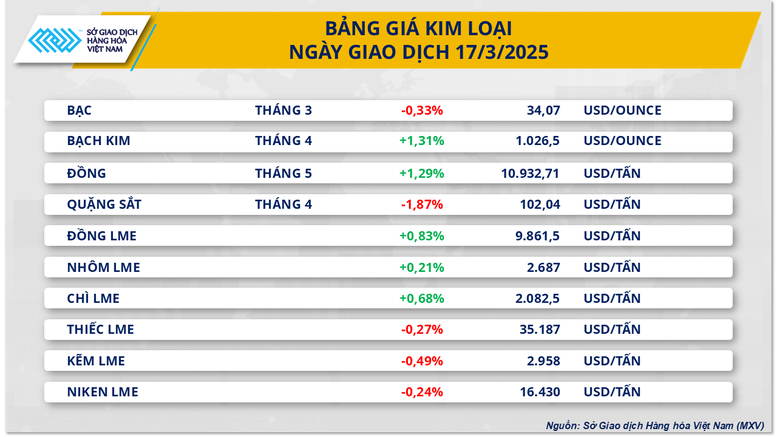

The first trading session of the week saw a divergence between precious metals and base metals, as the market awaited the US interest rate decision this week. In addition, supply and demand concerns continued to put pressure on base metal prices.

At the end of the trading session on March 17, silver prices fell slightly by 0.33% to $34.07/ounce. Meanwhile, platinum continued to increase by 1.31% to $1,026/ounce.

Among the base metals, COMEX copper extended its gains by 1.29% to $4.96 a pound, or $10,932 a tonne, its highest in nearly 10 months. Iron ore, on the other hand, fell 1.87% to $102.04 a tonne.

Markets are now focused on the Federal Reserve’s monetary policy meeting this Thursday, with expectations that the agency will keep interest rates unchanged until June. The high interest rate environment is expected to continue to support the strength of the US dollar, as money flows into bonds to take advantage of attractive yields. This reduces the appeal of non-yielding assets such as precious metals, putting pressure on silver and platinum prices.

Meanwhile, newly released data showed that US retail sales recovered more slowly than expected in February, reflecting modest economic growth. This development took place in the context of President Donald Trump's administration's strict import tax policy, raising concerns about rising costs and prices. The weak economic outlook in the US has stimulated demand for shelter, partly helping to limit the decline in precious metals in the last trading session.

In other news, copper prices rose to their highest since late May 2024 as the market anticipated that the imposition of tariffs on imported copper by the United States could lead to a severe shortage in the country’s supply. The move triggered a wave of speculative buying amid concerns about copper supply.

Meanwhile, iron ore prices in the last trading session were under pressure from weak demand in China's real estate and construction markets. The country's crude steel output in the first two months of the year fell 1.5% compared to the same period in 2024, reflecting a decline in consumption of input materials, including iron ore.

Despite Beijing’s stimulus measures, new home prices in China continued to fall in February, while new construction starts fell sharply by 29.6%. Weak demand is believed to be insufficient to absorb excess supply, creating the risk of hot pig iron inventories rising in the coming weeks, further pressuring iron ore prices.

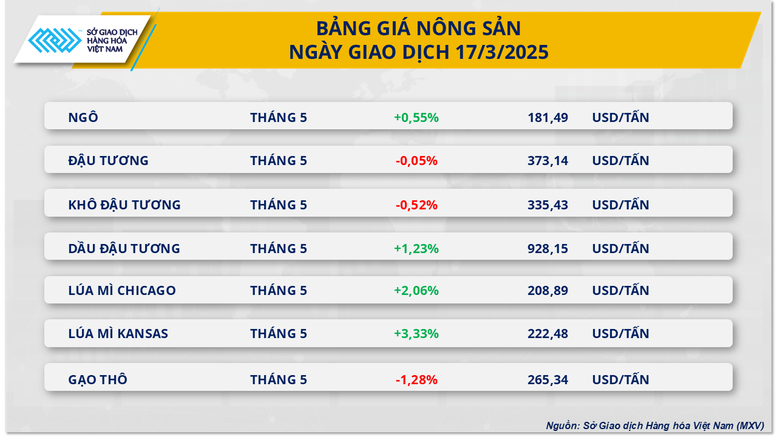

Soybean prices traded sideways yesterday and ended with little change at around $373/ton. The market showed a clear two-way trend as the May futures contract fell slightly, while the November new crop contract rose slightly. This sideways movement was explained by the conflicting effects of negative fundamentals and technical recovery at the end of the session.

Source: https://baochinhphu.vn/chi-so-mxv-index-tien-sat-moc-2300-diem-102250318100426782.htm

Comment (0)