With fewer new customers, securities companies must always find ways to attract new customers and retain old ones, increasing market share with attractive, preferential products and services, notably margin lending products.

With fewer new customers, securities companies must always find ways to attract new customers and retain old ones, increasing market share with attractive, preferential products and services, notably margin lending products.

|

Large and stable source of income for securities companies

Margin lending generates revenue from interest and transaction fees for securities companies. Margin lending interest rates at securities companies are fluctuating at 10-14%/year, providing a stable and higher source of income compared to other products and services, thereby significantly increasing revenue for businesses.

Margin lending during a booming market is also a positive factor in increasing market liquidity. This service also helps individual investors with small capital to participate in the stock market. For many investors, margin lending is a quick way to increase profits, suitable for investors with high risk appetite.

Just comparing the proportion of revenue from loan interest and receivables of securities companies in the first 9 months of 2024 with the same period last year shows a significant difference. According to the author's statistics, out of 27 large securities companies, 21 companies have increased the proportion of loan interest and receivables/total operating revenue. Meanwhile, only 11 companies have increased the proportion of FVTPL (financial assets recorded through profit - loss)/total operating revenue, mostly due to the fact that self-trading activities in the same period last year brought in quite low revenue. In brokerage, many companies also recorded a large decline in revenue, leading to no longer contributing much to total operating revenue.

In general, the proportion of self-trading activities decreased by more than 1.6%, brokerage activities only increased slightly by 0.2%, while the lending segment increased by 4.3%. In terms of absolute value, the total lending interest and receivables of the 27 companies in the first 9 months of 2024 increased by more than 37% compared to the same period last year.

In many securities companies, margin lending activities are promoted, even becoming the main activity that bears the revenue and profit of the entire business.

Yuanta - a Korean-owned securities company operating in Vietnam - has demonstrated a strategy of focusing heavily on margin lending and not on proprietary trading. In the first 9 months of 2024, Yuanta's loan interest and receivables reached VND293 billion, contributing 62.5% to total operating revenue, up sharply from 47.2% in the same period last year. Meanwhile, although the brokerage segment grew, its contribution was only approximately the same as last year, around 30%.

MBKE, Mirae Asset, PHS, FPTS are also companies with loan interest receivable accounting for over 50% of total operating revenue in the 9-month period of 2024. Even companies that previously had limited margin lending activities have now continuously promoted this segment by attracting financial resources, notably VIX, KAFI, VPS, ACBS...

The importance of margin activities is increasingly raised in the operating structure of securities companies. In the market, margin debt reaches new peaks every period.

FiinTrade's statistics from the Q3/2024 Financial Reports of 68 securities companies representing 99% of the industry's equity capital show that the outstanding margin loan balance reached more than VND 228,000 billion as of September 30, 2024, a slight increase compared to the end of the second quarter of 2024 and continued to set a new peak.

Risks are always present

Although it brings huge profits to securities companies, margin is still not a “magic wand”. Increasing margin means increasing pressure on securities companies.

When it comes to the classic lesson of margin, investors and the financial community must remember the case of Thang Long Securities (TLS). From a leading securities company in the market with the largest stock brokerage market share for many years, TLS fell into margin. In 2010, the margin product was still very new. As a pioneer, TLS used margin and rose quickly. However, when the economy was in difficulty, the stock market fell sharply, and it was margin that caused TLS to quickly fail. Poor risk management in lending caused TLS to lose its ability to pay, eventually forcing the company to restructure and the name Thang Long Securities disappeared from the financial market.

In the market, the number of newly opened securities accounts is on a downward trend. In September 2024, the number of newly opened securities accounts was only nearly 159,000 accounts, the lowest since March 2024 and only half of the previous month.

In the market, the number of newly opened securities accounts is on a downward trend. In September 2024, the number of newly opened securities accounts was only nearly 159,000 accounts, the lowest since March 2024 and only half of the previous month.

By 2019, the financial market was shaken again by margin. A series of securities companies lost hundreds of billions of dong due to margin lending for FTM shares of Duc Quan Investment and Development JSC. Dozens of floor-price sessions in July 2029 caused FTM shares to plummet from VND24,000/share to more than VND3,000/share. FTM margin lending made many securities companies suffer bitter consequences during that period.

Lessons from the past have made securities companies more cautious about margin lending. At the same time, increasingly close supervision by state agencies, the State Securities Commission and exchanges has also contributed greatly to minimizing losses.

In October 2024, the Ho Chi Minh City Stock Exchange (HoSE) announced a list of 85 stocks that are not eligible for margin trading in the fourth quarter of 2024, including familiar stocks that are under warning or control such as AAT, AGM, APH, ASP, BCE, C47, CIG, CKG, CRE, DAG, DLG, DTL, DXV, EVG, FDC, GMC, HAG, HBC, HNG, ITA, ICT, JVC, KPF, LGL, MDG, NVT, OGC, PIT, PMG, PSH, RDP, SMC, TVB, TTF, VAF, VNE... Following that, the Hanoi Stock Exchange (HNX) also announced 85 stocks that are not eligible for margin trading with stocks under warning, control, suspension, restriction, negative semi-annual profit review... such as DDG, MAS, TVC, OCH, BTS, APS, API, CTP, VTV... In total, there are 170 stocks that are not allowed to be traded on margin on both exchanges in the last quarter of this year.

However, there are still securities companies that cross the regulatory “line”. Most recently, DNSE Securities JSC was fined by the State Securities Commission in early November 2024 for violating regulations on limiting margin trading.

Specifically, stock code L18 was added by HNX to the list of securities ineligible for margin trading from April 8, 2024, but DNSE still provided margin lending for this stock code from April 8, 2024 to May 8, 2024.

In October 2024, Pinetree Securities JSC was fined for violating the regulations on margin trading restrictions. The company made new loans for securities that were no longer on the list of securities allowed for margin trading and counted these securities as real assets of customers in their margin trading accounts.

Kafi Securities JSC was also fined for violating regulations on initial margin ratio, maintenance margin ratio, margin trading restrictions, allowing customers to conduct margin trading, and withdrawing money exceeding the current purchasing power in the customer's margin trading account.

The problem of balancing profit and capital

The margin game is leaning towards securities companies with advantages in capital and financial capacity. Therefore, the market also records that there are companies that are losing steam in this race.

SHS is a rare company that recorded a decrease in interest from loans and receivables in the third quarter of 2024 and the entire 9 months of 2024. In the third quarter of 2024 alone, interest from loans and receivables of SHS decreased by 47% compared to the same period last year, while the outstanding margin loans of SHS did not change much compared to the beginning of the year. This put pressure on SHS's proprietary trading segment. Unfortunately, due to the sharp decline in both proprietary trading and brokerage in the third quarter of 2024, SHS's after-tax profit this quarter decreased by 65%. Notably, SHS still regularly increases capital, but this capital flow is not pushed into margin activities.

The margin race is still going on. When the threshold is almost reached, securities companies are rushing to increase capital. Many securities companies, from large to small, have planned to increase capital in recent times, such as Kafi, HSC, ACBS, Viseco, SSI, TCBS, VIX…

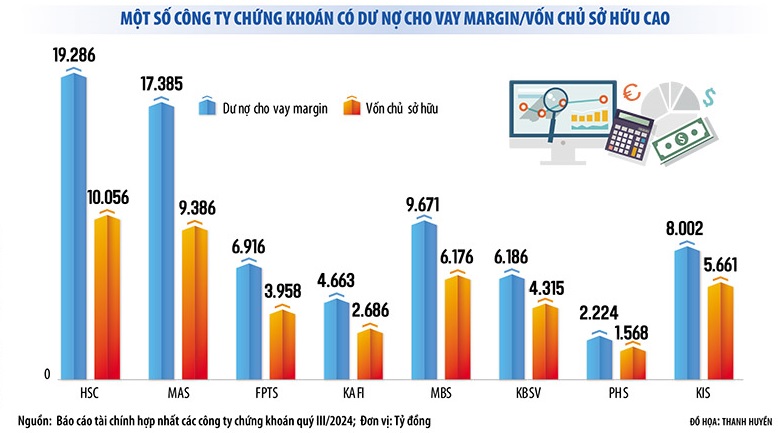

According to regulations, the total outstanding margin lending of a securities company must not exceed 200% of the equity of the securities company. With the continuous increase in margin activities, many securities companies are about to run out of margin lending room.

The highest is currently HSC with outstanding margin loans at the end of the third quarter of 2024 of over VND 19,286 billion, 1.92 times higher than equity. Next is Mirae Asset with 1.85 times, FPTS and KAFF are both over 1.7 times.

HSC plans to raise capital to over VND10,000 billion through a share offering to existing shareholders, with approximately VND3,600 billion raised from the offering. This amount will be used to increase the Company's operating capital, expand margin lending capacity, and supplement capital for proprietary trading activities.

Kafi has also been preparing to increase its capital to a maximum of VND5,000 billion. Previously, the company planned to allocate additional capital to its operating segments, including 45% for self-trading, 45% for margin lending, and 5% for brokerage activities.

However, the margin race is not simply about capital, but also about risk management. Balancing profits and risks in margin lending is a strategic problem for securities companies. While margin opens up opportunities for revenue growth from interest and transaction fees, risks also increase when the market fluctuates strongly or customers are unable to pay. Therefore, to achieve balance, an effective risk management policy is needed, including measures to control margin ratios, assess customers' ability to repay debts and apply monitoring technology. Only by maintaining stability and protecting capital safety can securities companies maximize the benefits of margin lending without undermining their reputation or long-term efficiency.

Source: https://baodautu.vn/ban-can-loi-nhuan-va-rui-ro-cua-cong-ty-chung-khoan-d230791.html

Comment (0)