What does CenLand say about the late payment of land use fees at the Hoang Van Thu project?

Business plummeted in 2023, Century Real Estate JSC (CenLand, code CRE - HoSE floor) was also given an exception opinion by the auditor on the 2023 Consolidated Financial Statements.

In CenLand's 2023 Audit Report audited by AASC Auditing Company Limited, the auditor gave an exception opinion.

In particular, the auditor said that CenLand is presenting that the investor of the Hoang Van Thu New Urban Area project (commercial name: Louis Hoang Mai project) has not fully paid the land use fee for phase 3 of the project, so the progress of implementing the business cooperation contract for this project may be slower than expected.

“We were unable to obtain sufficient appropriate audit evidence to assess the impact of the issue of incomplete land use fee payment on CenLand's consolidated financial statements,” AASC Auditing Company Limited issued a qualified opinion.

Explaining the auditor's exception, CenLand said that for phase 3 of the Hoang Van Thu New Urban Area project, the investor has paid 758.7 billion VND in land use fees, the remaining debt is 668.1 billion VND. Due to the large amount of land use fees combined with the difficult economic situation, sales have been affected, so the expected revenue to pay land use fees has not been as planned.

“Currently, the investor is actively handling and mobilizing other sources to ensure cash flow to pay land use fees for the remaining part of phase 3. The investor will proactively strive to mobilize resources to complete the payment of land use fees for phase 3 of the project by May 31, 2024,” CenLand added.

Louis Hoang Mai project is built on a scale of about 35 hectares, phase 1-2 of this project has completed legal procedures and issued land use right certificates to home buyers. In June 2021, Hanoi People's Committee decided to allocate land for the third phase to the investor with an area of 3.59 hectares. Of which, about 2 hectares are for low-rise housing construction.

In addition, the auditor also gave an exception opinion, CenLand is presenting the issue that Hong Lam Xuan Thanh Joint Stock Company has not paid enough value added tax (VAT), corporate income tax and late tax payment to the State Budget.

“We were unable to obtain sufficient appropriate audit evidence to evaluate the impact of the matter at Hong Lam Xuan Thanh JSC on the ability to collect receivables and related debts. Therefore, we were unable to determine whether it is necessary to adjust the related indicators on the 2023 Consolidated Financial Statements,” AASC Auditing Company Limited issued a qualified opinion.

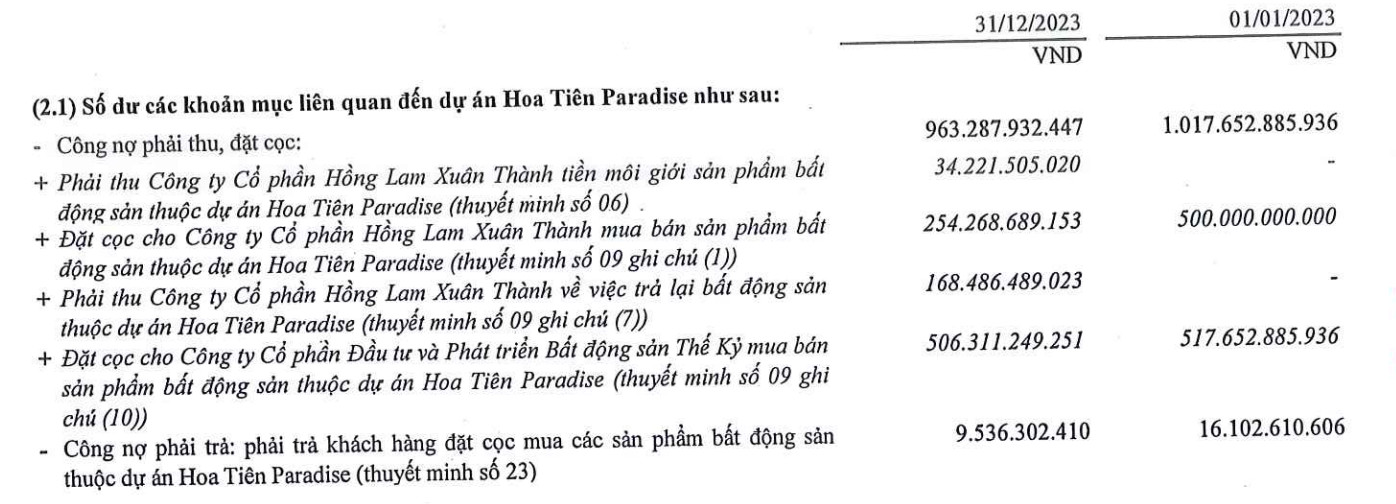

It is known that as of December 31, 2023, CenLand has short-term receivables from Hong Lam Xuan Thanh JSC of VND 34.22 billion; prepayment to the seller of Hong Lam Xuan Thanh JSC of VND 18.7 billion; other short-term receivables from Hong Lam Xuan Thanh JSC of VND 254.3 billion...

|

| Related items of CenLand at Hoa Tien Paradise project of Hong Lam Xuan Thanh JSC. Source: Audited financial statements 2023 |

According to the 2023 Financial Statements, CenLand said that other short-term receivables at Hong Lam Xuan Thanh JSC are related to the purchase and sale of real estate products of the Hoa Tien Paradise project in Xuan Thanh commune, Nghi Xuan district, Ha Tinh province under a contract dated January 10, 2022.

Regarding the tax debt of Hong Lam Xuan Thanh Joint Stock Company, it affects the auditor's opinion on determining the ability to recover the receivables of Hong Lam Xuan Thanh Joint Stock Company and related debts.

CenLand said: “We have worked with the investor to propose tax payment. The investor has information that the late tax payment is mainly VAT, the total tax debt and late payment is about 70 billion VND, however, the investor is still deducting more than 40 billion VND in VAT. This is only a temporary financial difficulty for Hong Lam Xuan Thanh in the context of economic difficulties, and the investor also committed to making every effort to gradually pay off the tax debt.”

In terms of business results, in 2023, CenLand recorded revenue of VND 933.75 billion, down 73.1% year-on-year, and after-tax profit of VND 2.1 billion, down 98.9% year-on-year. In particular, gross profit margin decreased from 24.3% to 19.6%.

As of December 31, 2023, CenLand's total assets decreased by 6.8% compared to the beginning of the year, equivalent to a decrease of VND 515.8 billion, to VND 7,101.3 billion. Of which, the main assets were short-term receivables recorded at VND 4,110.7 billion, accounting for 57.9% of total assets; long-term receivables recorded at VND 1,750.3 billion, accounting for 24.6% of total assets; cash and short-term financial investments recorded at VND 275.9 billion, accounting for 3.9% of total assets and other items.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)