Liquidity improves, HBC is still "locked on the floor"

While some stocks have been successfully rescued and even hit the ceiling (like QCG), Hoa Binh Construction's HBC stock is still under strong selling pressure.

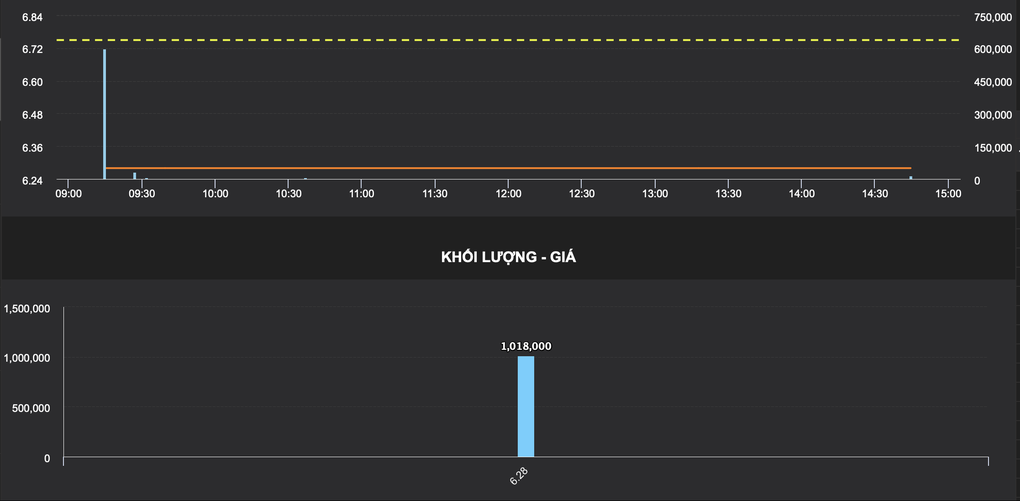

During today's trading session (July 30), this stock could not escape the floor price and was still stuck at 6,280 VND due to a large floor sell volume. HBC's total session order matching reached more than 1 million units, a strong improvement compared to previous sessions, but the floor sell volume was still up to 8.47 million shares.

The stock code of the company chaired by Mr. Le Viet Hai has had 4 consecutive sessions of decline, including 2 sessions hitting the floor after the news of being forced to delist by HoSE. In 1 week, HBC's market value decreased by 12.29% and decreased by 18.23% compared to the beginning of July.

Transactions at HBC in the session of July 30 (Source: VDSC).

The transfer is expected to be completed in August. HoSE delisted HBC shares due to Hoa Binh's total accumulated loss as of December 31, 2023 of VND 3,240 billion, exceeding its actual contributed charter capital of VND 2,741 billion.

In Hoa Binh's 2023 annual report, Mr. Le Viet Hai, as the head, "sincerely accepted responsibility for not developing Hoa Binh in 2023 according to the group's set goals and plans".

Mr. Hai also mentioned an unwanted story in 2023 - the "civil war" in the Board of Directors that took place on the day before Lunar New Year - when he originally intended to step back but had to return to the position of Chairman of the Board of Directors to steer the group.

Regarding the issue after delisting, in the information posted on the group's website, Hoa Binh said that it is expected that nearly 347.2 million HBC shares will be transferred from HoSE to UPCoM under the Hanoi Stock Exchange (HNX) to ensure the trading rights of shareholders.

The company emphasized that the move to UPCoM does not affect the basic rights and interests of shareholders. At the same time, it affirmed that after a period of many events, Hoa Binh is gradually improving its financial indicators, pledging that in the next 2 years, HBC shares will grow well and soon be relisted on the HoSE.

Flash crash at the end of the session

The stock market today was a struggle in the morning session and suddenly adjusted in the afternoon session, making many investors' hearts stop. The "flash sale" (lightning decrease) caused the VN-Index to dip below the 1,240 point threshold at times, but it was not enough to stimulate cash flow.

At the end of the session, the HoSE index only slightly decreased by 1.54 points, equivalent to 0.12%, to 1,245.06 points; HNX-Index decreased by 1.65 points, equivalent to 0.69%, and UPCoM-Index decreased by 0.22 points, equivalent to 0.23%. The entire market had 524 stocks decreasing, 28 stocks hitting the floor compared to 331 stocks increasing, 23 stocks hitting the ceiling.

Low liquidity, reaching 653.07 million shares on HoSE, equivalent to VND13,739.01 billion, and 54.23 million shares, equivalent to VND985.26 billion, on HNX. UPCoM had 32.8 million shares traded, equivalent to VND510.65 billion.

The food industry today witnessed a successful rescue operation with HNG stock. This code escaped the floor but still closed down 5.5% to 4,100 VND, with 16.4 million units matched.

However, CMX and DBC were sold off, in which, CMX matched 4.19 million units and DBC matched 13.46 million units. Both codes had excess selling on the floor and no buying side.

Construction stocks in addition to HBC hit the floor include DXV, however, liquidity at DXV is very modest. TCR, HU1 and HVH escaped the floor.

In the real estate sector, QCG still had a ceiling price buy order of 1.77 million shares while the matched orders only reached 757,000 units, showing a very limited supply. VRC increased by 6.3%; VPH increased by 4.4%; ITA increased by 4.1%; NVL increased by 3.6%. In the opposite direction, DRH hit the floor, LDG escaped the floor with a matched order of 25 million shares, closing down 5.7%; NVT also escaped the floor, down 5.2%.

Large-cap stocks played an active role in leading the market recovery. VN30-Index increased by 2.09 points, equivalent to 0.16%, although only 11 stocks increased. Of which, "king" stocks including VCB, HDB, SHB, VPB, TCB increased slightly, VIC increased by 1.4%; MWG increased by 1.6%; MBB increased by 1.7%.

Source: https://dantri.com.vn/kinh-doanh/con-ban-thao-hbc-chua-dung-xay-dung-hoa-binh-tran-an-ve-vien-canh-sap-toi-20240730174715511.htm

Comment (0)