The stock market continued to adjust in the session on October 21 - Photo: QUANG DINH

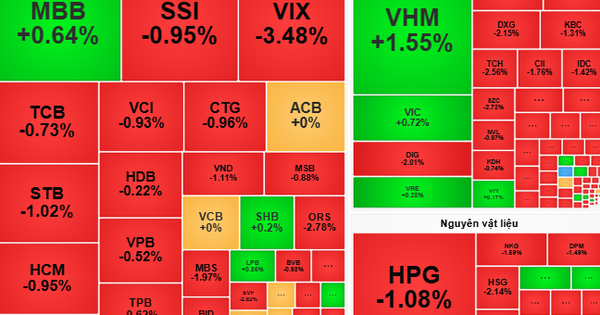

At the end of the session on October 21, VN-Index decreased by nearly 6 points, falling further to 1,279.77 points with low liquidity. The total transaction value of the whole market was more than 15,000 billion VND.

On the HoSE, stocks were mostly in red with nearly 290 codes, less than 100 codes remained green. If all 3 floors were counted, the market had nearly 480 codes losing points, weighing heavily on investor sentiment.

In the group of stocks that pulled the index down, there were contributions from 6 banking stocks, including CTG of VietinBank (-2%), BID of BIDV (-1.29%), VCB of Vietcombank (-0.43%), TCB of Techcombank (-1.23%), ACB (-1.15%), MBB of MBBank (-0.78%).

FPT (-1.09%), HPG of Hoa Phat (-0.74%), BCM of Industrial Development and Investment Corporation (-1.48%), GVR of Vietnam Rubber Industry Group (-1.81%)... are the remaining codes in the group of stocks that had the most negative impact on the market today.

On the other hand, the Vin group of stocks performed very positively despite the gloom of the VN-Index. In particular, VHM of Vinhomes is playing the role of "leading".

Cash flow is strong into VHM shares, total transaction value is over 21 million units, double the average per session in the past year.

At the end of the session, VHM shares increased by nearly 5.7%, the market price pushed up to 47,800 VND/share, the highest level in the past year.

Since Vinhomes announced its plan to buy back a maximum of 370 million treasury shares, the value of the company's shares has increased by about 38%. Thanks to positive price movements, the market capitalization has also exceeded VND208,000 billion at the close of trading on October 21.

Regarding the move to buy back treasury stocks, Vinhomes has "finalized" the trading time starting from October 23 to November 21.

Vinhomes is about to make the largest stock acquisition deal in the securities industry.

The State Securities Commission has received the report on Vinhomes' share repurchase. According to the plan, Vinhomes will repurchase up to 370 million treasury shares, equivalent to 8.5% of outstanding shares.

The purpose of the buyback is because the market price of VHM shares is lower than the real value of the company, so the buyback is to ensure the interests of the company and shareholders.

The source of capital for the above transaction is from undistributed profit after tax according to the audited semi-annual financial report of 2024. The transaction method is order matching or agreement through a securities company.

If the above transaction of Vinhomes is successful, this will be the largest treasury stock purchase deal in the history of Vietnamese securities.

Source: https://tuoitre.vn/co-phieu-vinhomes-tang-boc-von-hoa-vuot-200-000-ti-truoc-thuong-vu-lich-su-20241021151814278.htm

Comment (0)