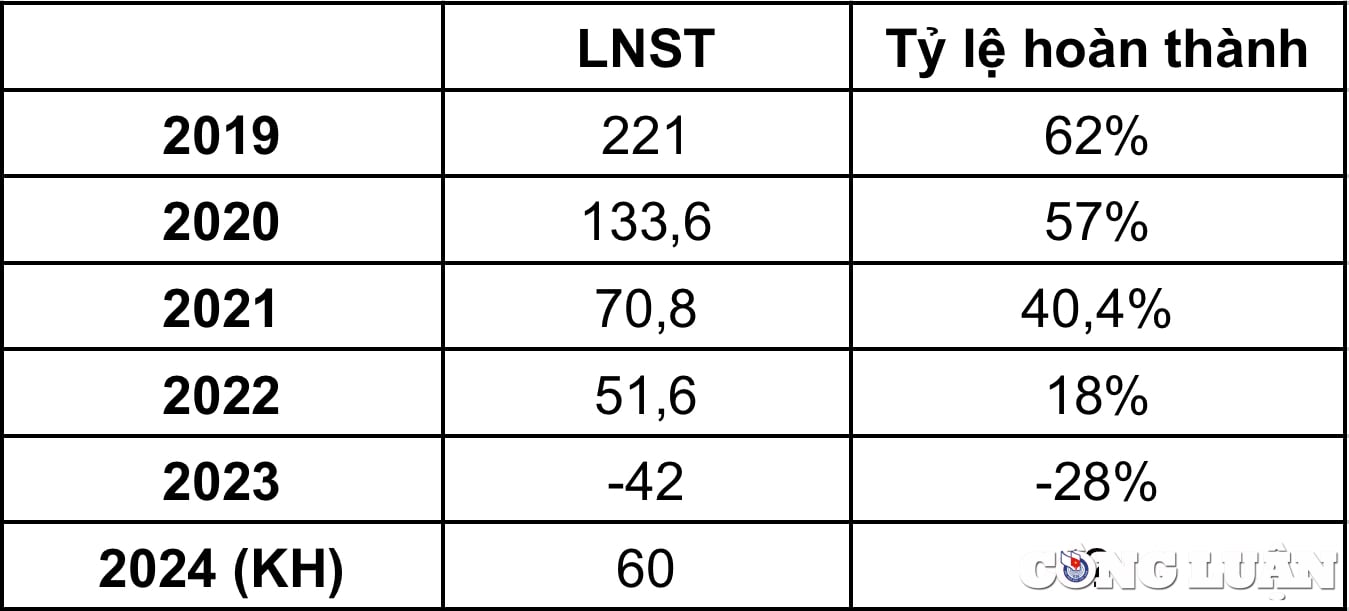

In fact, Fecon has failed to meet its profit target for five consecutive years. The completion rate has even continued to decline year by year in the 2019-2023 period.

Specifically, in 2019, Fecon achieved a profit after tax of VND 221 billion, equivalent to completing 62% of the plan. In 2020, the profit decreased by 40% to VND 133.6 billion, equivalent to completing 57% of the plan.

For 5 consecutive years, Fecon has not completed its business plan.

In 2021, Fecon's profit continued to plummet 47%, to 70.8 billion VND, equivalent to 40.4% of the year's target. This is the 3rd year of the COVID-19 pandemic, so the company's profit decline is understandable.

However, in 2022, Fecon's profit only reached 51.6 billion while the target was up to 280 billion VND, equivalent to completing 18% of the plan this year. In 2023, Fecon lost 42 billion VND, completing -28% of the yearly plan.

In 2024, Fecon set a target of after-tax profit of only 60 billion VND. In the first half of the year, Fecon only achieved 1.4 billion VND in profit, equivalent to only 2.3% of the yearly plan.

Business cash flow is negative 319 billion, debt accounts for a high proportion

A notable point is that Fecon's capital structure is recording a large proportion of debt. Liabilities at the end of the second quarter of 2024 amounted to VND 5,176.8 billion, 1.5 times higher than equity.

Of which, short-term debt alone accounts for VND2,084 billion, long-term debt accounts for VND908.5 billion. Compared to the beginning of the year, the total debt has increased by nearly VND50 billion. These debts, along with interest expenses, are putting great pressure on the company's cash flow.

Specifically, the cash flow statement recorded that Fecon had to spend 103.5 billion VND on interest in the first half of the year, compared to 137.1 billion in the same period. As a result, the company's cash flow from operating activities was negative 319 billion VND.

Meanwhile, net cash flow from investing activities was positive VND 41.7 billion, net cash flow from financing activities was negative VND 51.8 billion.

Source: https://www.congluan.vn/fecon-fcn-cua-chu-tich-pham-viet-khoa-100-dong-von-thu-ve-khong-noi-1-dong-lai-post305977.html

Comment (0)