Century Real Estate Joint Stock Company (Cen Land - stock code: CRE) has just announced its consolidated financial report for the fourth quarter of 2023 with a sharp decline in results.

In the last quarter, the company achieved VND 330.6 billion in net revenue, 2.1 times higher than the same period in 2022. Revenue in the fourth quarter of 2023 increased sharply, but cumulative net revenue in 2023 only reached VND 932.6 billion, down 73.2% compared to 2022.

Revenue from financial activities in the fourth quarter of 2023 reached VND13.8 billion, down 62%. Other income also decreased sharply from VND8.2 billion to VND656 million while other expenses in the last quarter amounted to VND3.7 billion, double the same period in 2022.

After deducting expenses, profit after corporate income tax in the last quarter was VND1.2 billion, an improvement compared to last year's loss of VND62.6 billion.

Due to difficult business operations, Cen Land's profit for the whole year of 2023 was only 2.5 billion VND, down 98.7% compared to 2022.

At the end of 2023, the company's total assets were VND 7,108.5 billion, down 6.7% compared to the beginning of the year. Of which, short-term receivables were VND 4,101.9 billion, accounting for 57.7% of total assets, down 3.9% compared to the beginning of the year. Long-term receivables were also VND 1,763.7 billion, accounting for 24.8%.

Thus, the total value of receivables accounted for 82.5% of Cen Land's total assets at the end of the year. This ratio was 83.7% at the beginning of the year.

The financial statement notes show that most of these receivables mainly consist of contract performance deposits that the company has paid to investors, to perform the role of general agent distributing real estate products formed from projects.

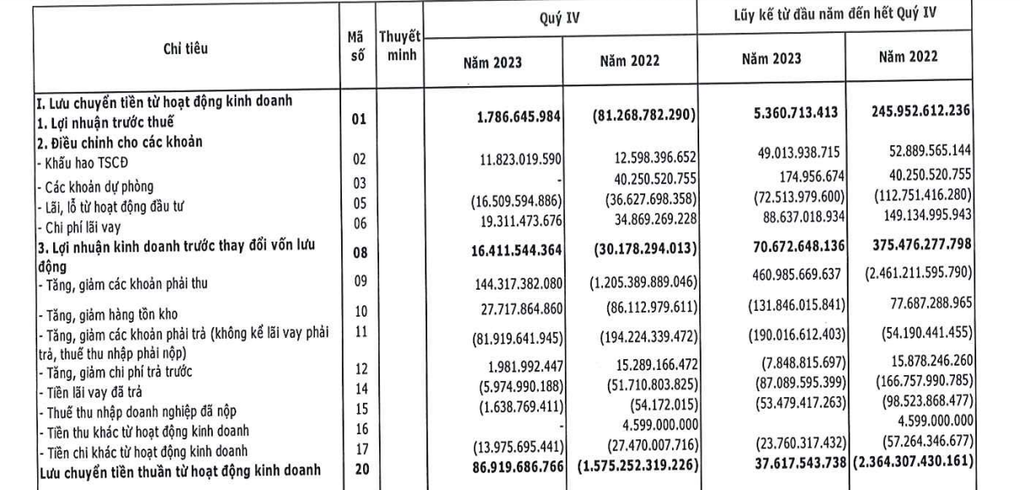

Although 2023 profits decreased sharply compared to 2022, the company's financial report showed that net cash flow from operating activities improved from negative VND 2,364.3 billion to VND 37.6 billion. The reason is that Cen Land increased receivables in 2023.

Thanks to the increase in receivables, Cen Land's net cash flow from operating activities in 2023 recorded a positive value (Photo: Financial statements).

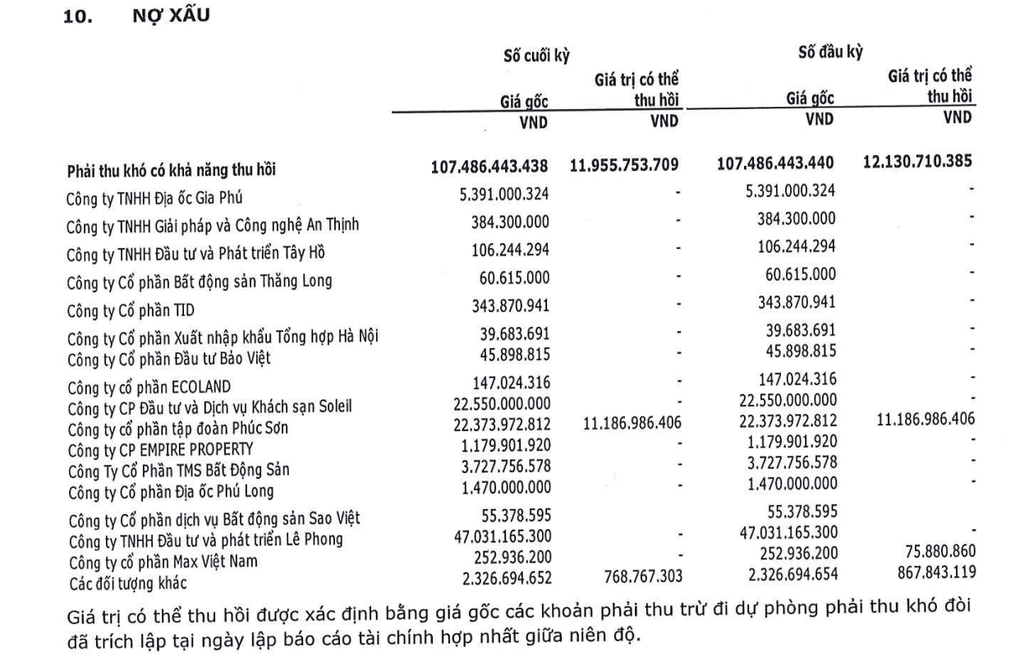

However, the increase in receivables due to deposits for partners also poses risks to the business. The report shows that the company's bad debt at the end of 2023 had an original value of VND 107.5 billion from receivables that are difficult to collect. But the recoverable value is only VND 11.9 billion.

These difficult-to-collect receivables come from partners such as Le Phong Investment and Development Company Limited, Soleil Hotel Investment and Services Joint Stock Company (a business related to the Van Thinh Phat case), and Phuc Son Group Joint Stock Company.

Bad debt from receivables that are unlikely to be recovered at the end of the year of the enterprise amounted to 107.5 billion VND (Photo: Financial statements).

The company maintains a low leverage ratio. As of December 31, 2023, liabilities were VND1,489 billion, down 25.6% from the beginning of the year. Owners' equity was VND5,619.5 billion, unchanged from the beginning of the year.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)