(NLDO) - Securities companies predict that the market may retreat in the next trading session (February 13).

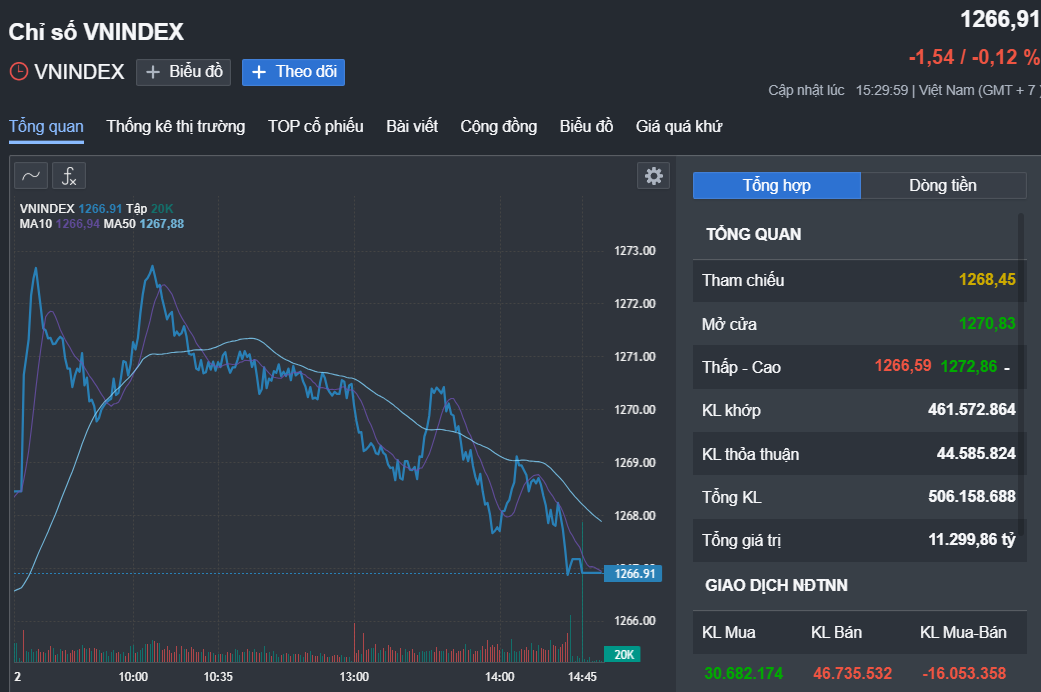

At the end of the trading session on February 12, VN-Index decreased by 1.54 points to 1,266.91 points. Order matching liquidity on the HOSE floor decreased with 461.6 million shares.

The VN30 basket of large-cap stocks decreased by 2.72 points, closing at 1,335 points. In the group, there were 11 stocks increasing in price such as BVH (+3.2%), VNM (+1%), LPB (+0.9%)...

On the contrary, there were 14 codes decreasing in price such as MBB (-1.3%), BID (-1.1%), HPG (-1%), TPB (-0.9%)...

In today's session, the insurance and public investment-related groups remained positive and contributed to supporting the market. On the contrary, the steel, banking, and healthcare groups had corrective developments.

Foreign investors continued to net sell on HOSE with a value of 409 billion VND. In particular, they sold heavily at MWG (-111 billion VND), HPG (-50.6 billion VND), VHM (-46.2 billion VND)...

On the contrary, they bought a lot at VNM (+51.9 billion VND), VCG (+51.1 billion VND), VTP (+35.1 billion VND)...

According to Dragon Capital Securities Corporation (VDSC), current signals show that the market is still being negatively impacted by the sharp decline on February 10.

Market performance in today's session. Source: Fireant

This cautious state may put pressure on the market to retreat in the next trading session to retest the support cash flow near the 1,260 point area. This area is expected to have a supporting impact and help the market recover to continue the process of exploring supply and demand.

Rong Viet Company recommends that investors need to observe supply and demand developments to re-evaluate the market status; they should still consider taking profits on stocks that have increased/recovered quickly to the resistance zone or restructure the portfolio to minimize risks.

In the short-term buying direction, investors should prioritize some stocks that have had positive developments recently and are retreating to good support zones.

VCBS Securities Company said that market sentiment is cautious around the resistance point of 1270. Therefore, VCBS recommends that investors take advantage of the recovery during the session to take profits on stocks showing signs of reversal when encountering resistance to preserve profits.

In addition, continue to maintain the proportion of stocks that maintain the trend and balance in the support zone. Investors should take advantage of selectively selecting stocks that have not increased much from the nearest support zone and belong to the industry group that is attracting cash flow to disburse exploratory investments with short-term investment goals.

Source: https://nld.com.vn/chung-khoan-ngay-mai-13-2-nha-dau-tu-co-the-lam-dieu-nay-de-bao-toan-lai-196250212174358434.htm

Comment (0)