Implementing Decree 100/2015/ND-CP, the Vietnam Bank for Social Policies - Thanh Hoa Branch (VBSP Thanh Hoa) has actively coordinated with local authorities to promote propaganda and effectively implement the social housing loan program.

Opportunity to settle down

As a civil servant with a low salary, owning a private house is the dream of Ho Thi Phuong Dung and her husband in Tan Thuong quarter, Tan Phong town (Quang Xuong). The dream of having a house to settle down has come true since Dung and her husband accessed a loan from the Quang Xuong Social Policy Bank. Dung confided: “I am an accountant working at the State Reserve Department - Quang Xuong District Branch, my husband is also a civil servant, although my income is not high, it is quite stable. Being

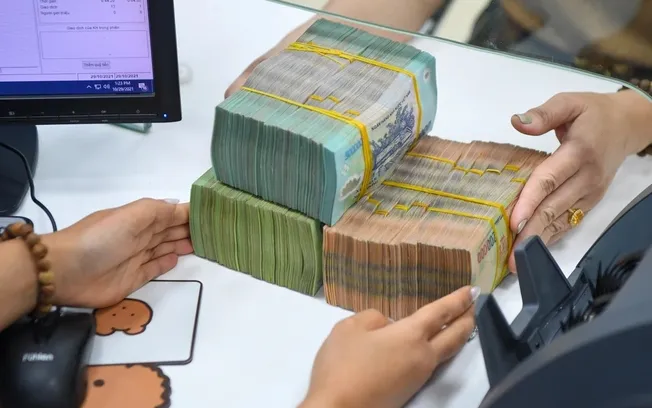

The Quang Xuong Social Policy Bank lent us 350 million VND, and with the savings, the family built a spacious new house. The disbursement was very smooth, without any difficulties. The interest rate of the loan program is suitable for the income of the couple, every month we try to save to pay off the bank loan. And, the loan period is also very long, so we are not pressured to pay off the debt, and can work with peace of mind."

As for Mr. Cao Van Quan in Thanh Ngoc quarter, Truong Son ward (Sam Son city), the new house has opened a new page of happiness for him and his wife. Mr. Quan is a primary school teacher, his wife works at Truong Son ward Kindergarten. After getting married, the couple invested their capital to buy a plot of land of nearly 100 square meters and calculated to build a house. Initially, the couple planned to borrow from a commercial bank to build a house. They were hesitant because if they borrowed hundreds of millions of dong from the bank, the interest and principal they had to pay each month would be too high compared to their income. Fortunately, he learned about the social housing loan program and boldly borrowed 400 million dong. Mr. Quan recalled that before he could build a new house, his family had to live in a dilapidated corrugated iron house, every time it rained, the house leaked and there was no place to live... When the Sam Son branch of the Vietnam Bank for Social Policies provided support loans, his family had a new house. Now, his family feels much more secure, no matter the weather, rain or shine, no fear of leaks or drafts. The Government's social housing loan program is very suitable for low-income people, the loan not only helps many families "settle down", stabilize their lives but also creates more determination and motivation for them to work, save up to pay off debts, and move towards a better life.

It is known that, implementing Decree 100/2015/ND-CP dated October 20, 2015 of the Government on the policy of developing and managing social housing, Sam Son Social Policy Bank has proactively advised the City People's Committee and the Board of Directors of the City Social Policy Bank to direct the implementation. Thereby, the social housing loan policy has been implemented promptly, meeting the demand for loans to buy social housing, build new houses and repair houses of a number of households with housing difficulties in the area.

As of June 30, the Sam Son Social Policy Bank has disbursed more than VND 51.7 billion from the social housing loan program, helping 126 households to get preferential loans to build houses, helping them settle down and have motivation to move towards a better life. In order to continue to promptly implement the social housing loan program according to Decree 100/2015/ND-CP under the Socio-Economic Recovery and Development Program according to Resolution No. 11/NQ-CP of the Government, the Sam Son Social Policy Bank is focusing on disseminating and popularizing the program to all levels of associations, local leaders, poverty reduction officers of communes and wards, heads of villages, residential groups and members of the management boards of savings and loan groups to disseminate and popularize to beneficiaries. At the same time, closely coordinate with local authorities, associations, savings and loan groups to review, determine needs, and provide guidance on loan application procedures and implementation in a timely manner.

Meet the demand for loans to buy social housing

For low-income people, the dream of building their own "owner" houses is something very far away. To fulfill the dreams of families still facing difficulties, the capital of the Social Policy Bank is considered the "key", helping families of civil servants, public employees and low-income workers build "homes". Implementing the preferential credit program for social housing loans, in recent times, the network of the Social Policy Bank, political and social organizations receiving the trust, and authorities at all levels have always created favorable conditions for people to access capital. Loan applications and loan procedures are implemented in accordance with regulations and ensure the fastest loan disbursement time for beneficiaries. With preferential interest rates, capital from the program has helped many policy families, civil servants, public employees, and low-income people have the conditions to buy and build stable housing, and work with peace of mind.

Mr. Le Huu Quyen, Director of Thanh Hoa Social Policy Bank, said: The social housing loan program is of great significance, creating opportunities for low-income households to access preferential loans, build new houses, repair houses, and improve their lives. In the past time, Thanh Hoa Social Policy Bank has regularly directed transaction offices to focus on reviewing and promoting widespread propaganda about lending policies to beneficiaries in the area. By June 30, 2023, the outstanding balance of the social housing loan program reached VND 513.5 billion with 1,444 customers borrowing capital. In order to effectively implement the program, Thanh Hoa Social Policy Bank continues to coordinate with political and social organizations to strengthen propaganda and disseminate documents and instructions from superiors on subjects and lending procedures so that people understand and participate in borrowing credit capital. In particular, special attention is paid to disseminating loans to low-income workers who do not have housing and are eligible for loans; striving to disburse loans quickly, accurately, and to the right subjects, meeting the urgent housing needs of low-income people, ensuring social security, and promoting local economic development.

Article and photos: Khanh Phuong

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

Comment (0)