Favorable macroeconomic conditions and progressive regulatory changes will be supportive factors for IPOs in the coming period.

Favorable macroeconomic conditions and progressive regulatory changes will be supportive factors for IPOs in the coming period.

Deloitte's Southeast Asia IPO Report 2024 has updated the figures after a quiet year in the capital markets last year.

Deloitte said that in 2024, there were 136 IPOs in the Southeast Asian market, raising $3.7 billion in capital and reaching a market capitalization of $19.1 billion in 2024.

The Southeast Asian IPO market remains subdued in 2024, with the total number of IPOs falling from 163 in 2023 to 136 this year. As a result, the total amount raised from IPOs will fall by 36% and the total IPO market capitalization will fall by 54%.

The IPO market has experienced two consecutive years of declines in both total funds raised and overall market capitalization. In addition, the average amount raised per IPO has been steadily declining since 2021, reflecting a difficult environment for public offerings.

While the number of IPOs remained positive, the total amount raised was the lowest in nine years, down from the $5.8 billion raised from 163 IPOs in 2023.

The region saw a decline in IPO activity compared to the previous year, largely due to a lack of large-scale listings. In 2024, there was only one IPO raising over $500 million, compared to four such listings in 2023.

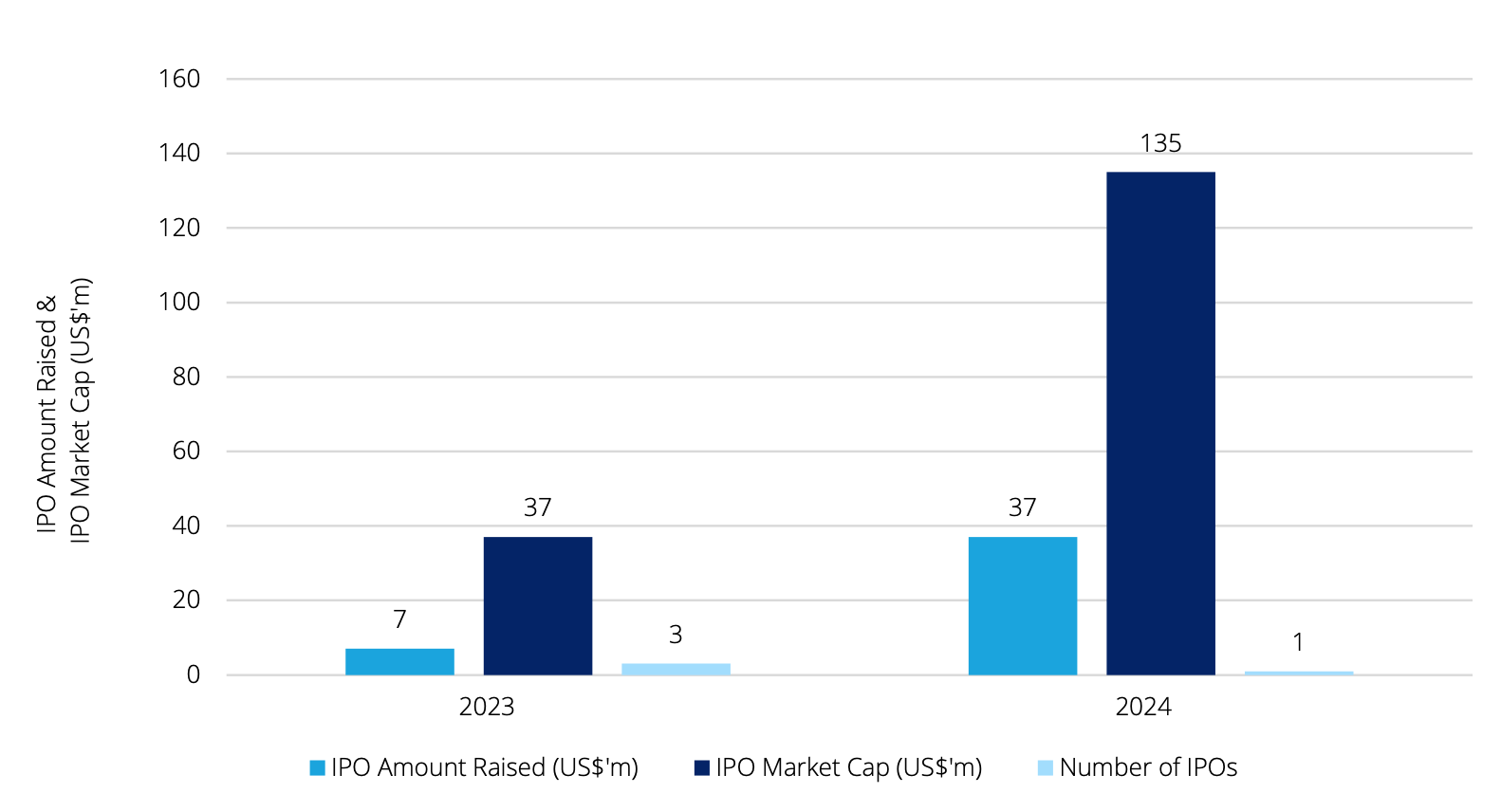

Malaysia has emerged as a bright spot in Southeast Asia, leading the region in both the number of IPOs and the total amount of capital raised. Vietnam, meanwhile, has only had one IPO listed in 2024, DNSE, which raised about $37 million.

In the Vietnamese market, the average IPO raised from 2021 to 2023 was only $7.09 million. The last time Vietnam recorded a deal worth more than $30 million was in 2019 (Viglacera – raised $68 million). The only IPO in 2024, which was also Vietnam’s first in the FinTech sector, surpassed Vietnam’s market performance for the entire year of 2023 and was about five times the average capital raised from an IPO in the 2021-2023 period.

|

| IPO situation in Vietnam in the period 2023 - 2024. Source: Deloitte |

The Deloitte report also mentioned that, in addition to the traditional path of IPO to be listed on the stock exchange, Vietnamese companies also follow an atypical but popular path of IPO through the normal offering method. In this direction, companies must first have their application to become a public company approved by the State Securities Commission, then register to trade on a secondary exchange supervised by HNX, i.e. Upcom. After 2 years, these public companies can apply to list on one of the two main exchanges, HSX and HNX, according to the Securities Law No. 54/2019/QH14.

Mr. Bui Van Trinh, Deputy General Director of Deloitte Vietnam “Despite the challenges facing the Vietnamese economy in 2024, it is still considered a good time for both existing and potential investors to enter the market. This expectation is supported not only by favorable macroeconomic conditions including controlled inflation and low interest rates, but also by progressive legal changes to attract more foreign investment and further integration into the global economy. The general view is that the most positive times are still ahead,” said Mr.

In the market, IPO plans are also being actively implemented in 2025.

For example, Masan Group's plan to list Masan Consumer Goods JSC (MCH) shares on the HoSE in 2025, the policy of issuing shares to the public and listing two subsidiaries of Hoa Sen Group, Hoa Sen Steel Pipe JSC and Hoa Sen Plastic JSC on the stock market. Previously, at the 2024 Annual General Meeting of Shareholders, the Chairman of the Board of Directors of Hoang Anh Gia Lai JSC also revealed the IPO and listing plan of Gia Lai Livestock JSC....

Or Vinpearl JSC - a subsidiary of Vingroup Corporation (VIC) is also getting closer to its plan to return to the stock exchange after completing its public company status in November 2024.

Source: https://baodautu.vn/da-den-thoi-diem-tot-nhat-cho-cac-thuong-vu-ipo-d245063.html

Comment (0)