After a few minutes of opening in green, the market quickly fell below the reference under the adjustment pressure of many bank stocks and increased selling.

The highlight was the steel group when HPG increased by 1.1% and was the strongest net buy of foreign investors in the whole market in the morning session. The codes NKG, POM, HSG, VGS, VCA and NSH all traded positively. Meanwhile, the stocks of the large-cap group were strongly differentiated, most of them only increased and decreased with low amplitude. Except for MSN, which increased by 3.4% to 73,200 VND and was the code that contributed most positively to the VN-Index.

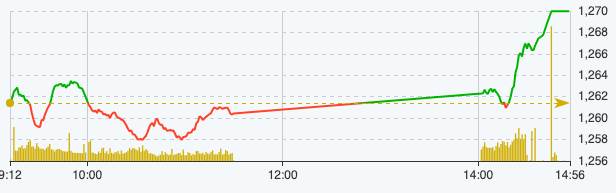

At the end of the morning session on March 5, VN-Index decreased by 0.97 points, equivalent to 0.08% to 1,260.44 points. The entire floor had 169 stocks increasing and 285 stocks decreasing. HNX-Index decreased by 0.79 points to 236.59 points. UPCoM-Index increased by 0.22 points to 91.34 points.

VN-Index performance on March 5 (Source: FireAnt).

Entering the afternoon session, thanks to the reversal from a series of securities stocks along with the positivity of the steel group, the market rebounded towards the end of the session, with the VN-Index approaching the 1,270 point mark.

At the end of the trading session on March 5, VN-Index increased by 8.57 points, equivalent to 0.68% to 1,269.98 points. The entire floor had 258 stocks increasing, 212 stocks decreasing, and 80 stocks remaining unchanged.

HNX-Index decreased 0.03 points to 237.35 points. The entire floor had 74 stocks increasing, 83 stocks decreasing and 82 stocks remaining unchanged. UPCoM-Index increased 0.65 points to 91.78 points. In the VN30 basket alone, 20 stocks increased in price.

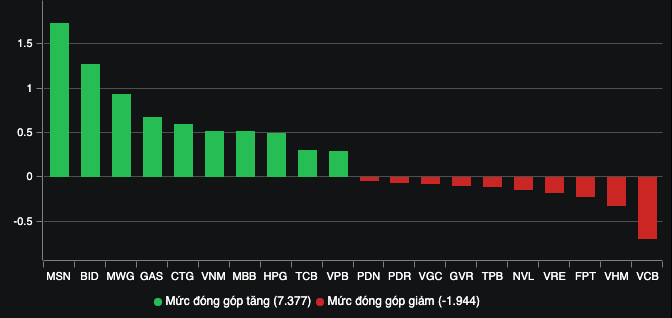

The main driver of the market today came from MSN, which climbed to its highest level in the past 5 months, increasing by 6.92% to VND75,600/share. This was also the session with the highest liquidity since listing with nearly 13 million units.

The reversal from the stock group also contributed to supporting the market, notably CTS increased to the ceiling price of 35,300 VND/share - the highest price since January 2022. The codes SSI, VIX, VND, SHS, VCI, MBS, AGR, FTS, BSI, ... also increased positively.

Banking stocks also gradually increased towards the end of the session, notably the four codes BID, CTG, MBB, TCB, contributing a total of 2.7 points to the general market. In the steel group, POM ended the session in purple, the big HPG increased by more than 1%, HSG and NKG ended the session slightly up.

Stocks that move the market.

The total value of orders matched in today's session was VND26,629 billion, down 16%, of which the value of orders matched on the HoSE floor reached VND24,356 billion, down 15%. In the VN30 group, liquidity reached VND10,218 billion.

Foreign investors returned to net selling with a value of 102 billion VND today, of which this group disbursed 2,286 billion VND and sold 2,389 billion VND.

The codes that were sold strongly were FUEVFVND fund 163 billion VND, SSI 136 billion VND, VHM 125 billion VND, TDM 61 billion VND, VNM 39 billion VND,... On the contrary, the codes that were mainly bought were MWG 212 billion VND, MSN 114 billion VND, STB 99 billion VND, CTD 51 billion VND, DGC 48 billion VND,... .

Source

Comment (0)