Caught in the cycle of borrowing here to pay there

According to the investigation of Lao Dong Newspaper reporters, in the past, each app and each website only used data once for lending, but now, there are apps and websites that use data once for dozens of small apps inside.

Just type the phrase "online loan" on Google, hundreds of websites and apps will appear introducing loans with advertised low interest rates or loans with no interest for 7 days, only paying the principal, but if anyone is gullible and submits a loan application, they will discover that the loan interest rate is quite terrible, for example, there have been cases of 7-day loans with interest rates from 5-12%/day (loan 15 million, disbursement 9 million, 7 days interest 6 million)...

Ms. Nguyen Thi T - a worker at Linh Trung Export Processing Zone, Thu Duc City - said that in December 2023, because she was sick and the company cut staff, she followed an online loan advertisement sent by a stranger on Zalo and went to an online loan app called "dongxxx" and borrowed many times. The final amount Ms. T was lent by this app was 20 million, but she had to pay interest of more than 11 million after one month of borrowing.

The total amount Ms. T has to pay to pay off the loan after one month is more than 31 million VND. If she cannot pay the debt on time, she will receive a fine of more than 500,000 VND if she is just one or two days late in paying the interest. The app also offers an extension fee, such as 2.2 million VND for 5 days, 4.2 million VND for 10 days, but then she still has to pay the full amount of more than 31 million VND. And now Ms. T has lost her job, so she is caught in a spiral of borrowing here and there to pay off the interest on black credit loans.

A common feature of today's high-interest loan apps is that they have changed their approach and handling of overdue debt compared to before.

Many lending apps are quite "gentle" with customers, no longer using the style of debt collection to terrorize and threaten, but instead switching to consulting on how to easily pay off the debt.

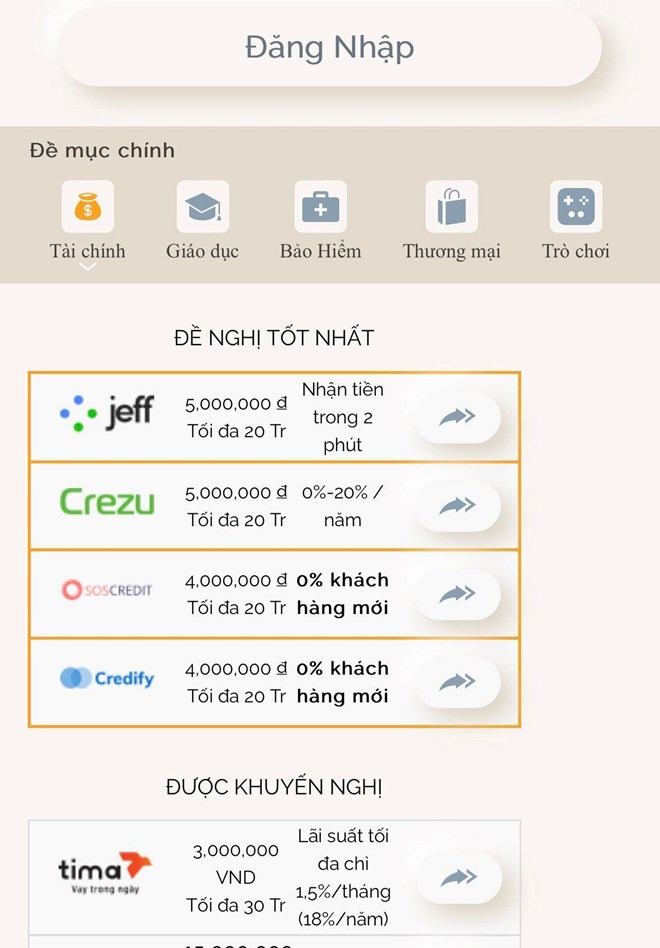

The consultants continue to guide the borrower to access a comprehensive website, on which there are dozens of other lending apps with advertisements of zero interest for the first loan. This makes it easier for those who need to borrow to fall into the trap. However, when the borrower proceeds to borrow, the actual amount received is deducted quite a high fee and that is a type of "invisible" interest.

Why are loan shark apps still rampant?

Answering the question of why loan shark apps are still rampant, financial experts say that among many reasons, a major cause comes from the borrower.

Dr. Nguyen Duy Phuong, financial expert of DG Capital, said that many Vietnamese users today, especially low-income workers, students, workers... are short of money for rent, food, need to borrow money for personal expenses, family expenses, or groups of people who often gamble, bet...

These people are afraid to meet the bank because of procedures or do not meet the conditions, so they are willing to put all their personal information on social networking sites such as Facebook, Zalo...

Synthesizing information on the internet can help technical tools "smell" which users need money but have difficulty borrowing from friends and relatives. That is when lending applications "hit the bull's eye" of customers. That is the reason why these apps are still extending their "octopus tentacles" longer and longer, especially in difficult economic conditions and near Tet like now.

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)