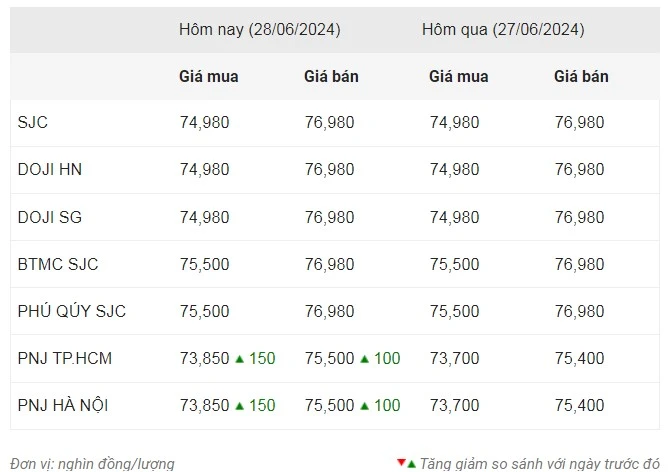

In the domestic market, gold bars are stable, gold rings increased to 75.5 million VND/tael.

As of 8:30 a.m. on June 28, DOJI gold prices in Hanoi and Ho Chi Minh City were listed at VND74.98 million/tael for buying and VND76.98 million/tael for selling, unchanged from the previous session.

|

| Gold price statistics of Dragon Viet Online Service Joint Stock Company VDOS - Updated at 8:30 am on June 28. |

SJC gold bar price is stable, listed buying-selling at 74.98-76.98 million VND/tael. The difference between buying and selling is 2 million VND/tael.

Following the increase in world gold prices, the price of SJC 9999 gold rings increased by 250,000 VND compared to the previous session, buying at 73.9 million VND/tael, selling at 75.5 million VND/tael. The difference between buying and selling is 1.6 million VND/tael.

PNJ Gold bought at 73.85 million VND/tael and sold at 75.5 million VND/tael, up 150,000 VND and 100,000 VND respectively compared to yesterday's closing price.

At 8:30 a.m. on June 28 (Vietnam time), the world gold price increased sharply by 27.4 USD compared to the previous session's close to 2,325.7 USD/ounce.

World gold prices today regained momentum as market analysts are optimistic about the May Consumer Expenditure Index (PCE) report, the US Federal Reserve's (FED) preferred inflation measure.

According to experts, the price of goods and services increased at an annual rate of 2.6%, down slightly from April's 2.7%. In particular, the core PCE (excluding energy and food prices) is expected to decrease to 2.6% from April's 2.8%. If these forecasts come true, inflationary pressures will continue to decline, bringing the economy closer to the Fed's desired 2% inflation target.

Markets are currently pricing in a more than 60% chance that the US Federal Reserve will begin its monetary policy easing cycle next September.

|

World gold price chart on June 28. (Photo: kitco.com) |

According to Joy Yang, Director of Marketing and Product Management at MarketVector Indexes, the next rally in gold will come after the Fed makes it clear that they will cut interest rates.

“Gold is a well-priced asset with little downside, investors buy and hold gold to diversify their portfolios and they are often more focused on the macro economy. The precious metal acts as a long-term store of value in a bubble market. Therefore, over the past two years, the largest buyers of gold have been global central banks,” said Joy Yang.

The female expert believes that the price of gold will not fall below $2,200 again. In the next few months, Joy Yang hopes that the floor price of this precious metal will increase to $2,400.

For his part, Sprott's asset manager John Hathaway is more optimistic that, in the current economic and geopolitical environment, a 15-20% increase in gold to $3,000 an ounce by 2025 is not too far-fetched.

This morning, the USD-Index rose to 106.10 points; the yield on 10-year US Treasury bonds fell to 4.293%; US stocks rose slightly while waiting for the PCE Report; oil prices stabilized at 85.54 USD/barrel for Brent and 80.08 USD/barrel for WTI.

Source: https://nhandan.vn/gia-vang-ngay-286-vang-nhan-tang-theo-da-phuc-hoi-cua-gia-vang-the-gioi-post816542.html

Comment (0)