Quick and easy links, reducing workload

Thanks to the development of technology, even the search operation is now significantly reduced by the widget feature - allowing the direct display of frequently used applications right on the phone's main screen. For the PVConnect application, customers can set up a "mini digital bank" right on the screen, with QR codes or information fields "Money Transfer" and "QR Scan" - which are transactions used frequently every day.

Although it is just a small detail on mobile devices, PVcomBank applies PVConnect to "touch" the actual experience of users.

“Previously, I used to group many applications with the same theme into one section. Although it made the phone screen smaller, it was a bit inconvenient when searching. Since the iPhone has the widget feature, with just “one touch”, I can quickly connect to PVConnect or other applications such as weather, calendar…”, said Mr. Thai, a customer of PVcomBank.

Money transfer has become a regular, daily transaction and users want to be able to do this anytime, anywhere. Understanding this need, PVcomBank has provided a money transfer utility via Zalo channel, helping customers easily transfer money while chatting. From the bank account number on the chat window, users can transfer money via the PVConnect application with just a few simple steps: enter the amount and message; confirm to complete the transaction. All customer information is secured by PVcomBank and Zalo thanks to the modern technology system and authentication layers on PVConnect.

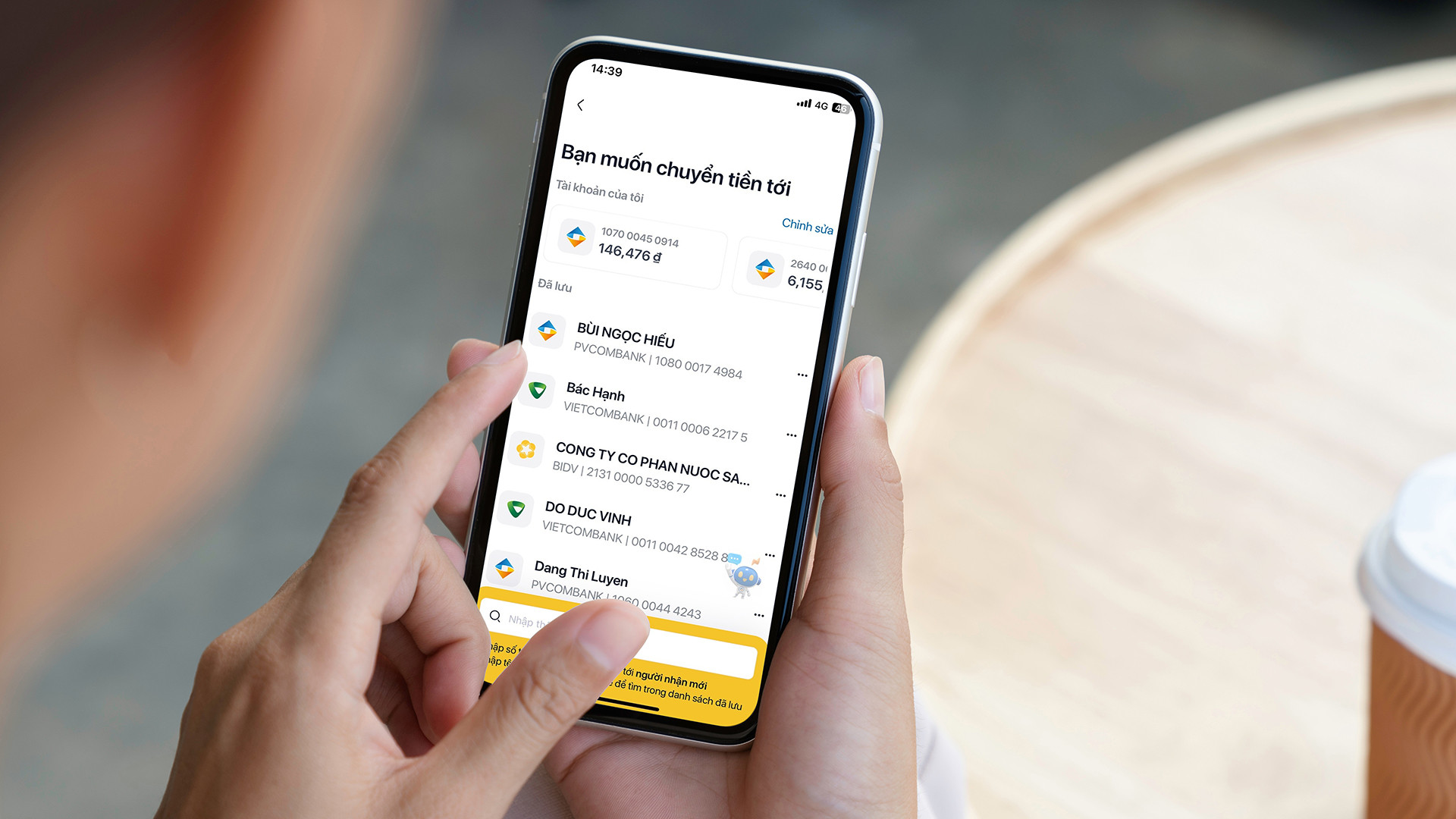

Smart suggestions, save search time

In order to optimize the search utility for customers when making money transfers, PVcomBank now allows users to quickly search for the beneficiary's account information by typing keywords related to the recipient's name, payment account number (TKTT) or phone number. PVConnect will automatically suggest suitable bank account numbers to customers, including account numbers saved in the beneficiary list or most recently transferred money.

Sharing about the "smart" utility of PVConnect, Ms. Nga (Ba Dinh, Hanoi ) said: "Instead of having to slide the toolbar to find the recipient's name, now I just need to enter 1 or 2 characters according to the name saved in the beneficiary's contact list or by phone number to find the information. PVConnect also automatically suggests suitable banks and account numbers for transactions, which is very convenient. The feature of displaying the most recently transferred account number is also convenient when needing to transfer multiple times to the same person."

Unique QR code for each transaction

As e-commerce grows, QR code payments are becoming more and more popular. On the PVConnect application, customers can create their own detailed QR codes for each transaction with separate amounts and contents, helping the sender to simply scan the code to complete the payment instead of manually entering the account number and amount, avoiding errors.

At many retail stores, this feature has helped reduce time and payment operations for buyers, while store owners can manage finances more effectively, limit mistakes like when using cash and avoid the risk of transaction fraud.

According to a representative of PVcomBank, using cashless payment methods not only helps users feel more convenient and safer, but also helps them manage their finances better and take advantage of the benefits of the digital payment ecosystem. The simultaneous development of many money transfer methods in particular and the increasingly diverse digital ecosystem with more than 200 utilities on PVConnect in general is one of PVcomBank's goals to personalize the customer experience.

“Today, phones are not just for listening, calling, texting or accessing social networks, but have also become a multi-purpose device with full smart features and utilities. In the financial sector, users always want to use a convenient, flexible platform that can fully meet personal transaction needs. Therefore, PVcomBank is constantly upgrading, perfecting, and developing new features, utilities, and services on the PVConnect ecosystem to optimize customer experience, help users manage personal finances safely and effectively, and at the same time build a modern, friendly mobile bank with comprehensive financial solutions,” emphasized a PVcomBank representative.

To meet the increasing demands for security and safety in online transactions, PVcomBank customers can update biometric identification information using chip-embedded citizen identification cards right on the PVConnect application. This is also a mandatory requirement to ensure the safety of online transactions according to Decision 2345 of the State Bank. At the same time, PVcomBank also combines transaction authentication using Smart OTP, minimizing risks for customers' financial transactions, especially large-value transactions.

Dinh Son

Source: https://vietnamnet.vn/pvcombank-da-dang-cac-phuong-thuc-chuyen-tien-tren-pvconnect-2326512.html

Comment (0)