The growth potential of securities companies this year may come from the bond and margin segments, after a year in 2024 that recorded positive profit growth.

The growth potential of securities companies this year may come from the bond and margin segments, after a year in 2024 that recorded positive profit growth.

|

| In 2025, profit growth of securities companies may improve thanks to cutting operating costs |

Profits continue recovery trend

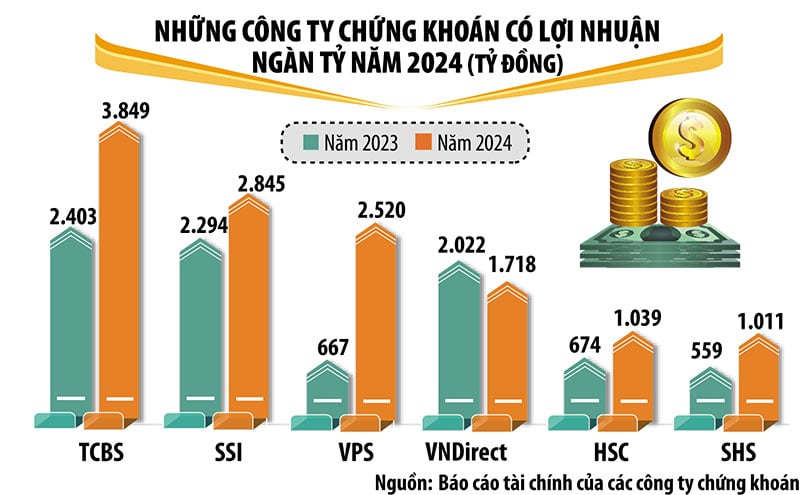

Statistics on the business results of securities companies in 2024 show that most companies have significant profit growth, reflecting the general market level when the first half of the year is optimistic and the second half is quiet.

2024 will see 6 securities companies achieve profits of over a thousand billion VND, including familiar and prestigious names in the industry including TCBS, SSI, VPS, VNDirect, HSC and SHS. Leading the industry in terms of profit is TCBS with after-tax profit in 2024 of nearly 3,850 billion VND, an increase of 60% compared to 2023.

Compared to 2023, VPS, HSC and SHS had strong profit growth, entering the trillion-dollar profit group. Meanwhile, although profits decreased slightly, it was enough to make VPBankS fall out of the group. Except for VNDirect, whose profits decreased by 15%, securities companies with profits over trillions all had double-digit growth.

In 2024, companies backed by banks such as SHS, HDBS, TPS, KAFI and some newly restructured securities companies such as LPBS, UPSC all recorded high profit growth.

Margin lending and proprietary trading activities still contribute the main proportion to the revenue of securities companies, while income from securities brokerage decreased due to competition in service fees as well as a decline in transaction value in the market in the second half of the year.

In the period of 2021 - 2024, securities companies all increased their capital, creating a more stable buffer in the increasingly fierce competition period. In particular, the capital scale of the group of securities companies related to banks has grown strongly.

The expectation that the Vietnamese stock market will be upgraded in 2025 creates a positive sentiment and expectations for stronger growth for securities companies this year. However, besides opportunities, there are also many challenges and the growth potential of each securities company is not entirely the same.

|

Growth potential from bonds and deposits

SSI's Analysis Team estimates that securities companies' revenue growth will be somewhat limited in 2025, but profit growth may improve thanks to cutting operating costs.

Specifically, the estimated fee/commission income of the securities brokerage segment is almost unchanged in 2025 while the slight increase in transaction value may partially offset the downward trend in transaction fees due to fierce competition among securities companies. The significant capital increase in 2024 and the 2025 plan will continue to support margin lending revenue, although growth is unlikely to break out in volatile market conditions. In addition, the net interest margin (NIM) may decrease due to competition and an increasing interest rate environment.

SSI estimates that the investment banking segment will gradually recover thanks to a number of ongoing IPOs and the bond underwriting segment may increase when the corporate bond market recovers. For the proprietary trading segment, revenue from certificates of deposit/valuable papers is expected to maintain a large proportion.

VIS Rating also believes that the profitability of the securities industry in 2025 will improve thanks to increased income from margin lending and bond investment. VIS Rating expects that in 2025, the creditworthiness of Vietnamese securities companies will improve slightly compared to the previous year, mainly thanks to higher profits from growth in margin lending and bond distribution.

According to VIS Rating, investor sentiment in 2025 will be supported by strong economic growth and improved overall corporate financial health. Continued efforts to improve market infrastructure will help attract investors to the domestic stock and bond markets.

Private banking affiliates will drive industry earnings growth of around 25% in 2025. They can leverage their parent bank’s customer base and capital base. As bond issuance increases in 2025, bond investment income and advisory fees will increase, thanks to the bank’s strong customer relationships and extensive distribution network.

However, VIS Rating also believes that the potential for profit growth for foreign companies will be limited due to the lack of scale advantages in brokerage, margin lending and modest customer base.

The sector’s holdings of high-risk assets, mainly corporate bonds, will increase, especially for firms affiliated with private banks. Banks and their affiliates work closely together to lend to large companies. These securities firms may also commit to more bond buybacks as they step up their distribution of bonds to retail investors.

However, industry credit losses will remain stable due to lower delinquencies. Strong business conditions will support corporate cash flows and debt servicing.

Private bank affiliates tend to focus their margin lending on a few large clients, and therefore face higher risks. However, asset risk is generally well controlled through a substantial amount of collateral. Leverage levels in the industry remain low thanks to new capital raisings.

In particular, private bank-affiliated companies will maintain higher capital increases than their peers thanks to bank capital support to boost asset growth. On the other hand, foreign securities companies can increase short-term bank loans to expand margin lending activities. Recapitalization risks are limited as companies maintain good access to various sources of capital.

Source: https://baodautu.vn/do-du-dia-tang-truong-cua-cac-cong-ty-chung-khoan-d245463.html

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

![[Infographic] Instructions on steps to contribute ideas to amend the 2013 Constitution on VNeID](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/c61c8c11815c4691848ae93a3e567ef7)

Comment (0)