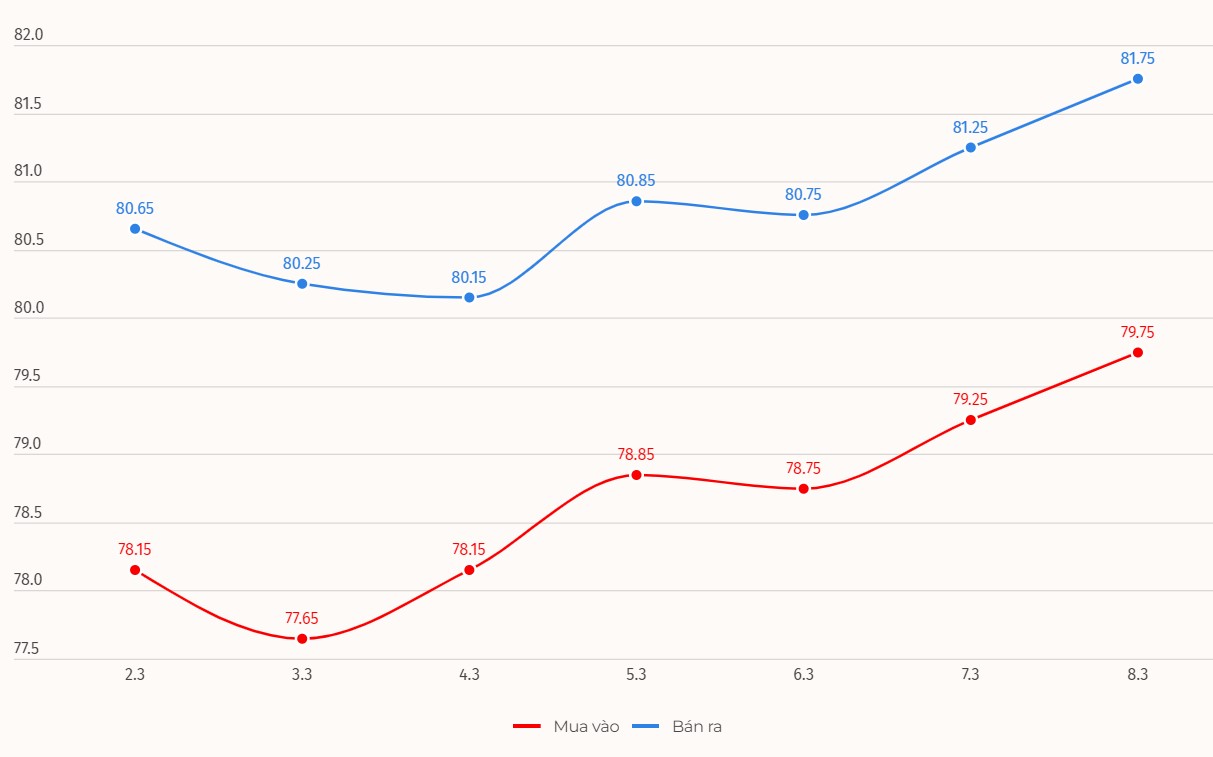

The domestic gold price opened this morning's trading session at 79.75 - 81.75 million VND/tael (buy - sell) listed by DOJI Group. The difference between the buying and selling price of SJC gold at DOJI is listed at 2 million VND/tael.

Compared to the opening of the previous trading session, the gold price at DOJI Group increased by 500,000 VND/tael for both buying and selling.

Meanwhile, at Bao Tin Minh Chau, SJC gold price is listed at 79.85-81.75 million VND/tael (buy - sell). The difference between buying and selling price of SJC gold is 1.9 million VND/tael.

Compared to the opening of the previous trading session, gold price at Bao Tin Minh Chau increased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling SJC gold is currently listed at a high level. This puts investors at risk of losing money when buying gold.

For gold rings, the price of plain round gold rings is listed by Bao Tin Minh Chau, the price of plain round gold rings 9999 is at 67.78-68.98 million VND/tael (buy in - sell out). Compared to the opening of the previous trading session, the price of gold rings is adjusted by Bao Tin Minh Chau to increase by 150,000 VND/tael for both buying and selling.

Saigon Jewelry is listed at 67 million VND/tael for buying and 68.35 million VND/tael for selling.

Phu Nhuan Jewelry (PNJ) listed at 66.9-68.2 million VND/tael (buy - sell).

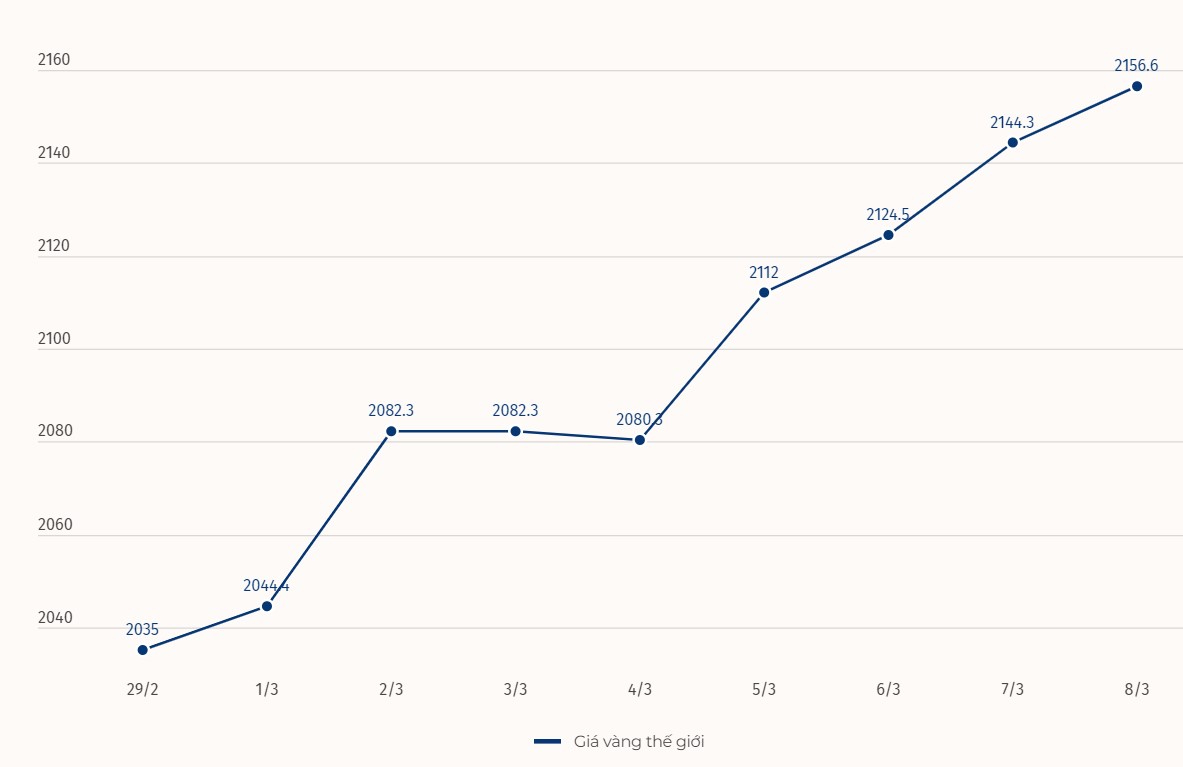

World gold price opened this morning's trading session listed on Kitco at 2,156.6 USD/ounce.

Gold Price Forecast

World gold prices are listed at a high level in the context of the USD index moving sideways. Recorded at 9:00 a.m. on March 8, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 102.785 points.

Gold prices extended their gains as comments from US Federal Reserve Chairman Jerome Powell at a congressional hearing reinforced expectations for monetary policy easing this year.

At the hearing, Mr. Powell said that interest rates could be cut this year if the economy does not perform as expected and there is more evidence of a sustained decline in inflation. The Fed Chairman also emphasized that it will not be long before inflation moves toward the 2% target.

Traders are pricing in a 72% chance of a rate cut in June, compared with about 63% on Feb. 29, according to CME's Fedwatch tool.

Source

Comment (0)