Trading session on April 3: Selling pressure spreads, VN-Index loses more than 15 points

Investors sold off large-cap stocks in the banking, securities, and steel groups, causing the VN-Index to lose 15.57 points at closing, close to the 1,270-point price range.

After the reversal from a deep decline to a slight increase on April 2, many analysis groups believe that the short-term trend of the market is still positive accumulation. VN-Index is expected to explode to surpass the 1,300-point price zone thanks to abundant cash flow in the context of low savings interest rates.

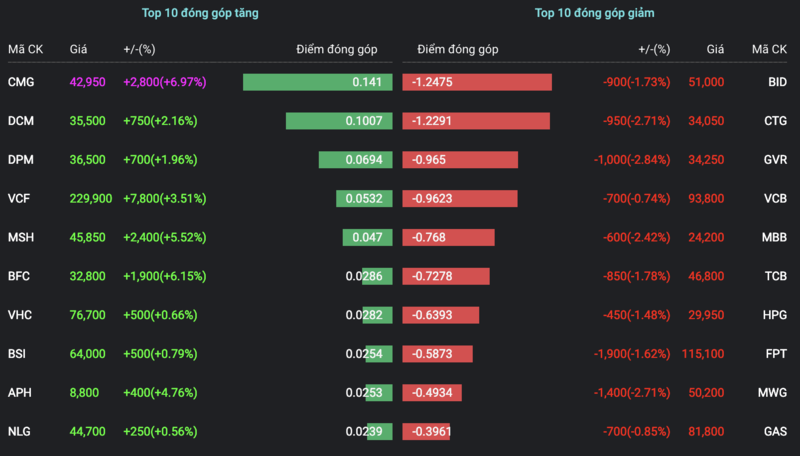

However, today's session was completely opposite to this prediction. VN-Index was in red since the opening, but the decrease range was relatively narrow, even bouncing back to the reference at times. The index representing the Ho Chi Minh City Stock Exchange only gradually widened the decrease range from the end of the morning session due to strong selling pressure. In the afternoon session, the index continued to fall deeply before closing at 1,271.47 points, losing 15.57 points, equivalent to a decrease of 1.21% compared to the reference. This was the sharpest decrease in the past half month.

The number of stocks that declined was overwhelmingly higher than the number of stocks that increased, with 368 stocks and 130 stocks, respectively. In the large-cap basket, all 30 stocks closed below the reference, causing the index representing this basket to lose 18 points compared to the reference.

The consensus decline was recorded in the banking group when all stocks closed in red. Of which, CTG led the way with a decrease of 2.7% to VND34,050, MBB decreased by 2.4% to VND24,200 and VIB decreased by 2.3% to VND23,550.

Stocks in the securities group also fluctuated strongly in a negative direction. Specifically, VCI lost 2.8% to VND52,100, SSI lost 2.2% to VND38,050 and HCM lost 2.2% to VND29,250.

Stronger selling pressure also appeared in the steel group when all stocks decreased, in which POM hit the floor to 4,670 VND after information about being forced to delist due to late submission of financial reports for 3 consecutive years.

|

In the sharp decline, liquidity on the Ho Chi Minh City Stock Exchange reached 1.07 billion shares, down about 10 million shares compared to yesterday's session. Trading value reached VND27,424 billion, down about VND100 billion compared to the previous session. VIX ranked first in terms of matched volume with more than 42.4 million shares traded, far surpassing the following codes: GEX (29.2 million shares), DIG (27.58 million shares) and STB (26.9 million shares).

The transaction value by negotiation method in this session reached 2,200 billion VND, of which more than 281 billion VND came from TCB shares and about 140 billion VND from MWG shares transactions.

Foreign investors continued to sell off. This group bought 57.2 million shares, equivalent to VND1,781 billion, while the selling volume was up to 86.6 million shares, equivalent to VND3,009 billion. The net selling value accordingly reached VND1,227 billion. VHM was under the strongest selling pressure from foreign investors when the net selling value reached VND177 billion, followed by VNM (VND157 billion), SSI (VND132 billion). On the other hand, foreign investors took the opportunity to net buy DPM shares for VND75 billion, NLG for VND55 billion and DCM for VND51.4 billion.

Source

Comment (0)