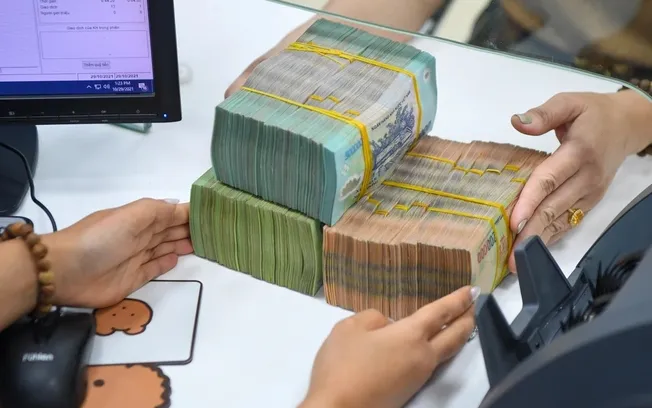

If you do not want to be suspended from trading from January 1, 2025, your bank account must be biometrically authenticated and your chip-embedded ID card data updated. Taking advantage of this, bad guys impersonate bank employees to commit fraud.

According to recommendations from banks, recently, there have been bad actors impersonating bank employees, contacting customers to instruct them to collect biometric information.

The subject contacts customers through phone calls, text messages, and makes friends through social networks such as Zalo, Viber, Facebook... asking customers to provide personal information, bank account information, citizen identification photos, and may request video calls to collect more of the customer's face, voice, and gestures.

The subject sends and requests customers to access a strange link to download and install an application that supports biometric collection on mobile devices.

In fact, this is a form of fraud to get customers to download files containing malware and spyware to exploit more customer information.

Then, the subject logged in, appropriated money in bank accounts and used customer information for bad purposes.

According to recommendations, banks only collect biometrics on customers' Mobile Banking applications or directly at bank branches/transaction points nationwide.

Customers do not access strange links or open attachments in emails from unknown senders.

Absolutely do not provide personal information, account security (login name, password, OTP code), card services (card number, OTP code) to anyone, including bank employees.

Customers need to be vigilant when sharing personal information, banking service information, and banking transactions on social networks.

Be wary of QR codes posted/shared in public/social media/email.

Do not buy, sell, exchange, rent or lend payment accounts or personal documents.

According to the requirements of Circular 17 of the State Bank, from January 1, 2025, customers are required to authenticate biometrics for all money transfer transactions. Therefore, even money transfer transactions under 10 million VND must be authenticated by biometrics.

In case the customer does not have a smartphone, the phone does not have NFC or cannot install biometrics at home, they can go to the bank's transaction office/branch for support.

Customers please remember to bring your ID card or citizen identification card when going.

In addition, Circular 17 also stipulates that from January 1, 2025, payment account holders/bank card holders will have their withdrawal or payment transactions suspended if the identification information in the registration file with the bank expires.

According to the 2023 Law on Identification (Law No. 26/2023/QH15), by December 31, 2024, identity cards (9-digit and 12-digit types) will no longer be valid for use in procedures and transactions.

Source: https://vietnamnet.vn/canh-bao-gia-mao-ngan-hang-de-thu-thap-sinh-trac-hoc-2354696.html

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)