SJC gold bar price

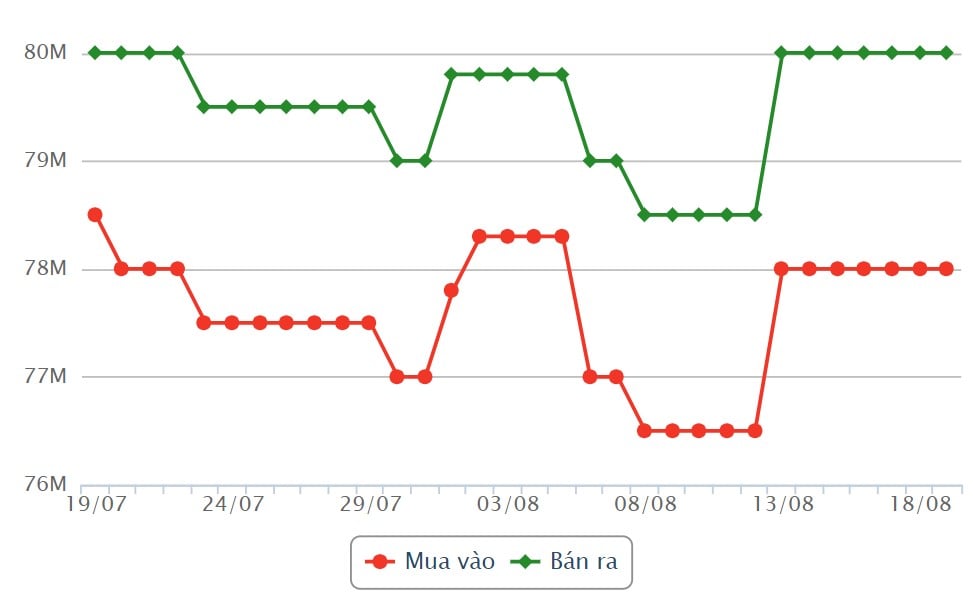

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 78 - 80 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 78 - 80 VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

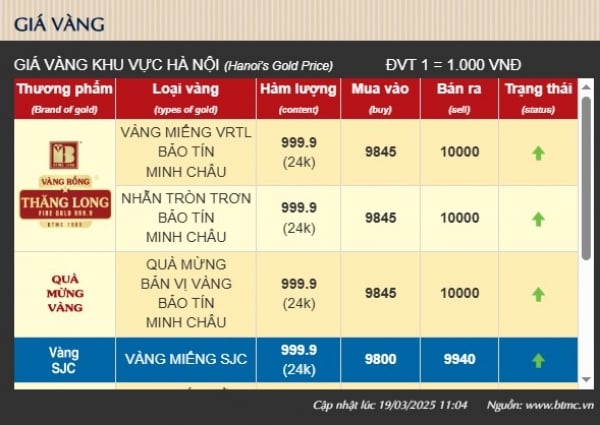

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 76.90-78.20 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 200,000 VND/tael compared to the beginning of the previous trading session.

Saigon Jewelry Company listed the price of gold rings at 76.80 - 78.20 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 76.93-78.23 million VND/tael (buy - sell); down 150,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 9:00 a.m., the world gold price listed on Kitco was at 2,498.7 USD/ounce, down 9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased in the context of the flat USD index. Recorded at 9:00 a.m. on August 19, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 102.310 points (down 0.49%).

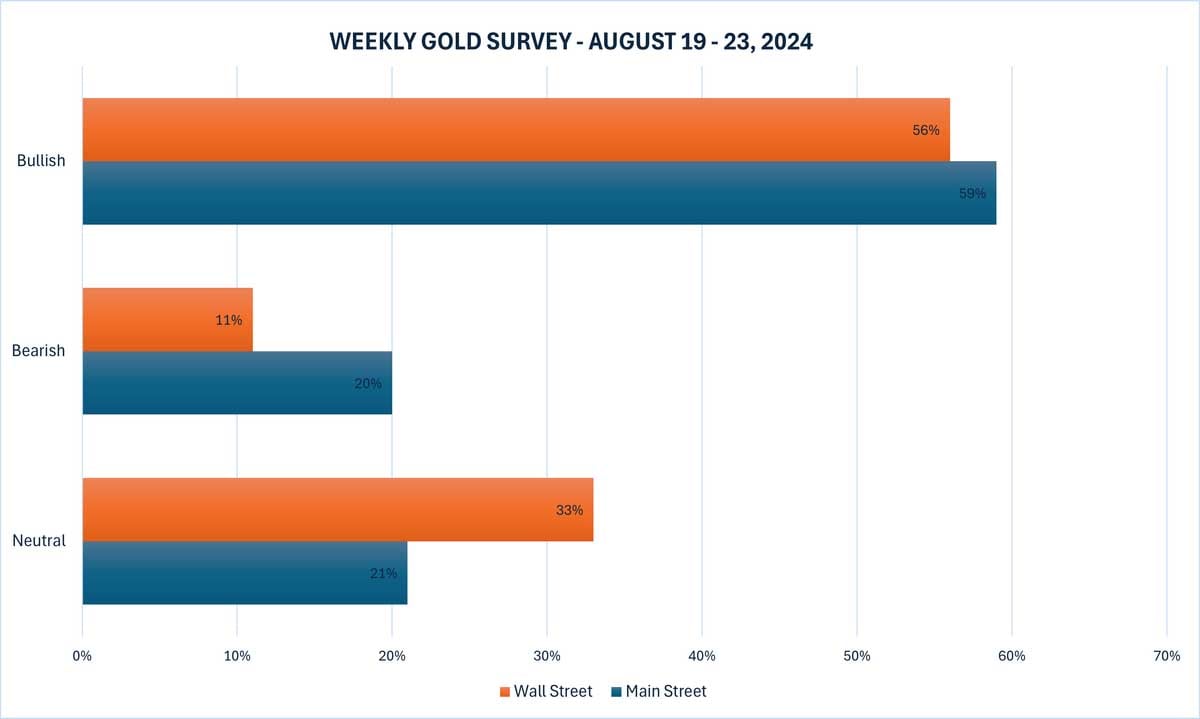

The latest Kitco News weekly gold survey shows that a majority of industry experts and investors believe gold prices could surpass this week’s all-time high.

Nine analysts took part in the Kitco News Gold Survey, with the majority still seeing upside potential beyond all-time highs.

Five experts expect gold prices to rise, while three analysts see it moving sideways this week. Only one predicts the price of the precious metal will fall.

219 votes were cast in Kitco’s online poll. 130 traders expect gold prices to rise this week. Another 44 expect the precious metal to fall. Meanwhile, 45 respondents said prices are likely to trend sideways this week.

Experts say the factor driving the recent increase in gold prices is strong demand for safe havens as political and economic concerns are increasing.

Mark Leibovit, publisher of VR Metals/Resource Letter, said there is no reason to doubt that precious metals could rise this week.

Michael Moor, founder of Moor Analytics, sees further upside potential if gold can hold above $2,500 an ounce. Kitco senior analyst Jim Wyckoff also sees the technical picture favoring further gains this week.

RJO Futures senior commodities broker Bob Haberkorn said that the world gold price will reach the $ 2,600 / ounce mark when the US Federal Reserve (FED) cuts interest rates. However, in the short term, the price of this precious metal will go sideways or decrease.

According to Haberkorn, the market may have anticipated the Fed's 50 basis point cut too early. He said the US central bank may not rush to cut at the upcoming meeting because although inflation has fallen a bit, it is still higher than the Fed's target level.

Haberkorn asserted that the gold market is in an uptrend. However, the $2,500/ounce level that was just broken is a high level and it is difficult to attract new buyers to the market at such high levels.

Meanwhile, Anuj Gupta - Head of Commodities and Currencies at HDFC Securities, said that the upward trend of gold prices is still there and the direction of the precious metal will depend on the policy direction of the FED.

He said that the speech of FED Chairman Jerome Powell at the Jackson Hole Symposium next week will give a clearer picture of the US Central Bank's policy path.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-198-dot-ngot-sut-giam-co-dang-lo-1381574.ldo

Comment (0)