On the evening of July 1, the Vietnam Bank for Industry and Trade (BVBank) announced that by the end of the day, more than 30% of BVBank's customers had conducted biometric authentication for convenient transactions. The remaining customers are still installing and updating biometric data.

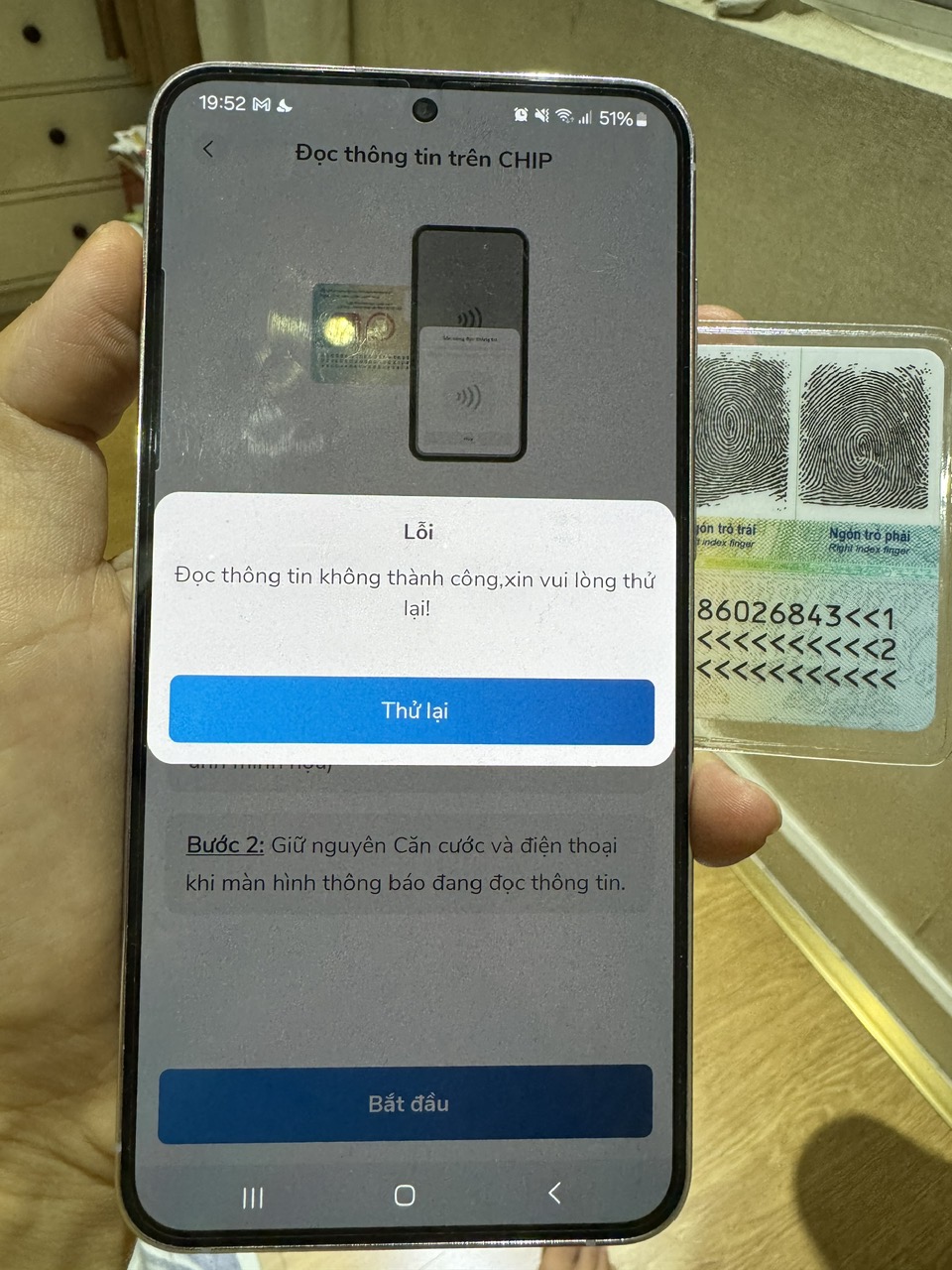

"During the installation process, customers who need to change their identification information can video call the 24/7 support department to receive support in converting information and starting biometric installation. For other difficulties in scanning NFC, customers can go to transaction points for support" - BVBank representative informed.

On the first day the banking industry applied the State Bank's new regulation requiring biometric authentication for some online transactions such as money transfers by individual customers from VND10 million or total transaction value in a day exceeding VND20 million, some problems arose.

On the evening of July 1, some customers said they were still updating their biometric data. The nature of authentication is to check that the account holder's information matches the information on the CCCD or in the national population database, eliminating fake, illegitimate, and illegal accounts.

Common problems are that the data on the chip-embedded CCCD does not match the customer's previous account opening information; the customer's phone cannot read the CCCD chip information via NFC... Even some customers using the latest phones such as Iphone 15 also reported that they have not been able to update their biometric data.

According to banks, some glitches are inevitable in the first few days of implementing the new regulations.

However, surprisingly, statistics show that on July 1, the percentage of transactions with a value of over VND10 million accounted for 8.8% of the total transaction value of the day. This figure is higher than the average of June (at 8%), but it is not too high. Transactions over VND10 million that encountered difficulties or problems were not many compared to the total transaction value of the system in the day.

Previously, data from the State Bank showed that about 70% of the number of payment transactions of individual customers in Vietnam had a value of less than 1 million VND. Transactions over 10 million VND accounted for only about 11% of the total number of transactions, and the number of people with transactions over 20 million VND/day was also less than 1%. Therefore, biometric authentication does not greatly affect users' transactions and payments.

According to statistics, by the end of 2023, the Ministry of Public Security has issued more than 84.7 million chip-embedded ID cards and 70.2 million VneID accounts. This is an important source of input data, helping the banking industry to accurately identify and verify customers.

"In the coming time, when the Ministry of Public Security provides electronic identification and authentication services, banks will deploy the integration of Mobile Banking and Internet Banking applications with the electronic identification and authentication system. From there, customers will be allowed to register biometric information through electronic identification accounts issued by the Ministry of Public Security" - a representative of the State Bank informed.

Source: https://nld.com.vn/con-so-bat-ngo-trong-ngay-dau-xac-thuc-sinh-trac-hoc-de-chuyen-tien-196240701202700598.htm

Comment (0)