USD/VND exchange rate today September 3, 2024 in the domestic market

USD exchange rate today September 3, 2024, USD VCB is flat, meanwhile, USD Index (DXY) is rising to 101.75 points.

The central VND/USD exchange rate today (September 3) was announced by the State Bank of Vietnam (SBV) at 24,221 VND/USD, unchanged from the trading session on September 2.

Currently, the permitted exchange rate of commercial banks fluctuates from 23,400 - 25,450 VND/USD. The USD exchange rate has also been brought to the buying and selling range of 23,400 to 25,450 VND/USD by the State Bank of Vietnam.

The bank USD exchange rate, foreign exchange rate and domestic USD price recorded stable at banks this morning. Specifically, Vietcombank has a buying price of 24,660 and a selling price of 25,030, unchanged in the buying price compared to the selling price compared to the trading session on September 2. The current USD buying and selling prices are in the range of 24,000 - 25,500 VND/USD.

| 1. VCB – Updated: 09/03/2024 05:26 – Time of the source website | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| AUSTRALIAN DOLLAR | AUD | 16,476.93 | 16,643.36 | 17,191.71 |

| CANADIAN DOLLAR | CAD | 17,972.86 | 18,154.40 | 18,752.53 |

| SWISS FRANC | CHF | 28,552.73 | 28,841.14 | 29,791.36 |

| YUAN RENMINBI | CNY | 3,431.90 | 3,466.56 | 3,581.31 |

| DANISH KRONE | DKK | – | 3,624.00 | 3,765.93 |

| EURO | EUR | 26,832.82 | 27,103.86 | 28,327.84 |

| Sterling Pound | GBP | 31,917.54 | 32,239.94 | 33,302.15 |

| HONGKONG DOLLAR | HKD | 3,106.12 | 3,137.50 | 3,240.87 |

| INDIAN RUPEE | INR | – | 295.45 | 307.52 |

| YEN | JPY | 166.07 | 167.74 | 175.91 |

| Korean Won | KRW | 16.11 | 17.90 | 19.55 |

| KUWAITIAN DINAR | KWD | – | 81,167.50 | 84,483.28 |

| MALAYSIAN RINGGIT | MYR | – | 5,690.78 | 5,819.77 |

| NORWEGIAN KRONER | NOK | – | 2,312.56 | 2,412.76 |

| RUSSIAN RUBLE | RUB | – | 258.81 | 286.74 |

| SAUDI RIAL | SAR | – | 6,604.07 | 6,873.85 |

| SWEDISH KRONA | SEK | – | 2,377.63 | 2,480.66 |

| SINGAPORE DOLLAR | SGD | 18,595.23 | 18,783.06 | 19,401.90 |

| THAILAND | THB | 648.89 | 720.99 | 749.22 |

| US DOLLAR | USD | 24,660.00 | 24,690.00 | 25,030.00 |

| 2. Agribank – Updated: 01/01/1970 08:00 – Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 24,700.00 | 24,710.00 | 25,050.00 |

| EUR | EUR | 27,024.00 | 27,133.00 | 28,258.00 |

| GBP | GBP | 32,139.00 | 32,268.00 | 33,263.00 |

| HKD | HKD | 3,126.00 | 3,139.00 | 3,244.00 |

| CHF | CHF | 28,808.00 | 28,924.00 | 29,825.00 |

| JPY | JPY | 167.38 | 168.05 | 175.81 |

| AUD | AUD | 16,597.00 | 16,664.00 | 17,177.00 |

| SGD | SGD | 18,752.00 | 18,827.00 | 19,382.00 |

| THB | THB | 713.00 | 716.00 | 748.00 |

| CAD | CAD | 18,104.00 | 18,177.00 | 18,730.00 |

| NZD | NZD | 15,351.00 | 15,863.00 | |

| KRW | KRW | 17.86 | 19.71 | |

| 3. Sacombank – Updated: 04/25/2002 07:16 – Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 24710 | 24710 | 25050 |

| AUD | AUD | 16733 | 16783 | 17285 |

| CAD | CAD | 18255 | 18305 | 18756 |

| CHF | CHF | 29082 | 29132 | 29686 |

| CNY | CNY | 0 | 3474.7 | 0 |

| CZK | CZK | 0 | 1060 | 0 |

| DKK | DKK | 0 | 3713 | 0 |

| EUR | EUR | 27321 | 27371 | 28074 |

| GBP | GBP | 32561 | 32611 | 33263 |

| HKD | HKD | 0 | 3185 | 0 |

| JPY | JPY | 169.55 | 170.05 | 175.56 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 18.3 | 0 |

| LAK | LAK | 0 | 0.993 | 0 |

| MYR | MYR | 0 | 5887 | 0 |

| NOK | NOK | 0 | 2368 | 0 |

| NZD | NZD | 0 | 15375 | 0 |

| PHP | PHP | 0 | 410 | 0 |

| SEK | SEK | 0 | 2440 | 0 |

| SGD | SGD | 18900 | 18950 | 19501 |

| THB | THB | 0 | 692.9 | 0 |

| TWD | TWD | 0 | 772 | 0 |

| XAU | XAU | 8000000 | 8000000 | 8100000 |

| XBJ | XBJ | 7300000 | 7300000 | 7620000 |

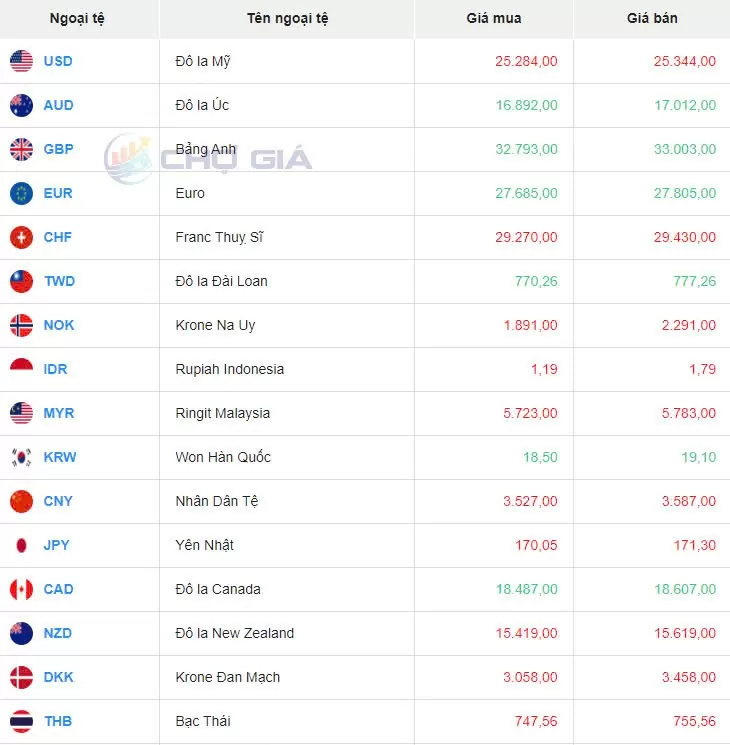

In the "black market", the black market USD exchange rate as of 5:30 a.m. on September 3, 2024 is as follows:

|

| Black market on September 3, 2024. Photo: Chogia.vn |

USD exchange rate today September 3, 2024 on the world market

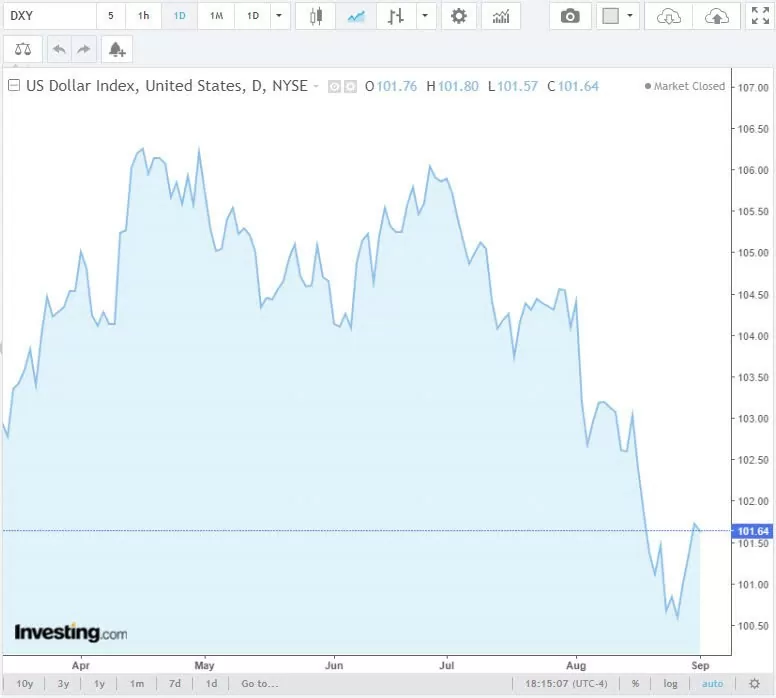

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 101.64 points, down 0.11 points compared to the transaction on September 2, 2024.

|

| USD (DXY) exchange rate developments in recent days (Source: Investing) |

The US dollar edged lower on Tuesday but remained near a near two-week high as investors focused on the US jobs report due later this week.

US payrolls, due for release on Friday, will be crucial after Federal Reserve Chairman Jerome Powell shifted from fighting inflation to being ready to guard against job losses.

Analysts say the jobs data will determine the extent of the Federal Reserve's expected interest rate cut. Markets have priced in a 25 basis point cut for weeks.

The greenback earlier rose the most since Aug. 20, supported by a rise in long-term Treasury yields to their highest since mid-August as inflation data pointed to smaller rate cuts.

US gross domestic product data also showed that the economy is on solid enough footing that the Federal Reserve can ease policy less aggressively.

Traders now see a 33% chance of the Fed cutting rates by 50 basis points this month, while fully pricing in a 0.25 basis point cut. A week ago, expectations were 36% for a larger cut.

“ Everyone is focused on economic data today. We expect the dollar to weaken in the second half of the year, but the market should not get too excited about it, ” said Athanasios Vamvakidis, global head of foreign exchange strategy at BofA. “ The U.S. economy is slowing but it is still doing much better than the rest of the world, ” he added, targeting the euro at $1.12.

The dollar index against six major currencies fell 0.08% to 101.67, after hitting 101.79, a level not seen since August 20.

Last week, the rate fell to a low of 100.51 for the first time since July 2023 after Fed Chairman Powell sent a strong message that the easing campaign would begin at the upcoming policy meeting.

The euro rose 0.2% to $1.1060 after touching $1.1043, its lowest since Aug. 19.

On the political front in Europe, the Alternative for Germany party is on track to become the first far-right party to win a regional election in Germany since World War II, according to predictions, giving it unprecedented power even as other parties are certain to oust it from office.

|

| USD exchange rate on September 3, 2024. |

| Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop – No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts – No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Jewelry Store – No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company – No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store – No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones – No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store – No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store – No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store – No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange – 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop – 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop – 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center – 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store – Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop – No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop – No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop – No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Comment (0)