5 consecutive years of "broken business plan"

FECON Corporation (Code: FCN) is a famous unit in the construction field, but in the last 5 years, FECON has never completed its proposed business plan.

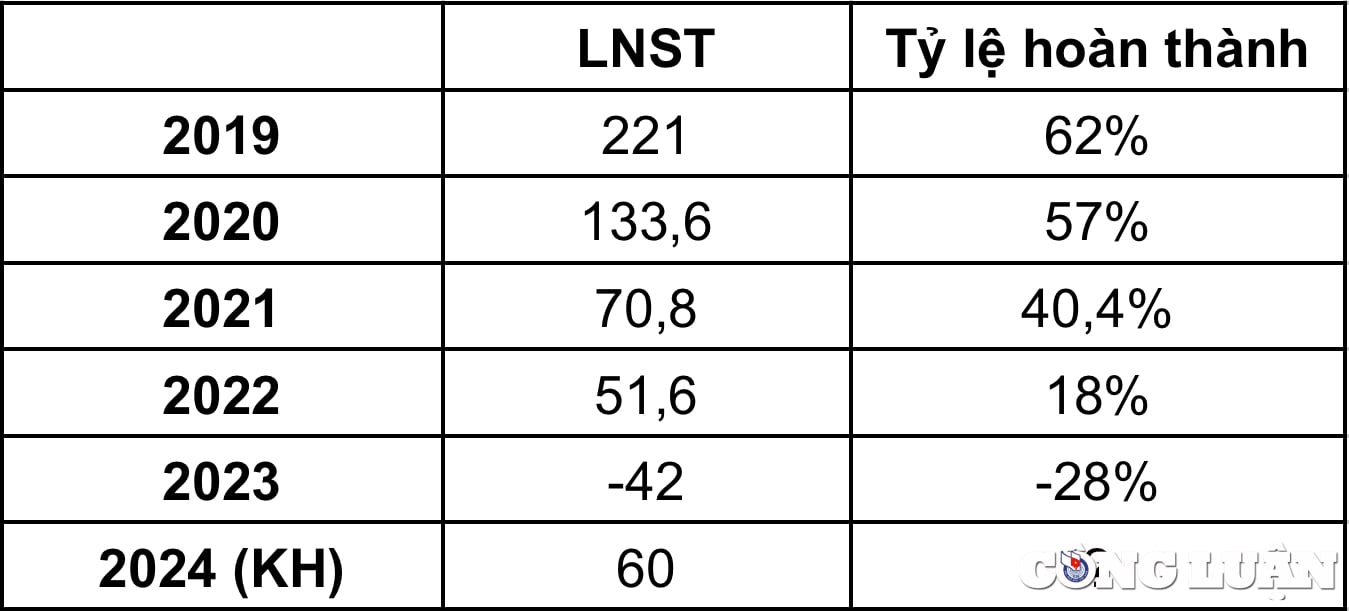

Specifically, in 2019, FECON only achieved a profit of 221 billion VND, completing 62% of the target. In the following year 2020, FECON's profit decreased by 40%, to 133.6 billion VND, equivalent to completing 57% of the plan. In 2021, FECON's profit continued to shrink, decreasing by 47% and only 70.8 billion VND, equivalent to 40.4% of the year's target.

For 5 consecutive years, FECON (FCN) has not completed its plan once.

This is the 3rd year of the COVID-19 pandemic, so it is not too difficult to understand why FECON's profits have continuously decreased. However, the company's business situation is still not better in 2022 and 2023.

In 2022, the company set a profit target of VND 280 billion but only brought in VND 51.6 billion, equivalent to only 18% of the annual target. In 2023, revenue grew to VND 1,890 billion but FECON reported a loss of VND 42 billion and continued to fail to complete the annual plan.

Difficulty competing in the construction sector, profits continue to decline

After 5 consecutive years of declining profits, FECON's business situation is still not improving.

According to the 2024 semi-annual consolidated financial statements, the company's net revenue reached VND1,428 billion. The increase in cost of goods sold caused gross profit to be only VND185 billion, down 25% year-on-year.

Financial revenue increased to 16 billion VND, combined with financial expenses reduced to 85 billion VND, helping to partially recover profits for the business.

FECON (FCN) profit decreased, cash flow negative 316 billion VND (Photo TL)

Selling expenses and administrative expenses accounted for VND10 billion and VND102 billion, respectively. As a result, the company reported a profit after tax of VND1.4 billion, equivalent to completing more than 2% of the yearly plan.

On the other hand, in terms of the main business activities in the construction sector on the separate financial statements, FECON's after-tax profit was only recorded at 4.3 billion VND, down 85% compared to the same period. Explaining this business result, FECON said that due to the competitive business situation, the company had to accept to sign contracts at low prices, causing profits to decline.

FECON negative cash flow of 316 billion VND

At the end of the second quarter of 2024, FECON recorded total assets of VND 8,517 billion, down VND 64 billion compared to the beginning of the year. Of which, the amount of cash decreased by nearly half compared to the beginning of the period, to only VND 370 billion. Meanwhile, the amount of receivables was too large, accounting for VND 3,891 billion.

With such a large amount of receivables while cash has decreased sharply, it is not difficult to understand why FECON is having difficulty maintaining cash flow for business operations.

FECON's cash flow statement shows that the unit's operating cash flow was negative at VND316 billion in the first half of the year, compared to only VND102 billion in the same period. Of which, the negative cash flow from receivables was VND217 billion, followed by interest payable during the period of VND103 billion.

Source: https://www.congluan.vn/fecon-fcn-loi-nhuan-sut-giam-85-dong-tien-am-316-ty-dong-post316310.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)