DC1, a subsidiary of DIC Corp (DIG), was charged with over 500 million VND in back taxes.

Recently, the Tax Department of Ba Ria - Vung Tau province issued a decision to collect additional taxes from Construction Development Investment Joint Stock Company No. 1 (UPCoM code: DC1) due to a number of violations related to the declaration of Value Added Tax (VAT), Corporate Income Tax (CIT), and Personal Income Tax (PIT).

According to the Ba Ria - Vung Tau Provincial Tax Department, DC1 under-declared the amount of tax payable for all three types of taxes according to the tax inspection records from 2015 to 2017. However, these violations were not administratively sanctioned because the penalty period had expired.

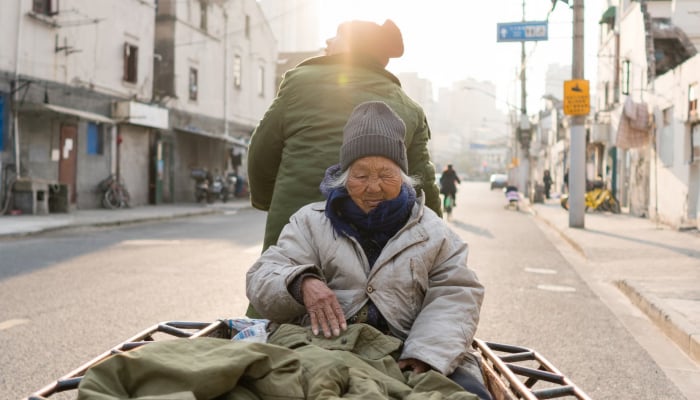

DIC Corp's subsidiary (DIG) was charged with over 500 million VND in back taxes (Photo TL)

Instead, DC1 was charged and had to pay late tax. Specifically, DC1 had to pay the outstanding VAT, CIT and PIT of VND 273.7 million. The late tax payment was VND 250.36 million. Thus, the total amount that DC1 had to pay was more than VND 524 million.

Construction Development Investment Joint Stock Company No. 1 is a subsidiary of DIC Corp. According to the 2022 financial statements, DIC Corp currently holds a 51.67% ownership ratio at DC1, equivalent to 2.12 million shares.

Revenue increased but profit decreased due to unoptimized costs

According to the 2022 financial report, DC1 recorded net revenue of VND 256.9 billion, 1.68 times higher than in 2021. Of which, cost of goods sold accounted for an extremely high proportion, up to VND 243.5 billion.

The high cost of goods sold reduced the company's gross profit to only VND13.4 billion, the gross profit margin decreased from 9.1% to only 5.2%. Financial revenue during the period was almost non-existent, just over VND5 million.

Meanwhile, most of the expenses have increased, including: financial expenses doubled from 1.7 billion VND to 3.5 billion VND. Business management expenses increased from 7.8 billion VND to 8.3 billion VND, corresponding to an increase of 6.4%.

The total profit after tax that DC1 brought in after deducting all expenses was only 2.4 billion VND, down more than half compared to the same period last year. Thus, it can be seen that despite the growth in revenue, the high cost of goods sold and other expenses incurred during the period have put pressure on DC1's business results in 2022.

Assets are mostly debt, cash flow is deeply negative at 35.4 billion VND

At the end of 2022, DC1's total assets were recorded at VND 189.2 billion, an increase of more than VND 35 billion compared to the beginning of the year. It is worth noting that most of the assets are in the form of short-term assets and have low flexibility.

Specifically, cash and cash equivalents are only 61 million VND, while at the beginning of the year it was still recorded at 2.5 billion VND. In addition, DC1 no longer records any additional deposits in the bank. This shows that the company is seriously short of cash.

In addition, short-term receivables increased sharply, especially short-term receivables from customers, accounting for VND100.7 billion, while at the beginning of the year it was only VND50.6 billion. This amount of receivables is equivalent to 53.2% of total assets. This means that more than half of DC1's assets are on paper and have not actually been collected from customers.

In addition, the company still has to record an additional provision for bad debt risks of up to 2.6 billion VND. The company's inventory is also recorded at 65.7 billion VND.

Regarding capital structure, DC1's short-term loans in 2022 tend to increase from VND 54.5 billion to VND 93.1 billion. Corresponding to an increase of up to 70.8%. This short-term debt is even 1.8 times higher than DC1's current equity.

Debt increased during the period, so it is not too difficult to understand that DC1's cash flow from business activities also recorded a negative of 35.4 billion VND, showing that the company is lacking a large amount of money to serve production and business activities. This is completely consistent with the record of the remaining cash amount of just over 61 million VND that we mentioned above.

Source

Comment (0)